May 3, 2023 • 8 min read

How to Measure and Improve Assurance and Compliance With IRM

Staying ahead of risk in today’s uncertain risk climate requires business leaders to rethink their approach to risk management. Most CEOs are ready to take a more strategic view on risk that moves beyond heat maps and simple questions of compliance. Instead, they’re asking: How can we be smarter about taking on risk? How does our risk appetite compare with the value of the business activities we’re looking to engage in? How can we use risk management to drive the business forward?

Business leaders can move past outdated and compliance-driven risk management approaches by better understanding and prioritizing their companies’ risks through four universally applicable risk management objectives of Performance, Resilience, Assurance, and Compliance (PRAC). An earlier article examined performance and resilience; we’ll take an in-depth look at assurance and compliance below. For a deep-dive on performance and resilience, as well as a bigger-picture look at the business case for integrated risk management (IRM), integrated risk priorities important in the current environment, and how PRAC can help your organization get on the right track, download the full ebook, The Integration Imperative: Connecting People, Technology, and Business in a New Era of Risk.

Assess PRAC to Better Understand, Prioritize, and Manage Risk

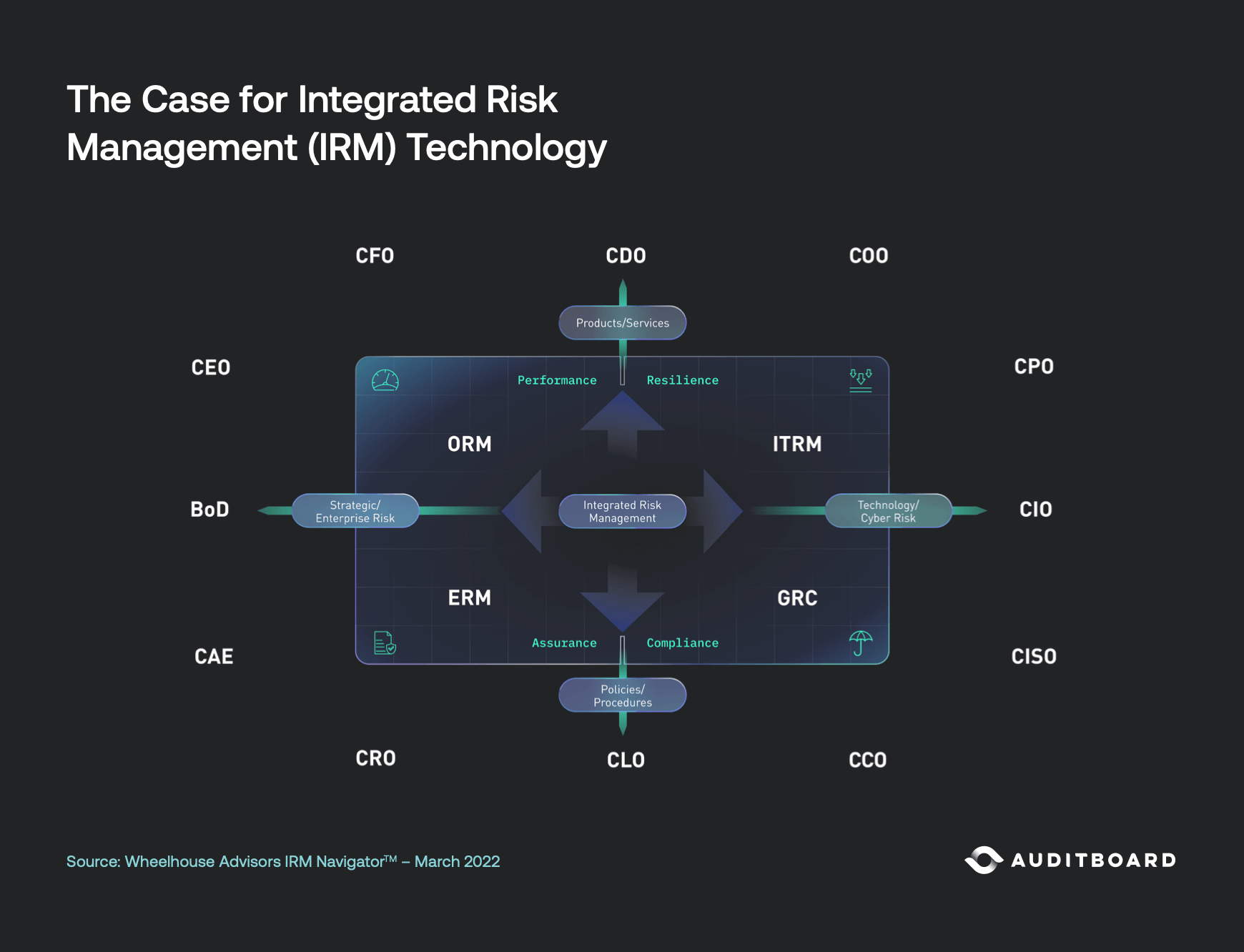

Every business looks to achieve better performance, stronger resilience, greater assurance, and more cost-effective compliance. The graphic below illustrates how assurance and compliance interconnect and overlay with key risk areas, disciplines, organizational leadership roles, and the complementary objectives of performance and resilience.

