Examples of Mergers & Acquisitions: 8 Factors for Success

Viking Mergers

MAY 13, 2022

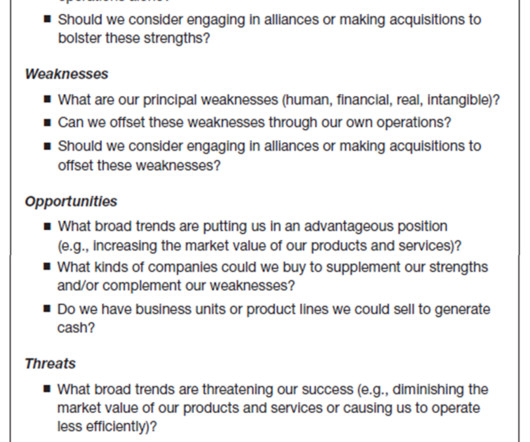

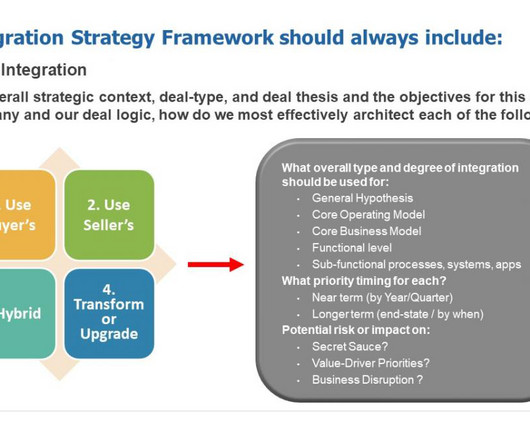

Integration can look like combining technology, lines of business, supply chain, etc, where the combination enhances your company’s ability to compete and increase efficiencies. So, a focus on synergies involves purchasing a business that, when added to your existing business, results in a greater sum than the separate entities. Integration.

Let's personalize your content