Will the IPO of ABB’s E-Mobility division give the share price a new boost?

Valutico

NOVEMBER 28, 2022

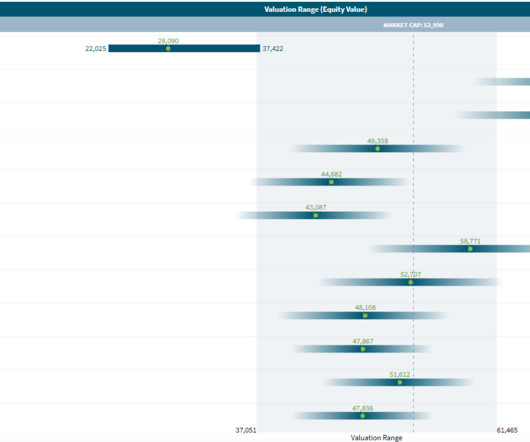

billion with EBIT margin increasing to 16.6% The company already paid over CHF 100 million in settlement in this matter in 2020. . The IPO of ABB’s E-Mobility division was planned for mid-2022 but has been delayed due to unfavorable market conditions. In comparison to ABB’s market capitalization of CHF 56.1

Let's personalize your content