Frederik Otto is Founder and Business Advisor of The Sustainability Board Report (TSBR); Rachael De Renzy Channer is Global Head of Sustainability; and Ashley Summerfield is Leader, Global CEO and Board Consulting Practice at Egon Zehnder. This post is based on a The Sustainability Board Report and Egon Zehnder memorandum by Mr. Otto, Ms. De Renzy Channer, and Mr. Summerfield. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) by Lucian Bebchuk, and Roberto Tallarita; Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy – A Reply to Professor Rock (discussed on the Forum here) by Leo E. Strine, Jr.; Does Enlightened Shareholder Value add Value (discussed on the Forum here); and Stakeholder Capitalism in the Time of COVID (discussed on the Forum here) both by Lucian A. Bebchuk, Kobi Kastiel, and Roberto Tallarita.

Egon Zehnder’s work with boards across the globe reveals a paradox.

On the one hand, board members are keenly aware of the environmental and social requirements their companies must address— given emerging legislation and global reporting standards, sustainability-conscious investors and customers, and the increasingly clear link between long-term company performance and sustainability. Boards know that environmental, social, and governance (ESG) goals can no longer be an afterthought, way down the agenda after financial governance and performance.

On the other hand, many board members tell us they feel ill-equipped to act on the ESG imperative in a structured and systematic way. Our research shows that many boards have not yet embedded the skills, mindset, and courage to pioneer a new way of doing business and change the ways in which long-term risks and opportunities are identified and assessed. This not only places their companies at risk—both reputationally and performance-wise among investors and customers—but also misses an opportunity to take the lead in finding ways to leave the planet in better shape for future generations.

Sustainability is no longer a nice-to-have item on a board’s agenda, appearing after financial governance and performance. Most farsighted boards know it is not a tick-box exercise either, included to merely meet legislative, procedural, or reporting requirements. Rather, sustainability—a term often used interchangeably with ESG—has moved to the core of a company’s business. This awareness has been driven by the links between long-term company performance and ESG performance; investors with sustainability at the core of their decisions; and emerging legislation and global reporting standards.

This dichotomy suggests that board leaders and members need to challenge themselves on multiple fronts if they are to embed sustainability in the board’s DNA. Questions to ask include:

- Do we have the deep commitment and courage required to act as stewards of sustainability?

- Do we have the right mindset and mix of people on the board? Do we have enough knowledge about sustainability, and if not, how do we change this?

- Do we have a clear understanding of the full scope of ESG as it relates to our company?

- Do we put sustainability at the heart of our decision-making?

To help answer these questions, this report presents the data and insights of the 2022 TSBR, a survey of the world’s largest 100 publicly listed companies to determine board ESG preparedness and director ESG engagement; and Egon Zehnder’s research on the role of boards in defining and driving sustainability agendas in companies.

WHAT THE RESEARCH TELLS US

While boards are striving to meet the challenges and opportunities of ESG via committees and sub-committees, and are increasingly becoming more diverse, there needs to be more focus on all the moving parts of sustainability, increased education on relevant sustainability issues, and an enhanced mix of individuals who together challenge the status quo.

DEFINING SUSTAINABILITY AND ESGThe terms “sustainability” and “ESG” span environment, human capital, social capital, business models and innovation, and governance. Tackling these issues requires both short- and long-term vision, with the needs of both current and future generations given consideration. This means boards and their companies must factor in a wide range of possible outcomes and make bold decisions while remaining flexible to respond to shifting situations. |

Committed to Committees

TSBR’s data (Figure 1) indicates that just over one-quarter of the directors in the surveyed companies were members of a relevant committee, with 45 percent on committees assessed to be ESG-engaged.[1] In 2019, this figure was only 16 percent, signaling significant improvement in representation of ESG-engaged directors on committees.

There was also a rise in the percentage of boards with a relevant committee, from 54 percent in 2019 to 80 percent in 2022.[2], [3] TSBR also identified an increase in dedicated committee activities around ESG, from 52 percent in 2020 to 69 percent in 2021.

