Will luxury brand LVMH continue to outpace the stock market?

Valutico

MARCH 9, 2023

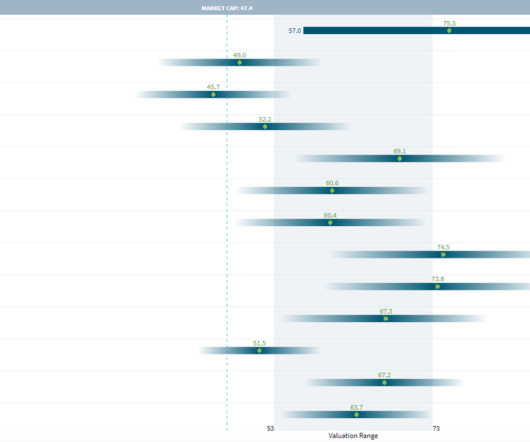

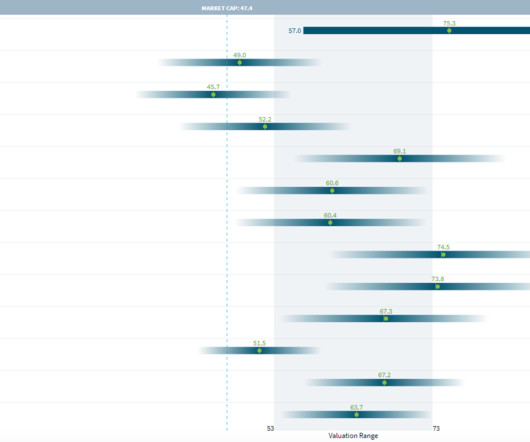

With a market capitalization of €395 billion, it is the most valuable company in Europe. Recent Financial Performance In late January 2023, LVMH released its 2022 annual report, posting record revenue and income levels. billion in profit from recurring operations in 2022, an increase of 23% in both metrics. The company made €79.2

Let's personalize your content