Melissa Sawyer, Lauren Boehmke are partners and Susan M. Lindsay is counsel at Sullivan & Cromwell LLP. This post is based on a Sullivan & Cromwell memorandum by Ms. Sawyer, Ms. Boehmke, Ms. Lindsay, Rodge Cohen, and Marc Treviño. Related research from the Program on Corporate Governance includes Dancing with Activists (discussed on the Forum here) by Lucian A. Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch; The Long-Term Effects of Hedge Fund Activism (discussed on the Forum here) by Lucian A. Bebchuk, Alon Brav, and Wei Jiang; and Who Bleeds When the Wolves Bite? A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System (discussed on the Forum here) by Leo E. Strine, Jr.

TRENDS IN SHAREHOLDER ACTIVISM

A. ACTIVISM ACTIVITY SURGES DESPITE MACROECONOMIC UNCERTAINTY AND MARKET VOLATILITY, LEADING TO INCREASED USE OF RIGHTS PLANS

Activism activity surged in 2022 despite turbulent markets amid macroeconomic uncertainties, including the continuing impacts of COVID-19, rising inflation rates, global supply chain issues, higher oil prices and the Russia/Ukraine war. The first quarter of 2022 represented the busiest quarter for U.S. activism on record as company advance notice windows began opening for the 2022 annual meeting cycle, and activism activity levels remained elevated during the second and third quarters of 2022 as compared to 2021 and 2020 (though more in line with historic pre-pandemic levels). This is in contrast to 2020, when activism activity was dampened during the even higher levels of stock market volatility resulting from the onset of the COVID-19 pandemic due to the economic uncertainty caused by the pandemic and concerns about acquiring stock that could continue to decline rapidly. During 2022, however, activists sought to take advantage of depressed stock prices and deteriorating financial outlooks from companies struggling with macroeconomic headwinds. Nonetheless, as discussed in the section titled “Activism Campaign Data Overview”, this increased activity did not lead to higher rates of success for activists.

Although activists have not been deterred by the market volatility, these underlying macroeconomic conditions appear to have driven changes in activists’ objectives. Campaigns targeting corporate strategies and operations (including demands for cost-cutting measures) have significantly increased this year, while the absolute number of capital allocation and M&A-related campaigns (historically the most common campaign objectives) has declined. Market conditions briefly rebounded over the summer, leading to a short-lived uptick in the number of M&A-related campaigns (particularly, attacks on announced deals) and capital allocation campaigns (including campaigns demanding the return of cash to shareholders at companies that built up cash reserves during the pandemic). However, with higher interest rates in effect for the foreseeable future, slower M&A markets and impending laws and regulatory proposals that could impact M&A activity and/or corporate cash reserves, activists may reduce or shift their capital allocation or M&A demands as we enter the 2023 proxy season. For example, the Inflation Reduction Act, which takes effect on January 1, 2023, will impose a nondeductible 1.0% excise tax on public company share repurchases that involve more than $1 million in the aggregate per tax year, which could make share buybacks a less desirable capital allocation strategy for activists.

The rapidly changing market conditions and rebounded activism levels (particularly at companies with low stock prices and operating and other economic challenges) also led to a surge in the adoption of shareholder rights plans during 2022. As of October 31, 2022, 21 companies had adopted rights plans (excluding plans designed to protect “net operating losses” for tax purposes) in 2022.[1] While this number represents a 68% decline in rights plan adoptions as compared to the 66 plans adopted during the same period in 2020 (during a period when many companies feared a potential hostile takeover as a result of significantly depressed equity values following the onset of the COVID-19 pandemic), it represents a 200% and 75% increase from the 7 and 12 plans adopted during the same periods in 2021 and 2019, respectively.[2] Many of these rights plans were adopted to preempt potential unsolicited takeovers by hostile bidders or activists seeking to take advantage of depressed stock prices rather than being adopted in response to a specific threat, a practice that is less common during more stable market periods.

B. COMPANIES PREPARE FOR UNIVERSAL PROXY RULES AND INCREASED FOCUS ON INDIVIDUAL DIRECTORS

On November 17, 2021, after years of discussion, the SEC adopted universal proxy rules mandating the use of one proxy card that lists both the issuer’s and the dissident’s nominees in non-exempt, contested director elections held on or after on September 1, 2022.[3] Broadly speaking, these rules allow shareholders to pick-and-choose nominees from competing slates when voting in a proxy contest (a practice mirroring what is available for shareholders voting in-person).

Although the rules contain notice, filing and presentation requirements that issuers and activists must comply with, the only significant requirement imposed on activists is an obligation to solicit a minimum of 67% of the company’s voting power in connection with its campaign (at its own expense). Although at first blush this requirement may seem potentially to increase an activist’s expenses when conducting a campaign (current proxy rules do not include any minimum solicitation requirement), activists will be free to use the “notice and access” model for delivering proxy materials to shareholders (which requires only the mailing of a postcard with a website link to the materials) and then can rely on the company’s broader solicitation efforts (since the activist’s nominees will be included on the proxy card distributed by the company).[4] Therefore, it will generally be less time-consuming and expensive for an activist to launch a proxy contest under these new rules.