HOW TSBR CONDUCTED ITS STUDYTSBR collated and analyzed a wide range of data on board activities and composition for the top 100 listed companies globally. It identified the presence of a relevant board committee that stipulates sustainability issues in its committee charter, and then analyzed the demographics of board members serving on these committees. To be included in the study, directors had to be assigned to a relevant committee. Businesses that did not disclose any sustainability policy as part of their board committee charters were not included in the study. TSBR’s full methodology can be found here. |

The Diversity Difference

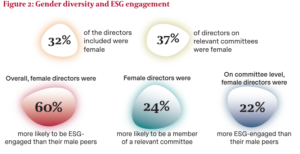

TSBR highlighted a positive link between gender diversity and ESG engagement in the top 100 companies (Figure 2). Diversity is considered by many to play a critical role in boards’ progress on their stewardship journeys, as demonstrated by TSBR’s findings presented above. Egon Zehnder’s research has shown that more women and environmental experts, a younger average age, and shorter tenure on the board often have a positive effect on corporate sustainability.[4] Diversity is not limited to gender and age, but should also embrace factors such as race, ethnicity, sexual orientation, lived experience, and geographical location— although links between these factors and sustainability performance have not yet been measured. Above all, a differing outlook or mindset is a necessary addition to enable boards to step up as stewards of sustainability.

Globally, there has been a significant improvement in gender diversity on boards, with Egon Zehnder’s data showing that the percentage of women on boards grew from 14.6 percent in 2012 to 27 percent in 2022. In the Netherlands, legislation requires boards to include a minimum of one-third men and one-third women, and in India, 2013 legislation made it compulsory to have at least one woman on the boards of publicly listed companies. These drivers have increased gender diversity in those countries.

There has also been significant progress on board diversity in individual companies. As just one example, a multinational plastics company headquartered in the United States has not only established geographical diversity on the board through ensuring representation from all regions in which the company operates but is also seeking to transition the board to being at least 50 percent female.

Despite some progress in gender diversity, however, Egon Zehnder’s Global Board Diversity Tracker reveals that older people still outnumber younger people on boards. In fact, there seems to be a move toward even more experience, with the average age of board members increasing slightly from 59.8 years in 2014 to 61 years in 2022. Research has shown that the capital market will start to show a preference for younger and more diverse boards due to their performance in terms of corporate sustainability.[5]

Gaps in Skills and Knowledge

Egon Zehnder’s research has shown that many boards still focus on financial metrics above all others, resulting in financial performance and shareholder value remaining the predominant decision drivers for CEOs (Figure 3). ESG concerns are placed lower on CEOs’ priority lists, even though the CEOs are recognizing the increasing urgency of addressing environmental and social challenges.[5]

Many companies have well-established processes for measuring ESG performance, driven by legislation and stakeholder demands. Egon Zehnder’s global survey of hundreds of executives, Creating a Sustainable World, found that most respondents believe their boards are well equipped to monitor sustainability threats and opportunities. However, the study found that many boards lack the skills and knowledge to translate such monitoring into improved governance—and that progress on setting and meeting ESG goals varies widely between companies and sectors.

Skewed Focus

In many parts of the world, engagement, measurement, and progress is greatest for environmental topics, as these may be easier to understand and quantify. Climaterelated considerations, including the setting of 1.5°C-aligned or net-zero emissions targets, are becoming high priorities for companies— sometimes overshadowing other relevant and critical issues.

When no legislation exists, social and governance have typically been given lower priority, although companies in sectors such as textiles and natural resources have had to respond to pressures to address their social impacts in order to retain their operating licenses. Regional variations also occur, with India and the United States, for example, having extensive experience on addressing governance issues in response to legislation.

There is no single template for success to deal with these complex topics, and we note differing approaches across sectors and regions. One company in the pharmaceuticals sector has been successful in separating out the E, S, and G portfolios, appointing one senior leader to be responsible for each, reporting back to the board. This approach resulted in previously fragmented ESG efforts becoming consolidated. Another company appointed a “shadow board” whose mandate was to challenge the board and come up with new and fresh ideas. Members of the “shadow board” could then go on to be appointed to the board.

