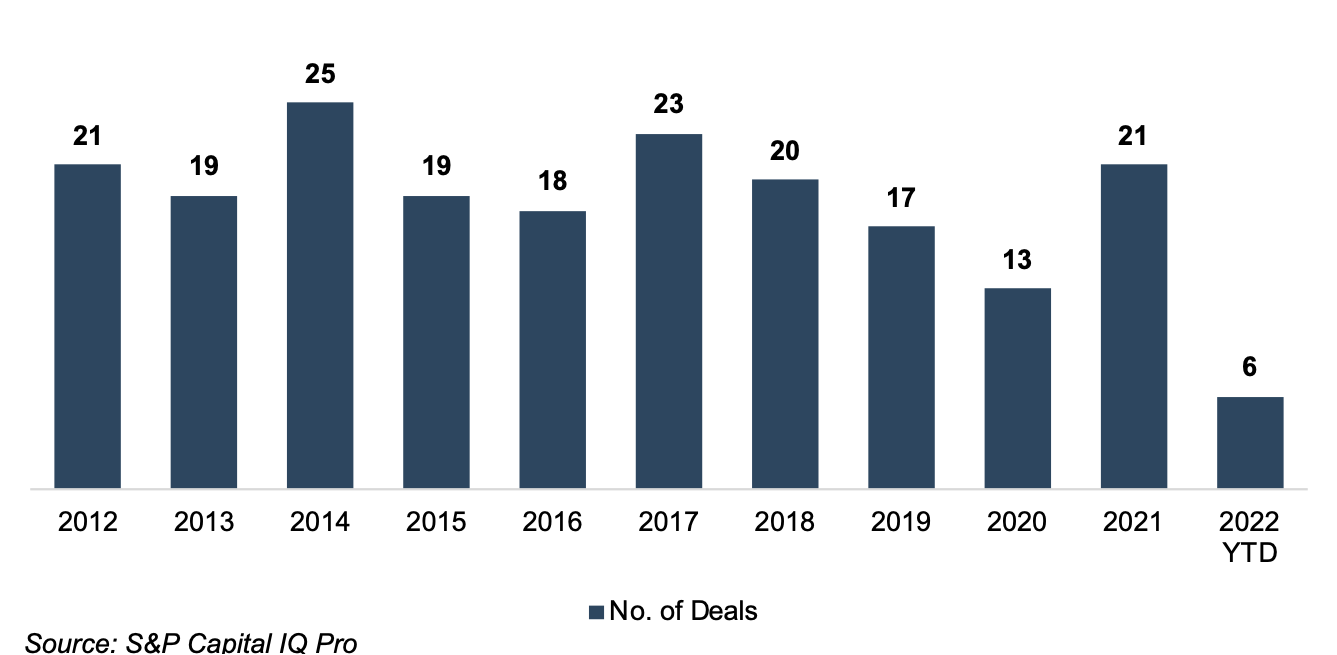

In 2021, there were 21 deals announced with a U.S. bank or thrift buyer and a specialty lender target. This represents a significant uptick from the prior two years and the highest level since 2017. Deals in 2021 were largely driven by a desire to deploy excess liquidity and grow loans. Other drivers of deal activity include efforts to find a niche in the face of competition or diversify revenue and earnings. Through May 19, six deals had been announced in 2022.

Bank & Thrift Acquisitions of Specialty Lenders

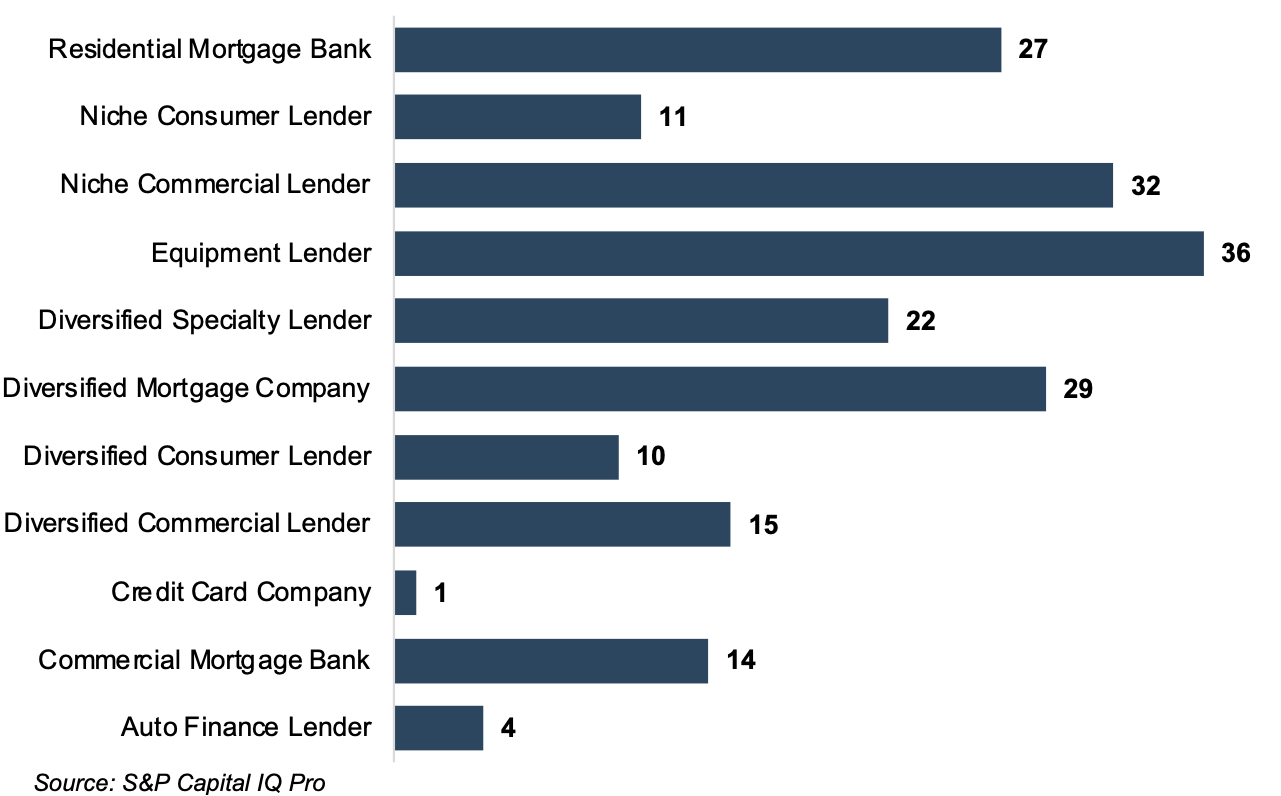

Specialty lenders encompass a variety of business models including mortgage companies, equipment finance, and auto lenders, among others. Over the past ten years, equipment lenders have been the most popular targets for bank acquirers. Other popular categories include niche commercial lenders and diversified mortgage companies.

Acquisitions by Target Focus

Rationale

The premise for a bank/specialty lender deal is intuitive: higher yielding loans funded with cheap/excess deposits. Such a deal also allows the acquirer to diversify the exposure in their loan portfolio. One reason equipment lender deals in particular have been more common is the generally steady demand for equipment. Companies are buying equipment as they expand in good times, but critical purchases cannot be scrapped in a downturn either.

According to the FDIC’s Quarterly Banking Profile, banks with assets of $100 million to $1 billion reported a median earning asset yield of 3.57% as of the fourth quarter of 2021. The cost of funding earning assets for these institutions was approximately 30 basis points. Yields on specialty finance assets can range from 6% to 7% on equipment leases to more than 20% on unsecured consumer loans in some cases. However, these assets are not funded with cheap deposits.