We expect that the universal proxy rules may result in: (1) a greater focus on individual directors and director qualifications because it will be easy for activists and shareholders to target and replace specific directors whom they view as underperforming or unqualified, (2) activists achieving higher rates of partial success because the rules’ pick-and-choose model may make it easier for the activist to win at least one or two seats (conversely, it may also make it more difficult for an activist to gain control of a board) and (3) more campaigns being launched by smaller, less-resourced and/or first-time activists (including, potentially, groups that have historically submitted Rule 14a-8 proposals who may now use a proxy contest to generate publicity and increase negotiating leverage to advance their agendas) due to the lower costs associated with launching a proxy contest under the rules.

C. INCREASED FOCUS ON MANAGEMENT CHANGES

Company management, particularly CEOs, have frequently been criticized as part of activism campaigns, often based on perceived failures related to strategic execution, operating performance, M&A and/or concerns related to entrenchment or qualifications. Although COVID-19 and concerns around the impact that a significant leadership change could have at companies struggling to stabilize their businesses led to a two-year decline in the number of campaigns targeting company management in 2020 and 2021, such campaigns have since rebounded.

As of October 31, 2022, 54 campaigns were launched in 2022 against U.S. companies demanding the removal of officers (up from 37 in 2021 and 42 in 2020). This represented the second-highest number of campaigns launched from January through October in a given year demanding management changes since Insightia began tracking this data in 2010.[5] These campaigns generally involved theses related to issues such as abandoned M&A transactions, missed earnings guidance, perceived excessive compensation despite low stock prices and allegedly poor capital allocation decisions. From the perspective of the activist, these campaigns have achieved considerable success, with 15 of the 54 companies already announcing a C-suite leadership change.[6]

In most of these cases, the executive appeared to step down voluntarily; however, in other cases, the activists involved conditioned their settlement agreements on the leadership change. For example, the settlement agreements between Southwest Gas Holdings, Inc. and Carl Icahn, U.S. Foods Holding Corp. and Sachem Head Capital Management and Quotient Technology Inc. and Engaged Capital, LLC each included language requiring the company’s then-current CEO to step down either immediately or no later than the company’s upcoming annual meeting. One additional settlement agreement took a less direct approach, calling for the creation of a board-level committee to consider whether any management changes are needed.

D. RISE IN ESG ACTIVISM

Although activists have incorporated ESG themes into their campaigns for the past few years as a way to appeal to a wider stakeholder base, the success of Engine No.1’s 2021 proxy contest at Exxon Mobile Corp. (the first successful U.S. proxy contest to focus primarily on environmental and social demands) prompted a considerable uptick in the number of activism campaigns with ESG critiques at the center of the activist’s thesis. As of October 31, 2022, there have been 44 U.S. activism campaigns (excluding Rule 14a-8 shareholder proposals) involving environmental-related demands (representing a ten-fold increase from the four campaigns brought in all of 2021) and 23 campaigns involving social-related demands (compared to three campaigns brought in all of 2021).[7]

Although ESG issues resonate with a broad base of investors and proxy advisors, these issues are more likely to form the basis of a successful campaign when the ESG objective can be strongly tied to the target company’s economic performance or risks (as in the Exxon example). Carl Icahn’s unsuccessful 2022 proxy contest for two board seats at McDonald’s Corp., which centered solely on McDonald’s ESG practices (principally treatment of animals) and received the support of only 1% of shareholders at McDonald’s annual meeting, illustrates the importance of having an underlying economic thesis.

Recent and prospective regulatory developments may also accelerate the number, and success, of activism campaigns that incorporate ESG issues. For example, the SEC’s proposed climate change and human capital disclosure rules, as well as its recent enforcement prioritization of “greenwashing” claims, may give activists additional information with which to criticize companies. Additionally, the SEC’s recent amendments to Form N-PX and proposed amendments to the Investment Company Act of 1940 and the Investment Advisers Act of 1940, which will require investment funds to provide greater transparency into their voting and ESG practices, could further increase public pressure on institutional investors to support ESG campaigns, resulting in higher levels of support and perhaps incentivizing activists to raise these issues in more campaigns. However, the success of any ESG campaign will still significantly depend on the nature of the specific demands at issue. For example, BlackRock, ISS and Glass Lewis voted/recommended votes against numerous environmental Rule 14a-8 shareholder proposals they deemed to be “too prescriptive” or that they believed “may not promote long-term shareholder value” in 2022, and they could take a similar approach in connection with ESG activism campaigns in which the activist seeks a specific ESG-related outcome but fails to provide a rationale for the demand.[8] For more information on ESG-related issues in Rule 14a-8 proposals, please see the Sullivan & Cromwell 2022 Proxy Season Review and related webinar available here.

