The Management Discussion and Analysis (MD&A) section of annual reports is widely credited with providing valuable information about public companies. Yet largely unexplored is the extent to which narrative context influences and complements the numerical data presented in that section. In two recent studies, we delve into the relationship between those two elements, highlighting how contextual information enhances the understanding of financial reports.

Quantifying the Value of Context

In one study, “Context-Based Interpretation of Financial Information,” we use a large language model, BERT (Bidirectional Encoder Representations from Transformers), to distill contextual information from the text and to explore the interplay between contextual and numerical data. As the initial step, we identify sentences addressing earnings-related content and convert them into high-dimensional vector representations. This encoded context encompasses a broad spectrum of information, e.g., changes in the competitive landscape, fluctuations in demand for products, reasons underlying a firm’s diminished profitability, and management’s plans and expectations about future earnings, elements usually missing from conventional textual analysis.

In the next step, we merge the context vectors with associated numerical data, including earnings, cash flows, and their preceding values. This combined data then feeds into a deep neural network model designed to predict future trends (either increase or decrease) in earnings, cash flows, and stock returns. Artificial neural networks are universal approximators that help uncover complex relationships between multi-dimensional input variables and eventual outcomes by learning highly nonlinear interactions between the inputs by means of layers of “neurons.” This process resembles the processing of information in the human brain. While individual neurons may possess little information, the collective interactions among them produce predictive power.

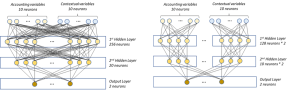

In our fully connected model (illustrated on the left below), context and numeric neurons fully interact, whereas, in our partially connected model (on the right), such interactions are confined within each group and prohibited across groups. Should these cross-group interactions convey vital information, the fully connected model will outperform the partially connected model. Conversely, if the interactions lack significance, the fully connected model will generally suffer from a lower ability to be generalized and thus will exhibit a lower predictive performance.

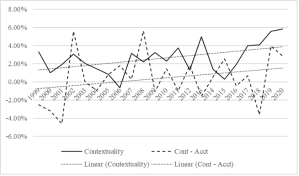

Our findings corroborate the former scenario: The fully connected model significantly outperforms the partially connected model. We define the difference in the performance metrics as the quantified value of contextual information. In forecasting short-term stock returns, contextual information enhances prediction accuracy by 3.64 percentage points. Given that even the most refined models rarely exceed a 60 percent accuracy rate in predicting stock returns, this improvement is substantial (see Figure below). Additionally, we demonstrate that the value of contextual information has been increasing over time and provide preliminary evidence that human analysts are also benefiting from such context information.

Does Context Matter in Pricing Financial Assets?

Motivated by these findings, we extend this insight into the field of asset pricing in our second paper, “Profitability Context and the Cross-Section of Stock Returns.” Here, we refine traditional asset pricing models by augmenting the profitability factor with contextual information.

Traditional asset pricing models implicitly assume that numeric information is context-free. However, factors like profitability, which is derived from financial statements, merit interpretation within the relevant narrative context. For example, GameStop Inc.’s profitability plummeted in 2011 due to a temporary fluctuation in product demand: Customers anticipated a forthcoming launch of the new generation of gaming consoles and curtailed their spending. While this context reshapes our interpretation of the profitability dip, conventional asset pricing models would have projected lower stock returns.

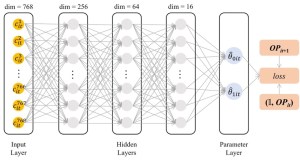

In theory, asset pricing models require knowing expected future profitability to explain expected stock returns. However, researchers typically resort to the current level of profitability as a simple proxy for future profitability, which tends to work well in practice. Our model advances the measurement of expected profitability by leveraging a deep-learning approach developed by Farrell et al. (2022). The crux of the model lies in enabling a heterogeneous interpretation of the influence of current profitability on future profitability. For instance, when the current increase or reduction in profitability appears to be temporary, as in the GameStop example, the model will learn from the narrative context to assign a lower weight to current profitability when forecasting future profitability. As depicted in the figure below, our model assimilates context information as its input and alters the relation between current profitability and future profitability depending on the insights learned from the context.

Our empirical analysis indicates the value of contextual information. In monthly Fama-MacBeth regressions, context-adjusted profitability subsumes traditional profitability. Moreover, while the predictive power of traditional profitability proxies has shown a gradual decline over time, our measure retains its statistical significance even in recent years. Investment strategies hinged on context-adjusted profitability yield an annualized alpha of approximately 5.8 percent. A factor built on context-adjusted profitability increases the Sharpe ratio of optimal portfolios from 1.04 to 1.31.

More important, the context-based profitability factor helps to resolve a long-standing puzzle in asset pricing. The puzzle is manifested in the persistence of significant alphas generated by a portfolio of small stocks with high growth. Specifically, this portfolio is not adequately priced by the conventional asset pricing models, including Fama and French’s (2015) five-factor asset pricing model. We find that our context-adjusted profitability successfully prices the portfolio of small, high-growth stocks by incorporating the context within which the profitability is discussed.

Both papers underscore and quantify the critical importance of contextual information in interpreting financial data. Leveraging the latest advancements in natural language processing and deep learning, we measure the value of contextual information through its interaction with numerical data. Furthermore, we demonstrate that enriching numerical data with context notably enhances the efficacy of asset pricing models.

This post comes to us from Alex Kim and Valeri V. Nikolaev at the University of Chicago’s Booth School of Business. It is based on their recent papers, “Context-Based Interpretation of Financial Information,” available here, and “Profitability Context and the Cross-Section of Stock Returns,” available here.

Sky Blog

Sky Blog

When the rubber hits the road, the real test is whether any aid to stock-market investing consistently produces profits. MD&A provides Management with an opportunity to present its positive/subjective spin on related financial-statement numbers. The numbers don’t lie (too much), but Management does. Using financial statement analysis, without the spin, produces consistent profits and avoids losses.

http://www.ConcernedShareholders.com/CCS_FSA.html