For example, Ohio-based Peoples Bancorp Inc. (PEBO) announced the acquisition of equipment lender Vantage Financial in February. Peoples’ CEO commented on the first quarter earnings call that the Vantage portfolio was expected to yield about 7% in 2022 with an additional 5% from the income based on residual values at the ending of the leases. This compares to Peoples’ reported earning asset yield of 3.61% for the first quarter. In addition, Peoples acquired small ticket equipment leases from North Star Leasing in 2021, and these assets were yielding approximately 15% as of 1Q22.

On the liability side, Vantage’s funding situation was not disclosed beyond the $21 million recourse loan paid off by Peoples at closing. It is safe to assume that Vantage’s debt was more expensive than Peoples’ total deposit cost of 14 basis points. These funding synergies were expected to lead to 3% earnings accretion in 2022 and 6% accretion in 2023.

Another benefit to acquirers is the opportunity to cross-sell by providing traditional banking products that a specialty lender could not provide. While additional revenue from these opportunities is usually not factored into the deal math, it is an important strategic consideration. Regions acquired home improvement lender EnerBank in 2021, and management framed the deal in terms of Regions’ plan to deepen relationships with EnerBank customers by providing a comprehensive suite of banking services

Risks

Banks considering a specialty lender acquisition need to be aware of the potential risks as well. A trade off exists between risk and reward with higher yields compensating the originator for greater credit risk. Specialty finance assets exist on a risk spectrum, ranging from assets such as home improvement loans to borrowers with generally clean credit history to consumer loans to those with poor or no credit history.

EnerBank, the home improvement business acquired by Regions, reported an average customer FICO score of 763 at the time of announcement, and average annual net losses of approximately 1.5%. CURO Group Holdings (CURO), a consumer finance business, estimates net charge-offs in its U.S. Direct Lending business of 11% to 13% of average loans.

For comparison, net charge-offs represented 0.08% of loans for banks with assets of $100 million to $1 billion and 0.14% of loans for banks with assets of $1 billion to $10 billion as of 4Q21. The credit concern may be especially pertinent in the current setting as the benign environment over the past few years is due to normalize at some point.

In addition to credit quality, bank acquirers should be aware of the potential regulatory implications of acquiring a specialty lender. Regulatory agencies have stepped up scrutiny of banks as of late, prompting many banks to reexamine their practices related to consumers (note the large number of banks doing away with overdraft and NSF fees). Acquirers should be comfortable with the credit and regulatory risk profile of the target, making sure the overall risk level will be acceptable in context of the bank’s total portfolio.