Companies deciding whether to adopt ESG initiatives should also consider the potential impact that the current political environment (in which some politicians and investors have demonstrated a greater willingness to criticize and even take or threaten action against companies which have adopted ESG friendly stances) could have on the company’s vulnerability to activism, as well as broader business (including customers and employees) and government relations implications.[9] Although we have yet to see an anti-ESG activist outside of the Rule 14a-8 context, such a possibility may exist, particularly now that the universal proxy rules have lowered the barriers to entry for running a proxy contest. Based, however, on the very low level of support for anti-ESG Rule 14a-8 proposals, such an anti-ESG-themed proxy contest seems highly unlikely to succeed.

E. CAMPAIGNS AGAINST DE-SPACS

The explosion of SPACs in 2020-2021 has resulted in a number of de-SPACed companies, most of which adopted structural defenses, such as classified boards and/or founder-controlled stock, despite the strong general trend away from these types of defenses by public companies. For example, of the 271 de-SPACs that remain publicly traded as of October 31, 2022, approximately 75% have classified boards, 69% allow directors to be removed only for cause, 80% prohibit shareholders from calling special meetings and 21% qualify as a “controlled company” under the relevant stock exchange rules.[10] These types of defenses have typically insulated companies from activism campaigns because they make it harder for an activist to initiate impactful changes at the company through a proxy contest (or a credible threat of a proxy contest), unless the activist is willing to engage in a multi-year campaign or is able to gain the support (or acquiescence) of the controlling shareholder.

One study found that, as of June 30, 2022, the average de-SPAC that went public in 2022 was trading about 30% lower than its offer price within two weeks and 62% lower after six months, and, overall, deSPACs completed in 2021 and 2022 have lost, on average, 67% and 59% of their value, respectively, relative to their offer prices.[11] This pervasive share price underperformance and other issues have led a number of activists to target these de-SPACs despite the limitations imposed by the company’s strong defenses, including in connection with campaigns pushing the de-SPAC to engage in an M&A transaction. For example, in March 2022, Third Point LLC filed a Schedule 13D announcing it had increased its stake in Cano Health Inc., a de-SPAC with a significant shareholder and a classified board, from 2.88% to 6.4% and expressing its view that Cano should explore a sale (despite Third Point participating in Cano’s $800 million PIPE nine months earlier), citing “recent developments” and “the market’s largely unfavorable view of companies taken public through special purpose acquisition vehicles” as the catalysts for a sale. Third Point ultimately sold its position in Cano in early December amid liquidity concerns as well as a report that CVS Health Corp. had backed out of talks to potentially buy the de-SPAC.[12]

These developments suggest that strong structural defenses may not be sufficient to deter activism campaigns if a company’s stock has declined sharply. It is prudent even for companies with such defenses to be prepared for a potential activism campaign.

ACTIVISM CAMPAIGN DATA OVERVIEW

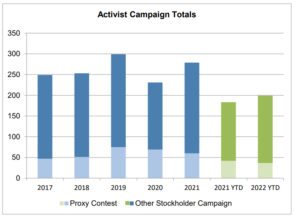

Aided by record-breaking Q1 activity levels, overall activism activity in 2022 has generally returned to pre-pandemic levels. As of August 31, 2022, activists launched 199 campaigns against U.S. issuers, representing an 8% increase from the 185 campaigns launched during the same time period in 2021, but in line with the pre-pandemic level of 203 campaigns launched during the same period in 2019.

Continuing a two-year trend, however, both the number of proxy contests and proportion of proxy contests relative to overall activism campaigns declined in 2022. As of August 31, 2022, proxy contests made up 19% of campaigns in 2022 compared to 23% and 32% during the same periods in 2021 and 2020, respectively. One possible factor contributing to the lower proportion of proxy contests in 2022 is that there were more activism campaigns targeting large cap companies (companies with market caps above $1 billion) as compared to those prior years, and activists may be less likely to pursue a costly proxy contest against a company with significant resources to spend on defense.

