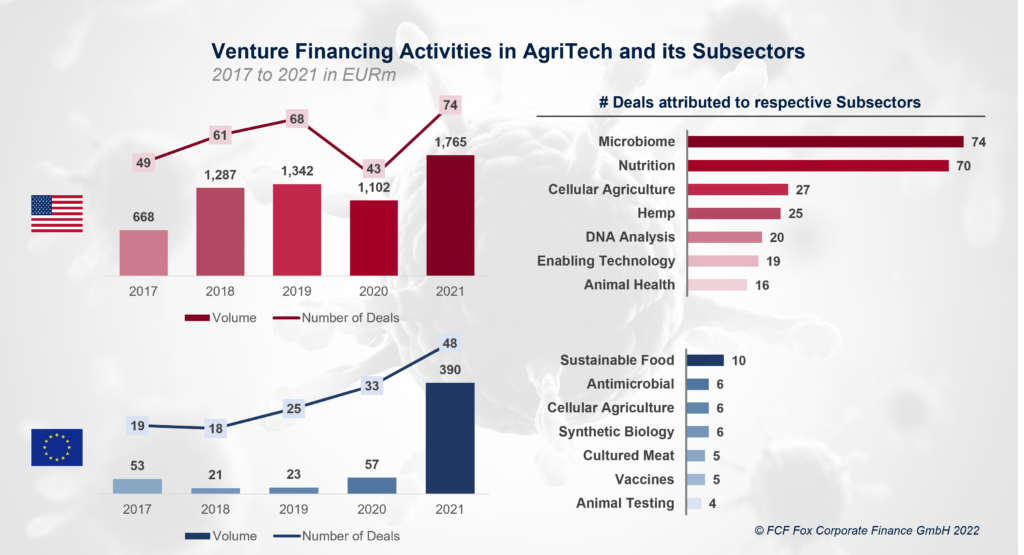

Transaction volumes and the number of closed deals in the AgriTech space continued their steady growth in the US and massively surged in Europe.

In the US, VC financing volumes in AgriTech more than doubled from EUR 668m to EUR 1.8bn since 2017. In Europe, the interest in the AgriTech sector significantly gained in importance in 2021 as financing volumes grew sevenfold from EUR 53m (2017) to EUR 390m (2021).

This jump in 2021 is partly due to the first financing round of 21st.Bio, a manufacturer of proteins and peptides for sustainable food and agriculture solutions (EUR 89m), backed by Novo Holdings.

Most deals in the US were attributed to the microbiome and nutrition subsector, while the sustainable food and antimicrobial subsector dominated European AgriTech deals.

SOSV has been the most active investor in European and US AgriTech deals. Interestingly, EIT Food, a Belgian accelerator, has been the second most active investor in Europe.About FCF Life Sciences

FCF Life Sciences advises leading healthcare companies in Europe on financing transactions (equity, debt, and licensing) with regional and international investors. Our team consists of science-driven industry and finance experts with a strong track record in managing financing processes. We thrive to maximize the efficiency in the fundraising process and increase its closing probability.

Learn more about FCF Life Sciences, click here.

We closely track the activity in the financial markets and are passionate about capital markets research. Not every idea or research question make it into the final selection for our publications. However, we generate interesting information on financing trends in Life Sciences sector, which we would like to share in our blog.

To hear from us on the latest insights, please sign up here: