Robert J. Rhee is John H. and Marylou Dasburg Professor of Law at the University of Florida Levin College of Law. This post is based on his recent paper, forthcoming in the Journal of Corporation Law, and is part of the Delaware law series; links to other posts in the series are available here.

Is Delaware corporate law relevant? Relevance is a relational concept. Relevant to what? Rules of corporate law are considered in efficiency’s light. Efficient laws should enhance firm value. Is Delaware law more efficient than the laws of other states such that we should see a “Delaware premium”? Do inter-state differences in corporate law matter?

The idea of a “race” for quality has commanded the attention of scholars since the Cary–Winter debate. It is central to the question of federalism in corporate law. The advocates of Delaware law accept the view that it represents the product of a race to the top. But suppose the “race” is a figment of our theoretical imagination. Suppose there is no evidence of a Delaware valuation premium. If so, under the generally accepted measure of quality (efficiency and firm value), corporate law would be irrelevant. A much smaller camp in the academic debate has argued that corporate law is “trivial.” In The Irrelevance of Delaware Corporate Law, 48 J. Corp. L. (forthcoming 2022), I provide empirical support for the hypothesis that, despite the law’s purported aspiration for efficiency, inter-state differences in state corporate law have no basis in efficiency.

I provide two sets of empirical data showing no empirical evidence of an actionable Delaware premium or advantage in firm value. The first set of data is a five-year study of valuations. It analyzes the market values and stock prices of public Fortune 500 companies over the period 2015–2019. About one-third of public Fortune 500 companies are chartered in other states, including some of the largest, most important companies in America. This article shows that there is no Delaware premium. The second set of empirical data is less traditionally thought of as “empirical,” but the evidence is every bit that and important. It is observations of market behavior. Market actors behave in a way that presumes the irrelevance of Delaware law and inter-state differences in state corporate law. Both sets of empirical data are equally important, and both are mutually reinforcing.

Empirical Data on Valuations and Stock Price

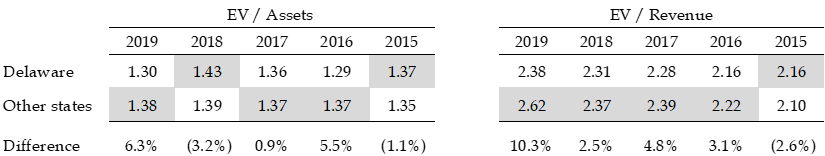

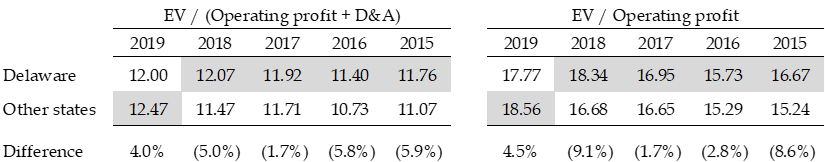

After sorting for state-chartered corporations with complete financial data and stock prices for the five-year period 2015–2019, two portfolios were created for the resulting 413 public companies: Delaware and non-Delaware corporations. Valuations were measured using six different market multiples (EV/Assets, EV/Revenue, EV/operating profit, EV/EBITDA, P/E, P/B). Taking multiple measures is a best practice of financial analysts, and is a better way of doing valuations than simply relying on one measure, which has been the method of past studies relying solely on Tobin’s Q. Also, stock price indices were created for Delaware companies and non-Delaware companies, and stock prices were tracked over the five-year period.

Raw calculations are almost never useful in valuation studies because invariably there are outlier data that disproportionately affect the aggregate outcomes. Three sets of screening were conducts. All rules were applied uniformly to the entire data set. The following are the multiples for the six valuation measures between Delaware and non-Delaware companies over five years. This set of data screened out extreme values and negative multiples. Higher values are shaded in gray.

The average difference among the six multiples across five years is negative (0.5%) for all non-Delaware companies. An examination of all sets of multiples in the article shows no actionable Delaware premium.

