Anheuser-Busch InBev: Uncorking the success of the brewery giant despite problems with FIFA World Cup 2022 sponsorship deal

Valutico

DECEMBER 19, 2022

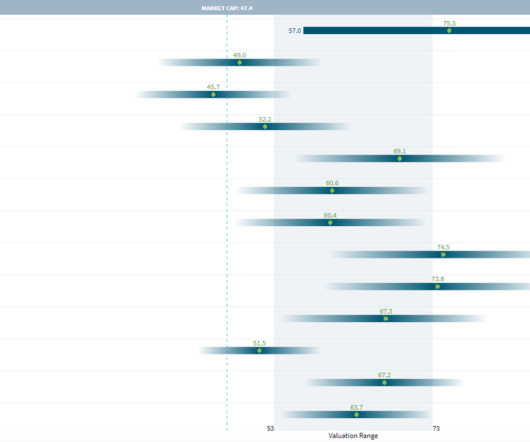

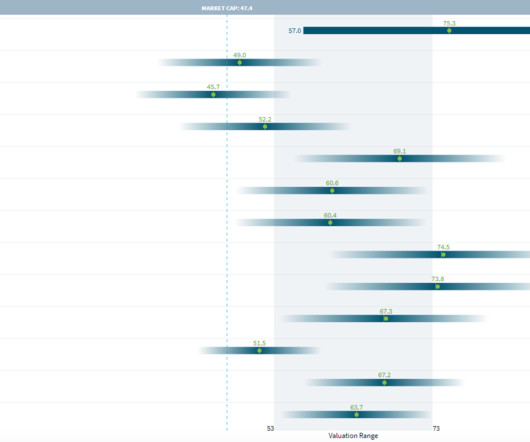

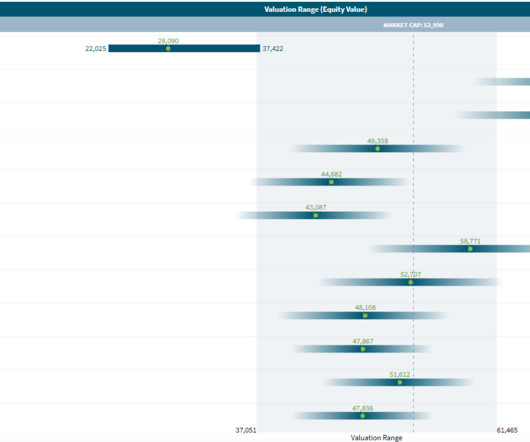

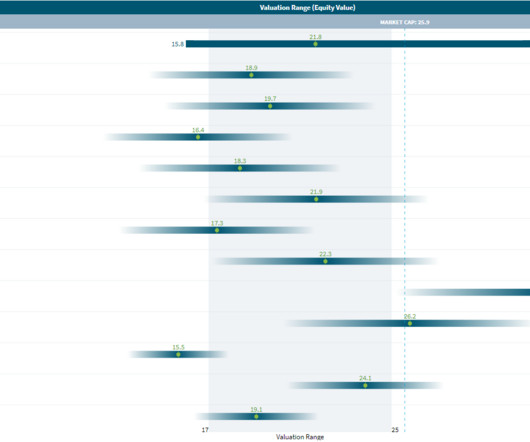

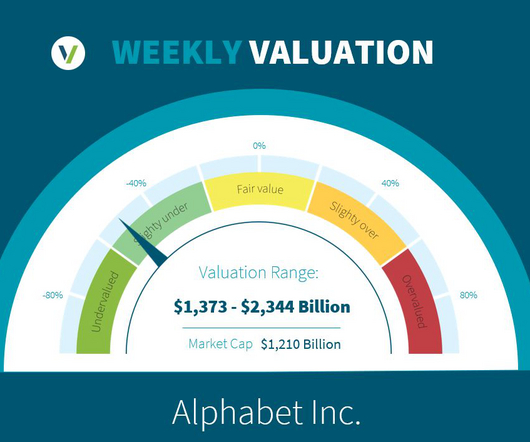

Weekly Valuation – Valutico | 12 December 2022. Recently, Budweiser hit the headlines when its €71 billion sponsoring deal as the official beer supplier to the stadiums of the 2022 FIFA World Cup was not honored because Qatar refused to sell beer in their football stadiums. The company also was able to increase its EBITDA by 6.5%

Let's personalize your content