Activists generally received higher levels of support from certain institutional investors and proxy advisors in 2022 proxy contests relative to prior years. For example, in connection with proxy contests for board seats, BlackRock, Fidelity and JP Morgan voted in support of the dissident slate in 33%, 33% and 40% of such contests this proxy season, respectively (reflecting an increase in support of 20%, 13% and 10%, respectively, compared to the 2021 proxy season). [13] Conversely, Vanguard and State Street slightly decreased their support of dissidents, voting in support of the dissident slate in 26% and 21% of such contests, respectively (reflecting a decrease in support of 7% and 2%, respectively, compared to the 2021 proxy season).[14] ISS and Glass Lewis support for dissidents also increased this year, with ISS supporting the dissident in 42% of proxy contests for board seats (compared to 31% in the 2021 proxy season) and Glass Lewis supporting the dissident in 32% of such proxy contests (up slightly from 31% in the 2021 proxy season and 27% in the 2020 proxy season).[15]

An important development with respect to the voting of shares owned by institutional investors is the steps being taken by major institutional investors to provide their investors with the ability to choose how to vote on a variety of corporate matters. The consequences of this development could be far-reaching, as institutional investors, largely through index funds, hold increasingly large positions in most major companies. In November 2022, BlackRock announced it was expanding its January 2022 “Voting Choice” policy that gave institutional clients the ability to determine how Blackrock votes their underlying shares to also apply to retail investors starting in 2023. The same month, Vanguard also announced it was launching a pilot program for U.S. retail investors to decide how their votes are cast. State Street has announced that it is also exploring the possibility of providing investors with greater choice around how their shares are voted, but it has also warned about the potential consequences of dispersing voting power held by large institutional investors, including that it could amplify the voting influence of select shareholders, such as activists with short-term interests, make it more difficult for companies to meet quorum requirements and diminish the opportunity for their investors to benefit from the experience institutional investors have in exercising a long-term perspective in voting decisions.[16] At a minimum, institutional support in proxy contests may become even less predictable.

The SEC’s newly adopted amendments to Form N-PX may also impact activism support levels. These amendments, among other things, will require certain investment funds to disclose more about their voting records, including how they voted on each proposal up for a vote and the number of shares loaned and not recalled (and thus, not voted by the fund—although, depending on the terms of the loan, such shares may be voted by the borrower). As a result, institutional investors which have historically loaned a significant amount of shares may feel pressure to recall, and then vote, those shares based on stakeholder expectations that the fund will vote on key ESG issues, potentially resulting in higher levels of support for ESG-friendly campaigns.

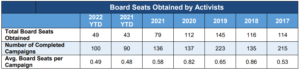

Despite the increased support activists received from institutional investors and proxy advisors this year, activists’ overall success rates (as measured by the number of board seats obtained) decreased compared to recent years. As of August 31, 2022, activism campaigns resulted in an average of 0.49 board seats per campaign, in line with the numbers for the same period in 2021 but representing a significant decline from the full year 2018-2020 average of 0.72 seats per campaign. This decline may be attributable to a number of factors, such as (i) more campaigns launched against large-cap companies that have more resources to spend defending against the activist (although having more resources does not guarantee success, as evidenced by Engine No.1’s success over Exxon Mobile), (ii) fewer settlements between companies and activists (settlement agreements have historically served as the most common means for an activist to gain board seats) and (iii) an increase in the number of split-vote recommendations between ISS and Glass Lewis.[17] Notably, every activist that won a board seat had at least partial support from both ISS and Glass Lewis, highlighting the continued influence proxy advisors have over the outcome of proxy contests.[18]

SETTLEMENT AGREEMENTS

Often, a company will agree to settle with an activist before a shareholder vote. Settlement agreements (or cooperation agreements, as they are sometimes known) typically provide for the appointment of one or more persons selected by (or in consultation with) an activist to the company’s board in exchange for a “standstill”, which generally includes limitations on share ownership and prohibitions on proxy solicitation and other activist actions for a defined period of time. This section analyzes settlement agreements reached in connection with campaigns announced in 2022 that have been publicly filed as of August 31, 2022 as compared to prior years, including the frequency of settlements, the timing of reaching a settlement and the key provisions of settlement agreements.

A. FREQUENCY AND SPEED OF SETTLEMENT AGREEMENTS

In 2022, fewer campaigns ended in a settlement agreement as compared to previous years. As of August 31, 2022, 25% of completed campaigns[19] ended in a settlement agreement, compared to 29% and 32% for full year 2021 and 2020, respectively. Proxy contests, in particular, resulted in settlement agreements less frequently than in previous years, with 28% of completed proxy contests in 2022 resulting in a settlement as of August 31, 2022, compared to 39% for the full year in both 2021 and 2020.

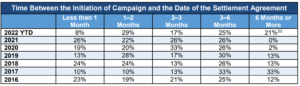

In addition to companies and activists entering into fewer settlement agreements in 2022, those campaigns that did result in a settlement also reached the settlement more slowly in 2022 than in past years (including a few high-profile campaigns that settled right before the shareholder vote, such as Icahn’s proxy contest against Southwest Gas). As of August 31, 2022, only 8% of campaigns that reached settlement in 2022 reached such settlement less than one month after the campaign was publicly announced (down from 26% in 2021 and 19% in 2020), while 21% took six months or longer (up from 0% in 2021 and 2% in 2020). On the whole, the average speed at which activists and issuers entered into a settlement was 102 days, compared to 64 days in 2021 and 78 days in 2020. The longer average settlement time may be impacted by the changes in activist demands in 2022, as the shift towards campaigns focused on more complex or longer-term goals (such as board control, management changes and ESG goals) may require more drawnout discussions and negotiations.

