In derivatives markets, as in other financial markets, customers rely on intermediaries for access to products. When transacting, a customer faces a choice of whether to return to a prior provider or seek a new one. My post yesterday documented concentration among derivatives market intermediaries, which are used to support credit quality under characteristically long-dated derivatives instruments. This post provides a novel explanation for that concentration, as well as the difficulty new entrants face if seeking to break into the intermediation market.

An interaction among commercial law, bankruptcy law, and statistical properties governing derivatives portfolios makes it cheaper to trade with a pre-existing counterparty than a new counterparty. In other words, the marginal cost of a derivative instrument declines when trading that instrument through an existing service provider as opposed to diversifying across intermediaries. Prior research has focused on other explanations for observed concentration. They include the high fixed costs imposed by technological and regulatory demands as well as demands for multi-product offerings from customers. Prior explanations also include declining revenues from greater competition and low interest rates in the post-2008 period, which squeezed intermediaries’ revenues from customer collateral. My research adds to explanations for the observed concentration and links capacity for new entry to the portability of derivatives portfolios.

Before the punchlines can be digested, some background is necessary. Every derivative is a contract that allocates risk between its counterparties. The contract may tie that risk to fluctuations in interest rates, currency exchange rates, commodity prices, or any number of other variables. As risk manifests, the parties to the derivative exchange cash flows, with one becoming a payor and the other a payee. The risk that a party may have to make or receive future payment(s) based on the evolution of the referenced variable is called “market risk.” For example, if two parties agree that one will sell an asset to the other at a time and a price specified at execution, the buyer bears the market risk that the asset declines in value, and the seller bears the market risk that the asset appreciates in value. Beyond market risk, derivatives transactions also involve “credit risk.” Credit risk refers to the risk that the payor fails to satisfy a payment obligation. Several overlapping legal regimes manage credit risk and create the preference for pre-existing trading relationships. Before introducing these regimes, it is necessary to explore some of how derivatives are distinct from other financial instruments such as stocks, bonds, and loans.

The dynamics that encourage customers to prefer accumulating a portfolio of transactions with a single intermediary rather than spreading their transactions across several intermediaries rely in part on a statistical property that implies the “gross” amount payable under a set of transactions will be greater than the “net” amount payable. The gross amount refers to the sum of the absolute values of all the distinct payments. Thus, if the first counterparty had to pay 100 to the second, and the second separately had to pay 50 to the first, the gross amount payable would be 150. In contrast, the net amount payable takes into account the direction of payments and the possibility that they will offset one another. In the example above, provided simultaneous timing to the payments, the net amount payable would be 50. For capital raising instruments such as stocks, loans, and bonds, gross and net values are identical because the issuer is always the payor. However, gross and net values can massively differ for derivatives because, at the outset of any transaction, the direction of payments is unknown.

Distinctions between gross and net amounts payable are important to pairs of derivatives counterparties with portfolios containing distinct trades. If the market risk of two transactions (or sets of transactions) can move in opposite directions, the net exposure to credit risk is likely to be lower when trading with a single counterparty rather than multiple ones. The following example provides a simple illustration why the net credit exposure declines when concentrating trading with a single intermediary. Note that the same is not true of the gross exposure between the counterparties; however, as will be discussed below, legal regimes enable counterparties to reduce reciprocal exposure to the net rather than gross amount.

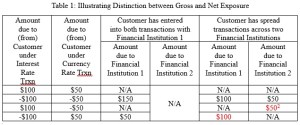

As a stylized example, consider a customer that enters into two independent transactions. The first transaction is based on fluctuations in interest rates and will require the customer to pay or be paid 100, depending on changes in interest rates.[1] The second transaction is based on fluctuations in currency exchange rates and will require the customer to pay or be paid 50, depending on changes in currency exchange rates. The customer may enter into each trade with a single counterparty, Financial Institution 1. Alternatively, the customer may spread out the trades, entering into the first with Financial Institution 1 and the second with Financial Institution 2. The table below calculates the potential credit risk from these two transactions across scenarios where the customer (a) is the payee or payor and (b) uses a single intermediary or both intermediaries. Table 1 illustrates the reduction in net exposure if a single provider is used.

