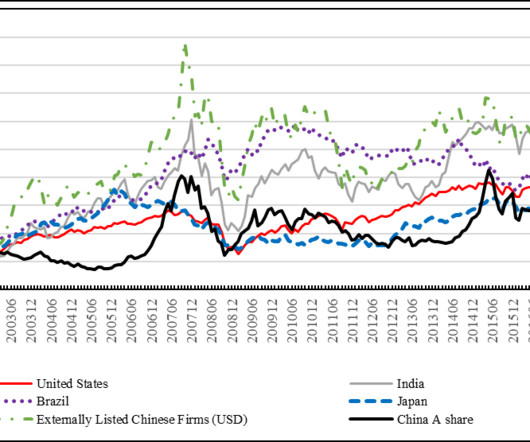

Dissecting the Long-Term Performance of the Chinese Stock Market

Harvard Corporate Governance

APRIL 16, 2024

Posted by Jun Qian (Fudan University), on Tuesday, April 16, 2024 Editor's Note: Jun Qian (QJ) is Professor of Finance and Executive Dean at the Fanhai International School of Finance (FISF), Fudan University.

Let's personalize your content