This approach to calculating the duration of activism campaigns is, however, limited, as our study necessarily only identifies an activist as having initiated a campaign when it makes the first public step towards achieving its goal, either by publicizing a letter sent to the company, sending a letter to other shareholders, filing a Schedule 13D or otherwise publicly announcing its intent to initiate a campaign. In many cases, the company and the activist will have had extensive private discussions prior to any public acknowledgement of the campaign, and the first public announcement may come in the form of a finalized settlement agreement between the parties. We excluded instances where the campaign and settlement agreement were publicly announced on the same day for purposes of calculating the durations outlined in the table below, although they represented 35% of the settlements we reviewed as of August 31, 2022.

[20]B. NOMINATION PROVISIONS AND MINIMUM SHAREHOLDING PROVISIONS

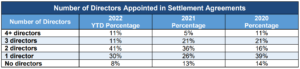

A significant majority of settlement agreements relating to 2022 activism campaigns provided for the appointment of one or more directors. The remaining agreements provided either for the nomination of a director candidate or some other arrangement, such as a change in committee composition. 92% of settlement agreements provided for the nomination and/or appointment of at least one director, which is slightly higher than the 87% in both 2021 and 2020. In 2022, settlement agreements were more likely to involve the appointment or nomination of one or two directors, while fewer agreements involved three or more directors, as compared to prior years.

This year, board diversity considerations also began impacting settlement agreements. Board diversity continues to be a top priority for many companies and stakeholders, particularly in light of the Nasdaq diversity rule (which took effect earlier this summer), the stricter minimum diversity requirements imposed by many institutional investor and proxy advisor voting policies and the SEC’s anticipated proposed rules on board diversity disclosures (currently expected in April 2023). As a result, some companies and activists have started to include requirements in their settlement agreements designed to ensure that any appointees/nominees will assist the board in satisfying diversity-related policies or objectives. Going forward, as board diversity requirements and related disclosure obligations continue to grow, it is likely that diversity will become an increasingly important factor in activism campaigns and settlement agreements. For example, activists may criticize company boards for having insufficient diversity and/or both sides may introduce more diverse slates to gain shareholder support.

The appointment of new directors led to a board size change in 65% of 2022 settlement agreements reviewed, consistent with the 64% last year and up from 50% in 2020. Additionally, in some of these agreements, the initial increase to the size of the board was followed by an eventual decrease following the 2023 annual meeting. Other agreements required incumbent director(s) to resign or retire prior to the appointment of the new director(s).

A majority of settlement agreements in 2022 also included provisions requiring the activist to maintain a minimum shareholding in order to keep its nominees on the board: 65% of 2022 settlement agreements included such a provision, down slightly from 67% in 2021 but up from 53% in 2020. Failure to maintain the minimum ownership threshold typically results in the nominees being required to resign from the board, the activist losing the right to name replacement nominees, the termination of the agreement or all of the above. Additionally, as of August 31, 2022, three agreements included multiple minimum ownership thresholds, with the activist incrementally losing rights after falling below the various thresholds, an increase from one such agreement in each of 2021 and 2020.

C. INFORMATION SHARING

86% of 2022 agreements specifically address the topic of information sharing by the new directors with the activist. In particular, 19% of agreements expressly permitted such sharing of information to certain entities or individuals (subject, in almost all cases, to the recipient entering into a confidentiality agreement), somewhat more often than in recent years in which approximately 5% to 15% of agreements expressly permitted such information sharing; 46% of agreements subjected new directors to the board’s standard policies regarding confidential information (which implies that information sharing with an activist would not be permitted); an additional 19% of agreements involved separate confidentiality agreements entered into with the activist fund itself; and 3% of agreements expressly prohibited such sharing of information. The agreements that contemplate information sharing usually arise when one or more activist insiders, as opposed to only independent directors, are appointed to the board of the issuer. It will be interesting to see whether the SEC’s new “shadow trading” theory of insider trading and the Department of Justice’s increased scrutiny of interlocking directors (each discussed below) will impact these percentages in future years given that such developments could result in a decrease in the number of activist insiders that are appointed to target boards and/or changes in the nature of information-sharing policies adopted by issuers and activists.

