First Quarter – Market Outlook 2021

The first quarter has show growth in confidence and optimism among business owners and M&A professionals alike. Valuation multiples and deal flow are expected to increase in the next three months, according to the first quarter Market Pulse Report. A shortage of strong performing businesses has driven premium prices for those who have show to be “pandemic proof” and have grown or remained unaffected. As a result, sale prices have jumped 30% for Main Street businesses according to the recent BizBuySell Insight Report. The Market Pulse also reported that valuation multiples remained steady or increased across main street and the lower middle market.

Despite these positive indicators, 1 in 4 businesses remain temporarily closed or operating below capacity through the first quarter according to the Market Pulse Report. In addition, the use of PPP Loans is complicating M&A transactions which create loan delays, although the number of businesses with PPP loans is declining. Retirement continues to be the leading reason for selling a business, but the past year has taken it’s toll on many owners and Burnout has jumped up the list as a top reason. There was also a higher amount of owners selling due to health issues than previous surveys.

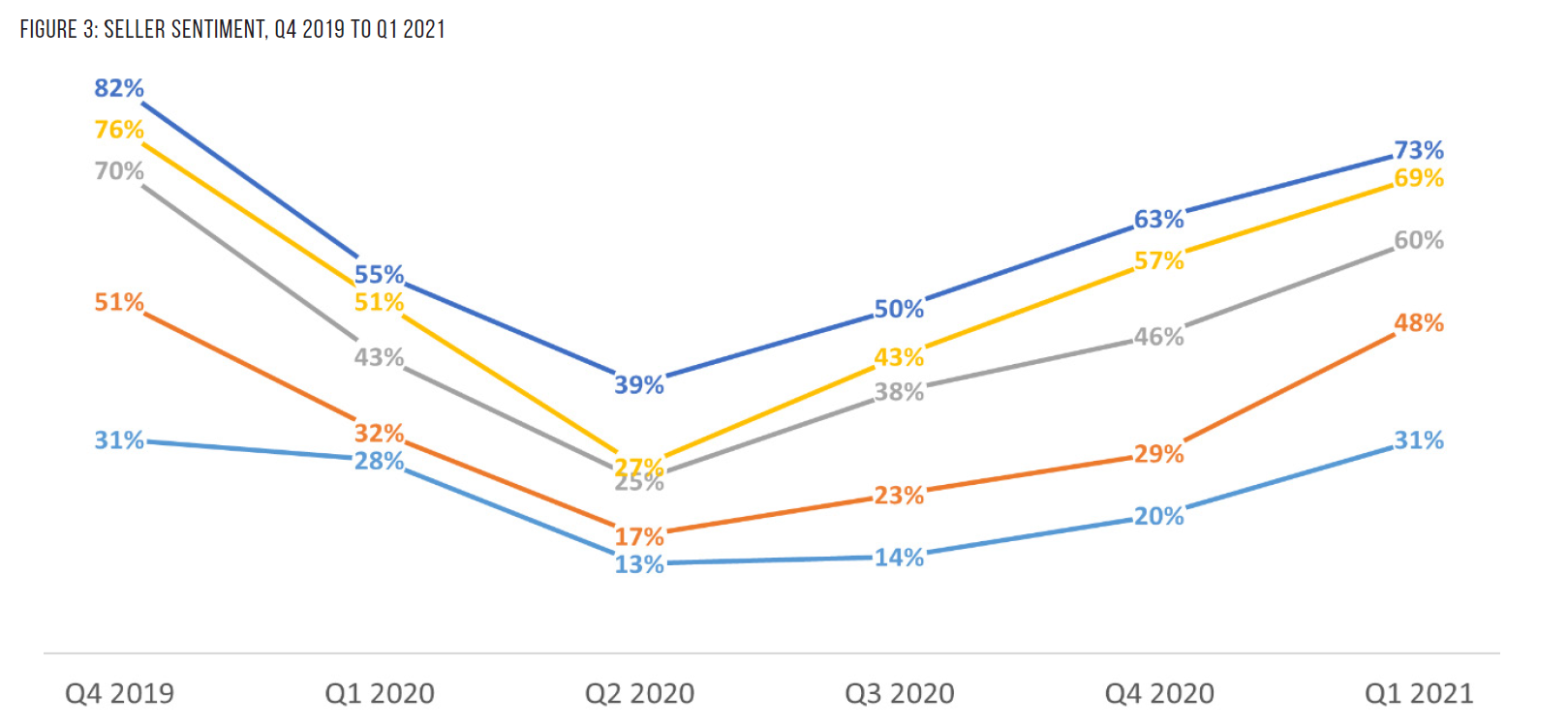

Quarterly comparison of Seller Sentiment clearly shows market confidence rebounding.

Market sentiment year over year shows optimism for continued recovery this year.

Click image to view full size.

Valuations are expected to increase this quarter.

Click image to view full size.

Small business transaction volume, improved slightly but may be depressed by lack of supply.

Click image to view full size.

Small business transaction volume, improved slightly but may be depressed by lack of supply.

Click image to view full size.