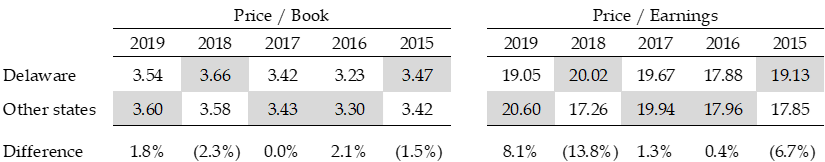

A stock price analysis was also performed. Indices of Delaware and non-Delaware companies were created. The following chart tracks the 5-year stock price movement for the period January 1, 2015, to December 31, 2019. The solid line (――) is the Delaware index and the dashed line (– – –) the non-Delaware index.

The correlation coefficient between the two portfolios was high (0.9857), which is expected given the number of companies in the indices, the diversification of the industries represented therein, and the relative size of the companies. Total returns and annualized rates of return for the five-year period were: (1) non-Delaware 75.08% and 11.85%; (2) Delaware 73.01% and 11.59%.

Based on a complete review of valuations and stock price performance as presented in my paper, Delaware companies did not show a discernable premium to value or superior stock price performance.

Empirical Data on Market Behavior

The fact that there is no Delaware premium is consistent with evidence of market behavior. Market actors typically act or report on value signals: e.g., corporations, shareholders, activist shareholders, attorneys, investment bankers, hedge funds and traders, security analysts, Delaware courts, financial expert witnesses, and trade publications and textbooks. If there was an actionable Delaware premium, market actors would surely have acted upon that value differential. They are not behaving as though Delaware law matters, and the silence is akin to the Holmesian dog.

- Non-Delaware corporations, some of which are the largest, important corporations in America, are not rushing to reincorporate in Delaware.

- Shareholder activism is not based on a strategy of reincorporation to Delaware as a form of extracting value.

- No shareholder proposal of non-Delaware companies studied here in the years 2015–2019, a total of 660 shareholder proxy statements, proposed reincorporation to Delaware.

- Traders are not executing a “Delaware trade” in which differences in law represent an arbitrage opportunity.

- Investment bankers do not consider inter-state differences in corporate law when they provide fairness or valuation opinions, and such discussions are not seen in merger proxies or registration statements.

- Security analysts do not reference inter-state differences in corporate law when they provide market research on corporate valuations.

- Delaware courts have not referenced a Delaware premium in appraisal cases, suggesting that financial expert witnesses are not considering Delaware law as a factor of value as well.

- Trade publications and standard finance textbooks do not state that Delaware law is a factor of value.

Concluding Thoughts

The dominant orthodoxy in corporate law scholarship accepts the relevance of the directionality debate and the narrative of Delaware’s superiority. The admirers and advocates of Delaware law are many, and academics and elite corporate lawyers share a broad commitment to the Delaware brand and believe that corporate enterprise at the national level is best served by Delaware law. The idea of Delaware’s irrelevance is challenging. The theoretical arguments have already been had. The most useful critique would answer pointed questions of an empirical nature.

If one believes in Delaware’s efficiency and the relevance of inter-state differences in corporate law as measured by efficiency, one should be able to answer simple but perplexing questions. If the market has not priced in “better” law, why not? Why hasn’t the smart money figured out a Delaware trade? What is the specific arbitrage trade from mispriced Delaware companies? If the market has priced in better law, what is the specific quantum of premium? How much untapped value can non-Delaware companies, including one-third of the Fortune 500 companies, realize from a change in law? Why is a systemic premium not readily apparent upon application of standard valuation methods despite scholarly efforts dating back several decades? If such a systemic premium exists, why do non-Delaware firms exist?

In short, the weight of empirical evidence and market logic shows that Delaware law is irrelevant to efficiency. The burden is on Delaware advocates to answer the above questions.

Print

Print