When negotiating these information-sharing provisions, issuers and activists alike will also have to consider the impact of information sharing on the activists’ ability to trade, not only in the issuer’s stock but in the stock of peer companies. In January 2022, a federal district court in the Ninth Circuit partially validated a novel SEC insider trading theory by denying a motion to dismiss an SEC complaint alleging that an executive violated the insider trading rules by using material, nonpublic information regarding the business of one company to trade in the securities of another, unrelated peer company (referred to as “shadow trading”).[21] One key aspect of the court’s finding that the SEC had sufficiently pled that the executive breached a duty to the company was the court’s focus on the specific language used in the company’s insider trading policy that prohibited trading in the securities of “another publicly traded company.” [22] Although it is unclear whether the court would have found a breach of duty even if the policy had not included this language, it does highlight the need for issuers and activists to review carefully the language of any confidentiality or insider trading policies they enter into to understand the potential scope of liability.

D. STANDSTILL PROVISIONS

Almost every settlement agreement includes a standstill provision, which prohibits activists from engaging in certain activities within a prescribed period of time. The main purpose of the standstill provision is to restrict the activist from initiating or participating in any further campaigns in the near term. The length of the standstill period is generally synced with the period when a director designated by the activist is required to be nominated to serve on the company’s board. The board is typically required to nominate the activist’s designee for election (or appoint the activist’s designee to the board) in connection with the annual meeting immediately following the settlement agreement date, in which case the standstill period would expire when the nomination window opens for the subsequent year’s annual meeting.

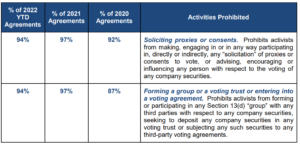

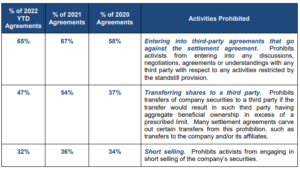

The following table lists the types of activities typically restricted by the standstill provisions and the frequency of their inclusion in 2022, 2021 and 2020 settlement agreements.

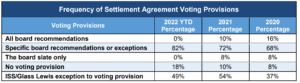

E. VOTING AGREEMENTS

82% of 2022 settlement agreements included a provision requiring the activists to vote their shares in a prescribed manner within the standstill period, lower than the 2021 (90%), 2020 (92%), and 2019 (89%) levels, and more consistent with the level in 2018 (80%). Unlike in previous years, all the settlement agreements that included a voting agreement provision imposed voting requirements that went beyond simply requiring the activist to vote for all the director candidates nominated by the board. However, at the same time, none went so far as to require the activist to vote in accordance with all board recommendations. Rather, all such settlement agreements either specified certain additional proposals that the activists must vote for (such as ratification of the appointment of an auditor, “say-on-pay” and “say-on-frequency” proposals, proposals regarding equity incentive plans, change of control transactions and the board slate for the director election) or included exceptions permitting the activists to vote in their own discretion on certain proposals (such as mergers or liquidations, amendments to the company’s articles of incorporation or implementation of takeover defenses).

Many voting agreement provisions include an exception for when a board recommendation for a proposal (other than the election of directors) differs from that of ISS and/or Glass Lewis. This exception has become popular over the past few years, appearing in 49% of settlement agreements reviewed for 2022, which is slightly lower than the 2021 level of 54%, but higher than the 2020 level of 37%. Some agreements including this exception permit the activist to vote against the board recommendation if either ISS or Glass Lewis makes a different recommendation with respect to the proposal while others require both ISS and Glass Lewis to make a differing recommendation. Some agreements also limit the exception only to ISS recommendations (with no exception in the event Glass Lewis makes a differing recommendation), while others limit the exception to only specified matters, requiring the activist to support all other board recommendations notwithstanding an ISS/Glass Lewis recommendation to the contrary.

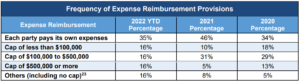

F. EXPENSE REIMBURSEMENT

The percentage of settlement agreements pursuant to which the company was required to reimburse the activist for its campaign expenses increased in 2022 as compared to 2021. 65% of 2022 settlement agreements included an expense reimbursement requirement, up from 54% in 2021 and slightly down from 66% in 2020. We have divided expense reimbursement obligations into three buckets based on the dollar value cap of the obligations—less than $100,000, $100,000 to $500,000, and $500,000 or greater. Fewer settlement agreements in 2022 provided that each party must pay for its own expenses as compared to 2021, with more agreements instead including an expanse cap of either less than $100,000 or more than $500,000. Notably, as was the case in prior years, the size of reimbursement caps in 2022 does not appear to correlate to the company’s market capitalization.

[23]G. FUND INSIDERS APPOINTED BY SELECT ACTIVISTS

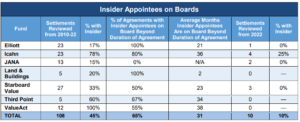

We also reviewed settlements with certain prominent activist funds to assess the frequency with which the activist appointed a person affiliated with the activist hedge fund (a “fund insider”) to the board (as opposed to directors who are independent of the activist) and the length of time that the longest-serving fund insider remained on the board. For this purpose, we limited our analysis to settlement agreements entered into between January 1, 2010 and August 31, 2022 in which the activist was granted the right to appoint at least one director.