Figure 3: CEOs’ ranking of decision-making metrics

The Merits of the Right Mix

Egon Zehnder’s research shows that the right “blend” of individuals, combined with an optimal board culture and effective personal dynamics, can move the organization from words to action, with the board playing its overall role as steward. Board members do not all need to be experts in sustainability. Rather, it is important that generalists are willing and able to improve their literacy on the various dimensions of sustainability—and develop a keen appreciation of the sustainability-related challenges and opportunities specific to their companies. Open-mindedness and a willingness to keep their understanding current in an everchanging environment are essential characteristics of board members.

A positive board culture and healthy board dynamics are vital for boards to become better stewards of sustainability. While chairs need to continue to facilitate the efficient performance of the board functions, developing a culture of curiosity and transparency among board members plays a significant role in embedding sustainability into board agendas. As Egon Zehnder’s Chair Jill Ader puts it, “Not everyone can be passionate, but blockers are not going to allow for progress.”

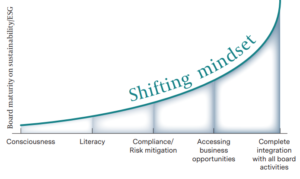

Figure 4: The board ESG maturity curve

STRENGTHENING BOARDS’ SUSTAINABILITY FOCUS

Egon Zehnder’s work with global firms across sectors suggests that the incremental changes being adopted by many boards are not achieving the transformations required to meaningfully progress the sustainability agenda.

Moving the board along the ESG maturity curve (Figure 4) takes courage from both the chair and the board members. We propose four actions to help boards progress along this curve.

1. Move ESG to the core of board activities

Boards should not wait to have all the challenges facing them and the solutions to these challenges resolved before they act. Rather, it is important to act early and commit to a way forward, knowing that actions will change as the journey evolves. Chairs play a significant role in creating this momentum.

Initially boards may engage with ESG through sustainability or ESG committees which are mandated to drive this agenda. We have observed different methods of increasing board knowledge and confidence on this topic; for example, one large multinational chemicals and technology company invites an expert on an emerging topic to chair the meetings of the ESG committee to help ensure the committee members are kept informed of current challenges and opportunities.

Some boards convene additional full board meetings focused specifically on sustainability topics, while others appoint sustainability experts to the board with the mandate to drive this agenda. Ultimately, however, effective stewardship requires boards to place sustainability on an equal footing with financial performance and risk assessment in all decisions and to integrate the ESG agenda into regular board meetings.

2. Develop board members through education and exposure

As highlighted previously, although not all board members need to be sustainability experts, there is a responsibility for keeping up to date on emerging sustainability issues and opportunities. We have heard examples of boards offering training sessions on emerging issues and inviting experts to brief the full board on emerging and critical sustainability matters or to help drive transitions on key sustainability issues. For example, boards appoint experts on addressing climate-related impacts or to advise on local ESG issues when establishing operations in new regions or countries.

However, our research suggests that while committees and expert briefings may be valuable in the early stages of sustainability journeys and while tackling individual topics, one-off interventions are not always effective in achieving the necessary mindset shifts. Every board member needs to begin with themselves and demonstrate the commitment to remaining on top of relevant sustainability issues, through their own regular education and learning.

3. Challenge mindsets through diversity of age and gender

A clear link has been demonstrated between diversity and board stewardship. Although the data shows improvements in gender diversity, in part in response to legislation, the relatively static age demographics of boards is robbing organizations of the important perspective of the younger generation. Boards need to give attention to increasing gender diversity during recruitment of new board members, as well as to considering younger applicants, even if they may require training and mentorship to fulfill their duties.

4. Shake up board dynamics and culture

Many boards are stuck in the status quo, continuing to do business in a way that is no longer relevant. To fully embrace their stewardship roles, they need to have the courage to challenge current practices and thinking, the flexibility to dive into unchartered waters knowing that plans and targets will likely change, and the vision to see both the short and long term.