The differences between gross and net amounts reflected in the table are due to cash flows being offset where they flow between the same two counterparties but not where a new service provider is used. The gross amounts due from or to the customer do not change based on whether the customer has split its trading across counterparties because each transaction is treated separately. However, the net amount does change. Where a counterparty owes an amount under one transaction and is owed an amount under a second transaction, the net amount that must be exchanged is lower if both transactions are entered into with the same counterparty. That is because the lower of the two payables can be subtracted from the higher and only that balance paid by the counterparty with the higher payment obligation. To the extent that law permits netting of obligations between two parties (and only between two parties), shifting trading to a second service provider is relatively disfavored from a credit risk standpoint.

A combination of commercial and bankruptcy law permits netting between two parties but not among three or more. Under contract law, multiple transactions may be integrated into a single contract. This is the role of master agreements in derivatives trading, as in other financial and commercial areas. Master agreements allow a pair of counterparties to integrate two or more independent transactions into a single contract, with provisions that prevent the severability of those transactions. As a result, a master agreement enables a trading relationship in which each new transaction is bundled into a single, inseparable portfolio. This prevents selective breaches and is especially important when a derivatives counterparty enters bankruptcy.

Bankruptcy law permits the debtor to keep some contracts outstanding but terminate and only partly satisfy others.[3] If each derivatives transaction between two parties was treated as an independent contract, a debtor could cherry-pick transactions to terminate. As a result, the expected payable under each transaction (i.e., the gross amounts rather than net amount) would become relevant to credit decisions. For example, in the absence of these regimes, if the customer declared bankruptcy in the fourth scenario, it could choose to retain the transaction on which it was owed $50 while settling the transaction on which it owed $100 for much less. The ability to integrate an infinite number of independent transactions between two counterparties into a single contract prevents this cherry-picking. The same is not true of multilateral trading arrangements, where a distinct contract governs the trading relationship with each counterparty, enabling selective rejection. This is how commercial and bankruptcy laws inadvertently deter diversification in derivatives markets. The effect of netting on credit risk is not merely academic; the Office of the Comptroller of the Currency estimates that just among banks, netting reduces gross exposure by approximately 88.6 percent, or $1.9 trillion.[4] The subsidy offered to bilateral trading relationships grows when considering other market participants.

These dynamics have implications beyond explaining concentration among derivatives intermediaries.

- Margin and capital: Margin and capital requirements are core to derivatives regulation. They aim at improving stability and cover trading relationships as well as the institutions themselves. Margin requirements mandate the collateralization of exposure under derivatives transactions. These requirements are costly because they force the allocation of capital to margin-eligible assets – generally low volatility collateral that is easy to liquidate such as cash. In defining the amount of exposure that must be collateralized, margin rules – implicitly or expressly – define netting sets. Netting sets identify transactions between counterparty pairs that may be viewed as (partly) offsetting and those that may not, whether (a) retrospectively for calculating amounts of accumulated exposure under a portfolio or (b) prospectively for estimating potential future exposure. As a result, margin regulations limit commercial and bankruptcy law permissions on netting even between two counterparties. Similarly, when estimating contingent obligations under derivatives transactions for purposes of calculating capital requirements, netting sets are used and reduce the extent to which offsetting market risks are accounted for. As part of rulemaking and lower-level relief (e.g., no-action letters), the scope of netting sets is sometimes deeply contested and sometimes taken for granted, as where jurisdictional lines or geographic borders limit the instruments considered in rulemakings. As discussed in my work, debates over the scope of netting sets implicate competitive concerns in addition to the questions traditionally shaping regulatory action in these areas such as efficiency, safety, and soundness and limitations on models’ capacities to identify correlation between transactions referencing distinct market risks.