Although institutional investors may prefer independent designees to fund insiders, as shown in the chart below (and as BlackRock has expressly stated), in 45% of the agreements we reviewed during this period at least one of the appointed directors was an insider of the activist fund. Value Act appointed an insider in all the settlement agreements reviewed and Icahn appointed an insider in over 75% of the settlement agreements reviewed, whereas Elliott, JANA and Land & Buildings appointed an insider in 20% or fewer of the settlement agreements reviewed. Starboard and Third Point were the most split between insiders and independents, with at least one insider in 33% and 60% of the settlements reviewed, respectively. In 65% of the agreements for which the duration of the settlement agreement has expired as of August 31, 2022, at least one insider stayed on the board longer than the length of time that the target company was required to appoint and nominate the director pursuant to the settlement agreement, consistent with 2021 but up from 55% for agreements that had expired by August 31, 2020. For agreements in which at least one insider remained on the board beyond the duration provided for by the settlement agreement, the longest serving insider for each such agreement has served an average of approximately 31 months longer than the period provided for in the agreement, down from 32 months as of August 31, 2021 but still up from 28 months as of August 31, 2020.[24]

The group of seven prominent activists referenced in the previous paragraph entered into ten settlement agreements in 2022 through August 31, 2022. Of those agreements, only one (Icahn’s settlement with Southwest Gas Holdings, Inc.) involved the appointment of a fund insider as opposed to an independent designee. Notably, Icahn placed a fund insider on the board in only one of four settlement agreements reached in 2022, which is significantly less than his average. Among the settlement agreements reached by this group of activists in 2022 as of August 31, 2022, only 10% included at least one insider director (compared to 45% for all agreements reviewed since 2010). One factor that could be impacting the decline in the appointment of fund insiders is the Department of Justice’s recently enhanced scrutiny of director interlocks that violate Section 8 of the Clayton Act (discussed below).

KEY CONSIDERATIONS

1. Enhanced levels of antitrust scrutiny in connection with future activist slates.

Recent antitrust enforcement actions by the Department of Justice (including its October 2022 announcement relating to the resignation of seven directors from five companies as a result of concerns over potential violations of Section 8 of the Clayton Act) have signaled an increasing level of scrutiny on interlocking directorship issues. This renewed focus, in combination with the potential uptick in proxy contests under the universal proxy rules and the fact that activists who successfully obtain board seats may appoint fund insiders to the target’s board, will enhance the importance of assessing potential Clayton Act issues when reviewing future activist nominees/appointees.

2. Look out for potential shifts in activist theses in connection with capital allocation/buybacks.

Share buybacks have historically been one of the most common activist demands since they provide shareholders with a quick return and tend to increase the earnings per share of the remaining outstanding stock. However, recent legislative and regulatory developments, including the recently enacted Inflation Reduction Act imposing a tax on buybacks (described above) and the SEC’s proposed share buyback rules,[25] along with higher corporate-borrowing rates, may make share buybacks less desirable as a capital allocation strategy. As a result, companies should prepare for activists to pivot their campaign demands towards other proposed methods of delivering value to shareholders (such as issuing dividends).

3. Consider potential implications of the SEC’s proposed Schedule 13D amendments on any existing or future rights plans.

As companies may continue to adopt rights plans in response to continued market volatility and increased activism activity, among other circumstances, consideration should be given to the potential impact that the SEC’s proposed amendments to Schedule 13D could have on the rights plan’s definition of “beneficial ownership” and triggering mechanics. For example, for rights plans that tie the concept of “beneficial ownership” to the Schedule 13D definition, the proposed amendments’ expansion of this definition to (a) cover cash-settled derivative securities and (b) broaden the “group” concept to cover more “wolf pack” activities (by clarifying that there does not need to be an express or implied agreement between two individuals for them to qualify as a “group”) could potentially impact the determination of whether the plan has been triggered or whether a shareholder is grandfathered at the time of the plan’s adoption.

4. Ensure bylaws include state-of-the-art advance notice requirements.

Public companies should review their bylaws to ensure they will be adequately prepared for a future proxy contest, especially in light of the new universal proxy rules, including by:

- Enhancing advance notice requirements: Because the notice and disclosure requirements included in a company’s advance notice bylaw apply in addition to the requirements imposed under the universal proxy rules, advance notice bylaws will be an important tool for companies to ensure they have sufficient time and information to evaluate the activist and its nominees. As a result, some companies have started to enhance the information disclosure requirements contained in their advance notice bylaws, by, among other things, requiring disclosure of many of the same items required to be disclosed under standard proxy access bylaws (e.g., information related to third parties working with the activist). However, companies should be aware when drafting such requirements that they could potentially result in shareholder criticism or litigation; and

- Adding language requiring compliance with the universal proxy rules: Many companies have also added language to their bylaws requiring shareholders, upon request, to provide reasonable evidence of their compliance with the universal proxy rules and explicitly allowing the company to disregard nominations if the shareholder subsequently fails to comply with the universal proxy rules.