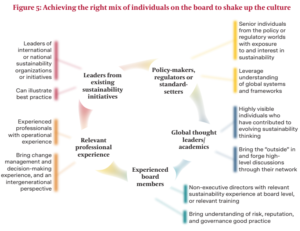

Focusing on board dynamics and culture to harness diversity and fresh thinking will go a long way in tackling the various dimensions of sustainability. Bringing people from different, sometimes seemingly incongruent, worlds onto a board can help challenge the status quo and ensure the right blend of individuals to make the necessary shifts (Figure 5). We have seen places where this is happening, for example with the appointment of a CEO of a sustainability consultancy to the board of a chemicals company, and the recruitment of a CEO of a global charity to the board of a building materials company.

Figure 5: Achieving the right mix of individuals on the board to shake up the culture

GETTING THE RIGHT INDIVIDUALS ON BOARD

While we have suggested opportunities for the board as a whole, the attributes of individual members are also key to advancing sustainability progress. Including individuals on a board with a systems mindset, who are driven toward action and have strong transformation and innovation skills, can help drive a smooth and effective transition.

Our “span of influence” describes individuals in terms of their understanding of and engagement with sustainability (Figure 6). We define “tea lights” as those with an individual interest or passion in sustainability but are unlikely to drive action; “beacons” as having some interest in individual sustainability topics or solutions; “firestarters” as those who will drive change in the organization; and “luminaries” as those engaging with sustainability as a systemic challenge.

Although a board will likely include tea lights, beacons, and firestarters, the presence of at least one luminary will be critical to igniting board stewardship and lighting the way to a more sustainable future. Current board members need to reflect on their outlook with reference to the span of influence, and what actions they can take to evolve their mindset and thinking. This in addition to looking for desirable qualities in new board appointees.

Figure 6: Individuals’ span of influence on boards

Egon Zehnder has developed a framework to assess where existing board members and new board candidates sit on the span of influence, and their potential role in contributing to board stewardship. We consider this framework to have value in highlighting ways in which individuals can bring value to the board (Figure 7). The framework examines individuals’ cultural fit, leadership competency, and ESG experience and exposure. The ESG experience/exposure metrics shown in Figure 6 are aligned with the dimensions of the Sustainability Accounting Standards Board (SASB) Framework, which provides sector-level guidance to help identify ESG issues that are materially relevant to industries and companies.

Figure 7: Framework for assessment of individuals’ potential contribution to board stewardship

Integrating sustainability into a board’s activities is a journey that requires working with the complexity of the challenge and committing to making meaningful change to prosper over the long term, with social justice and the health of the planet top of mind. An extensive and integrated focus on sustainability calls for a caring, committed, diverse, inclusive, educated, and equitable board. It also requires the boardroom to be a safe space in which entrenched culture and behaviors can be challenged without repercussions.

Chairs and board members alike need to embrace their stewardship roles, steering companies from regarding society and environment as something “out there,” to a position of being at the service of society and the environment. This radical mindset shift, which is the moral obligation of leaders at all levels, is critical to ensuring not only the longevity of the company, but of the planet for current generations and those to come. The courage to step out of the comfort of the past into an unsteady present that demands bold action for the future is what will truly define a committed board.

As Jill Ader, Chair of Egon Zehnder, puts it: “There is a bravery in not accepting incrementalism. Give boards the option to go far, and then the option to go further, and they’ll likely take the further option!”

Endnotes

1TBSR includes two measures of ESG engagement: those who are considered ESG-conscious or have an awareness and knowledge of issues, and those who are ESG-competent or have the capacity to act on issues (go back)

2Refers to committees in which a sustainability narrative is clearly stipulated in their charters. Some committees are named ‘ESG’ or ‘CSR’ committees, while in other cases sustainability responsibilities are part of shared committees such as Corporate Governance and/or Nomination committees, Risk, or Public Policy/Affairs committees (go back)

3The Sustainability Board Report 2022 (go back)

4Fresh impetus for greater sustainability in boards: The significance of board composition in European companies, Egon Zehnder (go back)

Print

Print