Assurance: Are You Mitigating the Right Risks in the Right Way?

Why It Matters

Enterprise risk management (ERM) provides a strategic view of risk, helping to support the assurance risk objective of addressing the right risks in the right way. But many organizations rely on outdated, legacy ERM technologies that can’t provide appropriate levels of assurance due to their siloed views of risk. What may be acceptable in one silo may not support the intended level of risk mitigation in other areas. For example, increased cross-border regulation related to data privacy may easily cause confusion, resulting in misallocation of resources to areas of the business that may not be as critical or that represent lower overall relative risk.

Assurance: How It’s Measured

Gaining appropriate levels of assurance requires an integrated approach to defining risk appetite, establishing risk metrics, and monitoring risk on a continuous basis. IRM assessments allow senior management to determine the favored risk mitigation options for identified risk issues, helping to clarify organizational strategy and risk appetite.

How IRM Supports Assurance

IRM provides a more comprehensive view that helps organizations to more effectively analyze total risk and prioritize efforts accordingly. IRM technology helps to integrate assurance functions by integrating and synchronizing multiple groups’ data (e.g., risks, controls, policies, issues, frameworks) into one system of record. Different groups’ data successfully communicate with one another, supporting cross-functional analytics and a streamlined view of risk based on a common taxonomy and risk scoring criteria. Silos are broken down to offer a comprehensive view of an organization’s risk profile, enabling the creation of a single integrated issues report, consolidated assurance report, and consolidated schedule of assurance activities.

Compliance: Are You Identifying and Remediating Areas of Non-Compliance?

Why It Matters

While meeting compliance requirements is an increasingly complex endeavor, the real challenge for most businesses is identifying and remediating areas of non-compliance. New laws and compliance mandates will require timely disclosure of non-compliant events under threat of penalty from greater enforcement of regulations.

Organizations often have separate governance, risk, and compliance (GRC) tools geared to individual compliance efforts, making it imperative to streamline and simplify processes for meeting the requirements of multiple compliance mandates. This need is evident in how the GRC technology marketplace has evolved, with integrated risk management platforms expanding their capabilities beyond GRC silos. While AuditBoard was founded to focus on better leveraging technology to assist companies with SOX compliance and readiness, solutions now span GRC, ORM, ITRM, ERM, security compliance management, compliance audits, assessment management, and beyond to create a truly connected risk platform.

Compliance: How It’s Measured

Compliance risk and gap assessments can help companies to easily identify coverage gaps between their organizations and industry standards or frameworks to develop more impactful audit plans. Requirements are tracked by mapping frameworks to specific risks and controls. New or updated regulations are integrated to ensure that organizations stay compliant. Issues, gaps, and exceptions are identified, tracked, and managed.

How IRM Supports Compliance

IRM helps companies navigate complex compliance requirements, thereby avoiding penalties and potential reputational harm. IRM includes both compliance risk assessments and fulfillment, providing reliable, current, and readily available data on the organization’s compliance positions. It can also help companies identify opportunities for savings and efficiencies, reduce costs due to compliance redundancies, scale and automate compliance programs, and reduce stakeholder fatigue by enabling one-time evidence collection for information that can be used many times.

Create Competitive Advantage With a Balanced View on Risk

Assurance and compliance are only two parts of the puzzle. For sustainable, successful IRM, organizations must balance assurance and compliance against the complementary objectives of performance and resilience. A practical, balanced view of risk doesn’t overly emphasize one objective at the expense of the others. It also moves beyond viewing risk simply as an impediment to avoid or overcome, understanding that risk is an integral part of business — and that companies can use risk knowledge to create a competitive advantage.

Get ahead of risk by using PRAC to “connect the dots” on risk across your organization and make better decisions about risk. Download your free copy of The Integration Imperative: Connecting People, Technology, and Business in a New Era of Risk.

You may also like to read

Effective planning in permacrisis requires unified, collaborative risk leadership

Fraud triangle: A practical guide for internal audit teams

HR audit process: A practical guide to streamline compliance and risk

Effective planning in permacrisis requires unified, collaborative risk leadership

Fraud triangle: A practical guide for internal audit teams

Discover why industry leaders choose AuditBoard

SCHEDULE A DEMO