Will luxury brand LVMH continue to outpace the stock market?

Valutico

MARCH 9, 2023

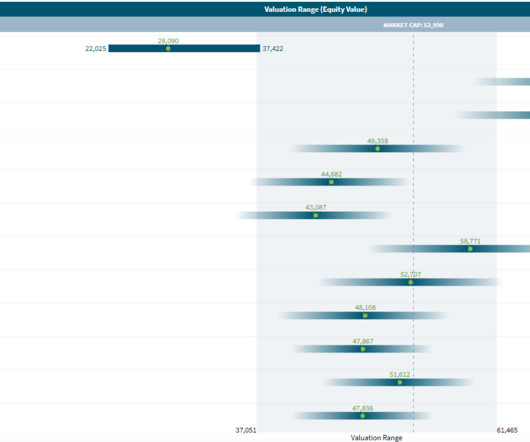

With a market capitalization of €395 billion, it is the most valuable company in Europe. After reaching new highs in early 2020 of €420 per share, the share price fell due to economic conditions and Covid-19. Since trading at €320 in mid 2020, the share price has more than doubled to its current level of €780 per share.

Let's personalize your content