Anheuser-Busch InBev: Uncorking the success of the brewery giant despite problems with FIFA World Cup 2022 sponsorship deal

Valutico

DECEMBER 19, 2022

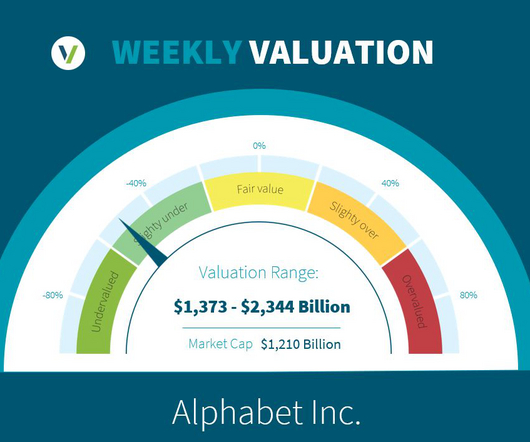

Weekly Valuation – Valutico | 12 December 2022. Anheuser-Busch InBev, a Belgium-based beer brewing and distribution giant operating in the global market, has an impressive portfolio of over 500 beer brands including Budweiser, Becks, Stella Artois and Corona. The company also was able to increase its EBITDA by 6.5%

Let's personalize your content