- Direct clearing: Prior to the calamitous demise of FTX, the CFTC was considering permitting direct clearing. Direct clearing refers to enabling access to clearinghouses without FCM intermediation, which was discussed in my post yesterday. Currently, some clearing members already clear purely on a proprietary basis rather than serving customers. Direct clearing represents relaxation of safeguards around clearinghouse membership to permit more FCM customers to become clearing members without the oversight or credit support that FCMs offer. This debate has missed how the stickiness of derivatives portfolios influences competition and how direct clearing would enable clearinghouses to compete with FCMs in the accumulation of portfolios that offer netting efficiencies. It is likely for this reason that CME filed an application for direct clearing with the CFTC soon after the clearinghouse owned by FTX filed its application for direct clearing. I expect that CME’s application horrified the FCM community, because industry insiders intuitively understand the potential for competition between clearinghouses and FCMs.

- Active accounts: A proposal under EMIR that was launched post-Brexit would have forced LCH clients to clear a significant part of their portfolios through Eurex instead.[5] This proposal was recently scaled back – perhaps a sign of cooler heads prevailing over what may have become intensifying economic competition in the guise of regulation. However, prior to its rollback, this was a direct regulatory push that would have had the result of diffusing the advantage LCH enjoyed through its massive preexisting portfolios that locked in clearing service customers.

- Universal custodian: My research proposes a novel intermediary that has not been considered in financial markets and that may be the future of derivatives market intermediation. I refer to this intermediary as a universal custodian. At present, transactions and collateral are distributed across markets and intermediaries, with substantial reductions in netting sets. The universal or smart custodian would be a single custodian that a derivatives trader uses for all its transactions – across products (including cleared and uncleared), markets, geographies, and regulatory jurisdictions. This custodian would track exposure on a net basis, requiring collateral on that basis. This would recognize offsetting market risk – potentially with conservatism built into the model. Currently, a trader is not able to net positions taken on a Japanese futures exchange with positions taken on an EU futures exchange, or futures positions with swap positions, or positions with equities underliers with metal underliers. My proposed intermediary would expand netting sets by enabling comprehensive management of exposure under all derivatives contracts. This type of entity would also diffuse the advantages incumbent clearinghouses, swap dealers, and other intermediaries could offer through the complementarity between existing portfolios and new transactions. This diffusion would occur more effectively if regulation mandated that intermediaries ease the porting of portfolios to competitors, whether in part or in whole. Serving efficient credit support while permitting competition, a custodian that comprehensively managed margin could massively improve on the status quo in derivatives markets.

ENDNOTES

[1] This stylized example is generalizable. The interest rate transaction could represent a portfolio of transactions to which the currency (or some other) transaction is being added. In this manner, the example captures the addition of a marginal trade where there is a preexisting portfolio with one counterparty. Similarly the payment amounts are arbitrary and can be replaced with payments of other amounts, including asymmetric expected gains and losses.

[2] The entries in red show where the customer poses higher credit risk due to spreading transactions across intermediaries and being thus unable to net the transactions.

[3] Specifically, debtors may accept or reject “executory” contracts. Executory contracts are those where material performance is required on both sides. Unmatured derivative transactions frequently meet the definition of an executory contract because they provide for reciprocal payment obligations based on the future state of one or more variable.

[4] OCC, Quarterly Report on Bank Trading and Derivatives Activities for 2023 Q1 at 5 (June 2023) (“[l]egally enforceable netting agreements allowed banks to reduce [gross] exposures by 88.6 percent ($1.9 trillion) in the first quarter of 2023”).

[5] The proposal didn’t facially single out LCH or Eurex, but this was its well understood effect because of (a) its disparate treatment of clearinghouses subject directly to EC as opposed to UK or US regulation, and (b) the scarcity of other major clearinghouses in the EU besides Eurex.

This post comes to us from Professor Ilya Beylin at Seton Hall Law School. It is based on his recent paper, “How Portfolio Netting Deters Diversification and Competition in the Derivatives Industry,” forthcoming in the University of Pennsylvania Journal of Business Law and available here.

Sky Blog

Sky Blog