Dissecting the Long-Term Performance of the Chinese Stock Market

Harvard Corporate Governance

APRIL 16, 2024

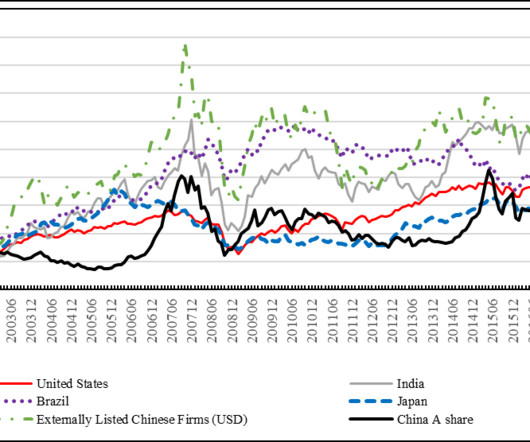

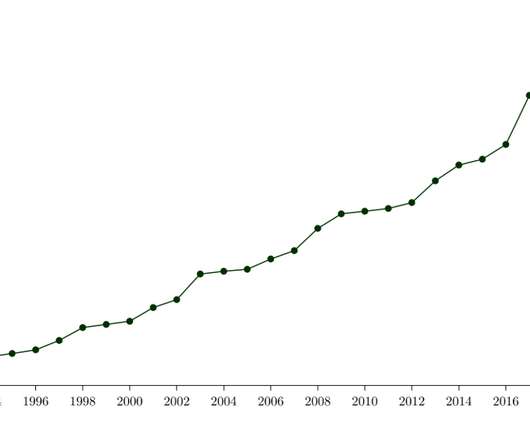

The Chinese stock market started in 1990 with the establishment of two domestic stock exchanges (the “A share” market): the Shanghai Stock Exchange (SSE hereafter) and the Shenzhen Stock Exchange (SZSE). The A share market is the second largest in the world in terms of total market capitalization, trailing only the US equity markets.

Let's personalize your content