Risk Capital and Markets: A Temporary Retreat or Long Term Pull Back?

Musings on Markets

JULY 1, 2022

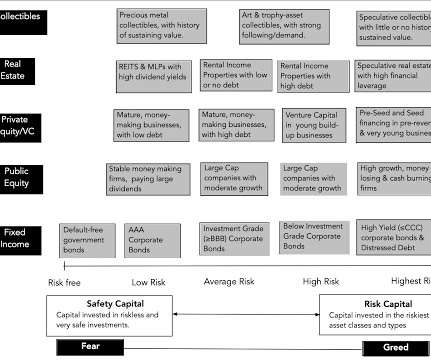

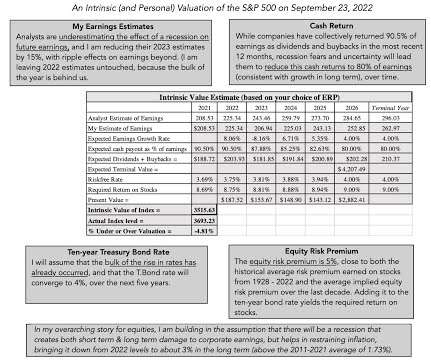

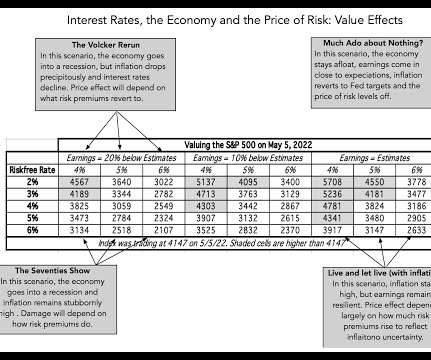

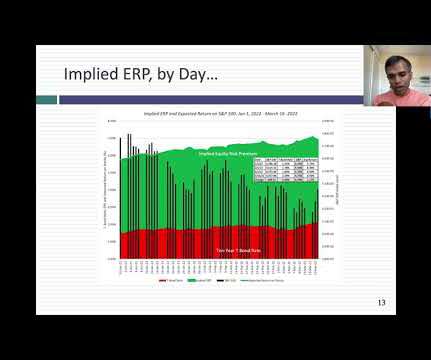

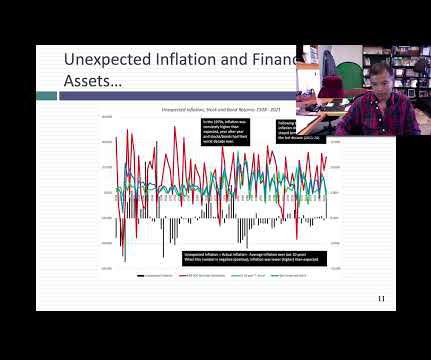

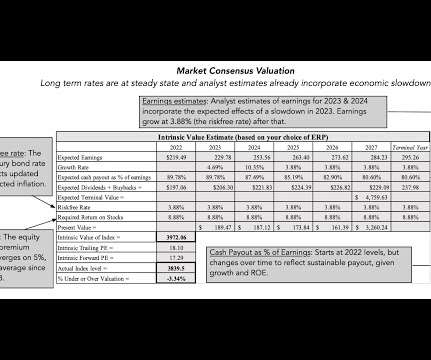

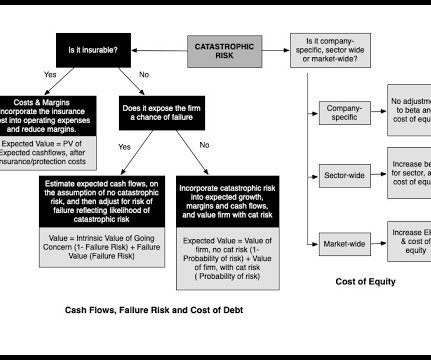

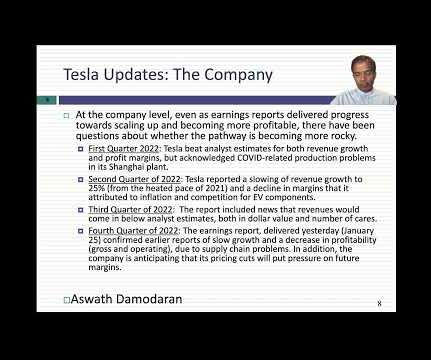

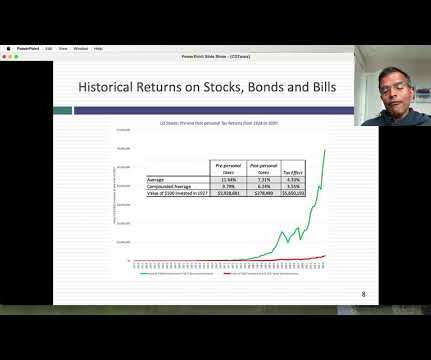

As inflation has taken center stage, markets have gone into retreat globally, and across asset classes. In 2022, as bond rates have risen, stock prices have fallen, and crypto has imploded, even true believers are questioning what the bottom for markets might be, and when we will get there.

Let's personalize your content