Data Update 2 for 2022: US Stocks kept winning in 2021, but…

Musings on Markets

JANUARY 19, 2022

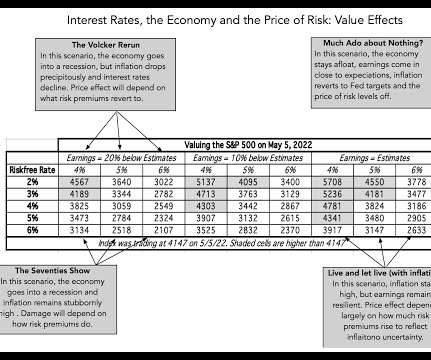

In a post at the start of 2021 , I argued that while stocks entered the year at elevated levels, especially on historic metrics (such as PE ratios), they were priced to deliver reasonable returns, relative to very low risk free rates (with the treasury bond rate at 0.93% at the start of 2021). The year that was.

Let's personalize your content