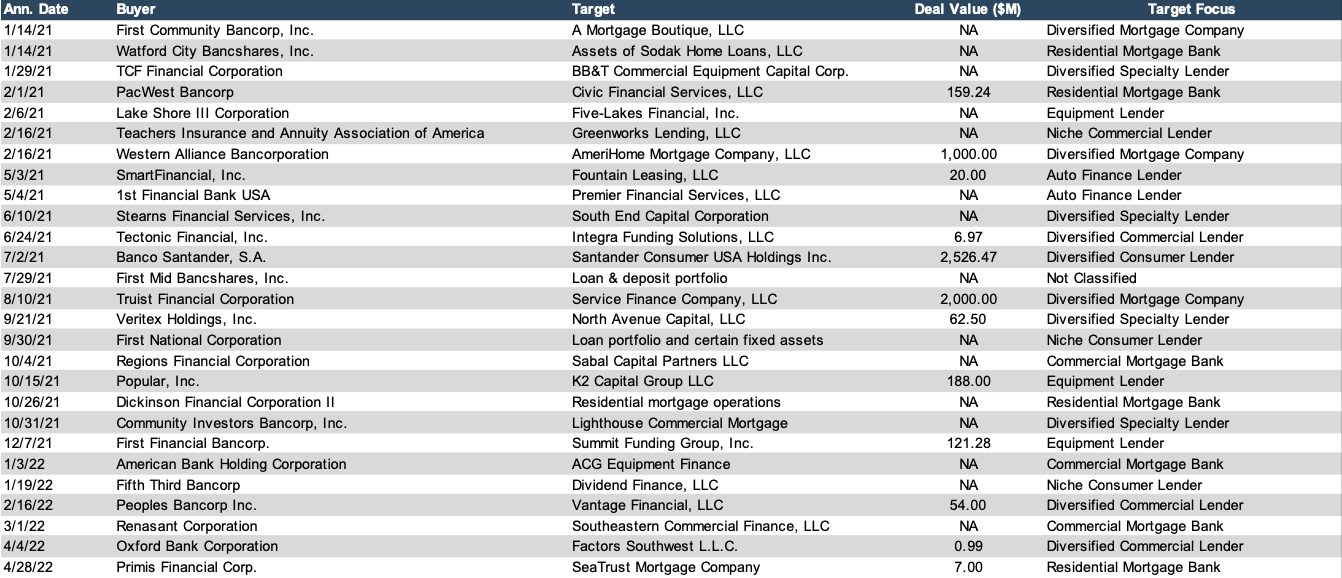

Recent Bank/Specialty Finance Deals

Click here to expand the image above

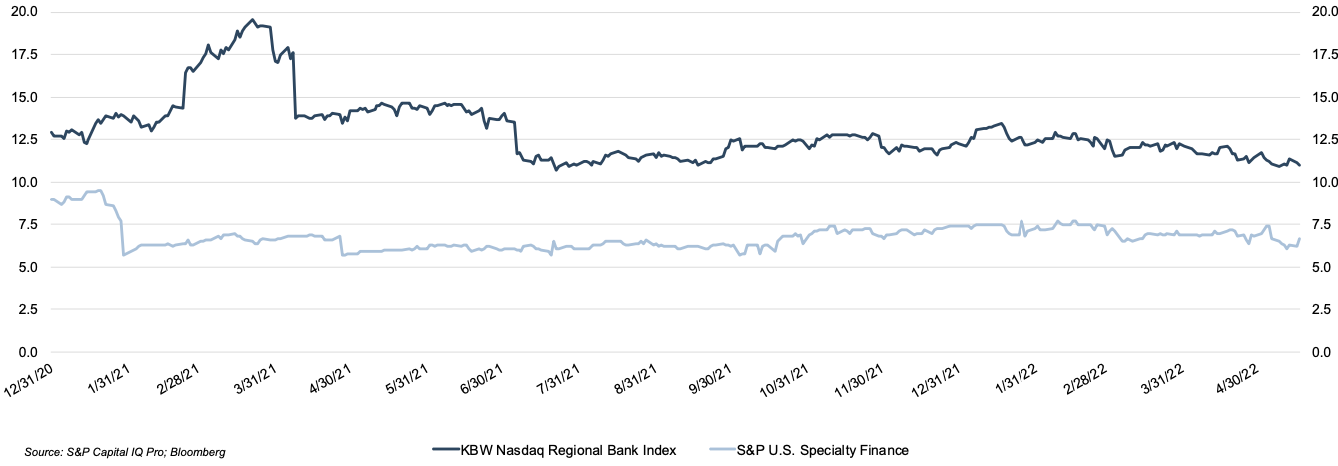

Valuation

While pricing data for specialty finance acquisitions is limited, these businesses tend to transact at lower multiples largely due to the risk factor. The price to earnings multiple for the S&P U.S. Specialty Finance Index was 6.7x as of May 17, and the price to book multiple was 1.7x. For publicly traded specialty lenders (based on S&P Capital IQ Pro classifications), the median P/E was 8.2x, and the median P/B was

0.93x. This compares to P/E and P/B multiples on the KBW NASDAQ Regional Bank Index of 11.0x and 1.2x, respectively.

Comparisons should be made with caution, as the homogeneity in the banking sector does not apply to the same degree in specialty finance.

Price / Earnings (x)

Click here to expand the image above

Conclusion

In summary, a specialty finance acquisition may not be right for every institution, but for the right buyer it can provide a new growth channel and help diversify revenue and earnings. Mercer Capital has significant experience in valuing and evaluating a range of financial service companies for banks.