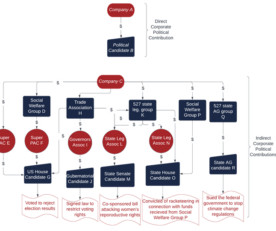

Oregon State Treasury Nomination Neutrality

Harvard Corporate Governance

FEBRUARY 26, 2024

Posted by Philip Larrieu, Oregon State Treasury, on Monday, February 26, 2024 Editor's Note: Philip Larrieu is a Stewardship Investment Officer at the Oregon State Treasury. This post was prepared for the Forum by Mr. Larrieu.

Let's personalize your content