Is Radiant Opto-Electronics an Undervalued Dividend Play?

Andrew Stolz

FEBRUARY 7, 2022

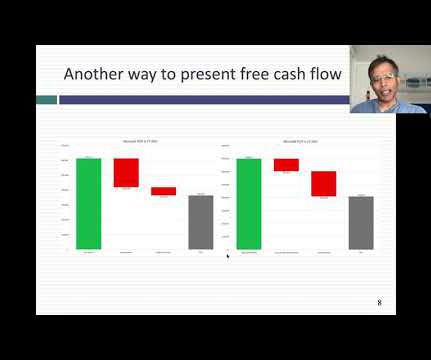

Highlights: End markets mature, no opportunities to grow. Massive dividend yield secured by strong cash generation. Radiant Opto-Electronics Corporation’s revenue breakdown 2020. Cash machine ensures consistent massive dividend yield. The FCF yield shows ROEC’s dividend-paying potential.

Let's personalize your content