Companies looking to make such changes to their bylaws should seek to adopt them prior to the opening of the director nomination window and before the emergence of an activist.

Companies should also continue to prepare for activism more generally, such as by (i) regularly reviewing their strategic options, likely activist lines of attack, governance and defensive profiles and general activism trends; (ii) engaging a stock-watch service to monitor for unusual trading activity; (iii) highlighting the qualifications and diversity of the company’s directors, both individually and as a whole, in public disclosures; and (iv) proactively engaging with shareholders.

Endnotes

1Based on data generated from DealPointData on October 31, 2022.(go back)

2See id.(go back)

3See Rule 14a-19 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).(go back)

4See Rule 14a-6 under the Exchange Act; SEC Release No. 34-93596 (Nov. 17, 2021).(go back)

5Based on data generated from Insightia on October 31, 2022.(go back)

6See id.(go back)

7Based on data generated from Insightia as of October 31, 2022.(go back)

8See BlackRock, Investment Stewardship Report (July 2022).(go back)

9Because ESG efforts, especially those achieved through industry consortia, can in themselves attract antitrust scrutiny (including enforcement actions by state Attorneys General), companies may need to consider seeking antitrust guidance when pursuing ESG initiatives through collaborations with industry groups or competitors.(go back)

10According to data from DealPointData as of October 31, 2022.(go back)

11See Charles Paraboschi and Max Hill, Valuation Research Corporation, SPAC Market Update: Who Turned on the Lights?.(go back)

12See Joshua Fineman, Seeking Alpha, Cano Health plunges on report activist Third Point sold stake, creditors organizing (update) (Dec. 8, 2022).(go back)

13See Insightia, Proxy Voting Season Snapshot 2022 (Oct. 2022), which summarizes voting data for proxy contests launched between July 1 and June 30.(go back)

14Id.(go back)

15See Jason Booth, Insightia, Activists Face an Uphill Battle, Harvard Law School Forum on Corporate Governance (Oct. 22, 2022) (the “Booth Article”), which summarizes voting data for proxy contests launched between July 1 and June 30.(go back)

16See State Street, The Role of Long-Term Shareholder Voice (Oct. 2022).(go back)

17According to a report from FTI Consulting analyzing proxy contests launched against U.S. companies with market capitalizations of at least $100 million and in which ISS and Glass Lewis published voting recommendations from 2017 through H1 2022, only 2 of the 80 proxy contests (2.5%) involved an activist obtaining a board seat while winning the endorsement of only one proxy advisor. See Kurt Moeller, FTI Consulting Inc., 5 Factors Impacting Activists’ Declining Success Rate (Sept. 2022). (Oct. 2022).(go back)

18See the Booth Article.(go back)

19“Completed campaigns” refers to a proxy contest or other stockholder campaign that ended in (a) a vote (in the case of a proxy contest), (b) the activist disclosing it exited its position or (c) a settlement. (go back)

202022 data for longer-term periods may be artificially low because the data includes only completed campaigns, and some long-running campaigns announced in 2021 had not yet been completed as of August 31, 2022. (go back)

21SEC v. Panuwat, No. 21-CV-06322-WHO (N.D. Cal. Jan. 14, 2022). (go back)

22Id. (go back)

23This category includes settlement agreements that (a) did not mention expense reimbursements, (b) included an agreed-upon cap but did not disclose the amount of it and (c) required reimbursement but did not specify a cap. (go back)

24However, that average likely understates the total amount of time activist insiders stay on a target board following the expiration of the settlement period, as, in 36% of the agreements for which insider appointees remained on the board beyond the duration of the settlement agreement, at least one such nominee was still on the board as of August 31, 2022. Furthermore, as of August 31, 2022, 8% of the settlement agreements we reviewed were still in effect, which means that the insider nominees appointed pursuant to those agreements may eventually stay on the target boards beyond the settlement duration. (go back)

25On December 15, 2021, the SEC proposed new rules that would require companies to provide more timely and detailed disclosures about their share buybacks, including by reporting any buybacks (including the total number of shares purchased and the average price paid per share) on a new Form SR before the end of the first business day after the buyback is executed. Companies would also need to describe the structure of their buyback programs, including the objective or rationale for the program and the criteria used to determine the amount of the buyback, in periodic reports. On December 7, 2022, the SEC reopened the comment period for these rules to allow commenters to consider the impact the tax imposed by the Inflation Reduction Act could have on corporate buyback behavior and the SEC’s proposed rules. (go back)

Print

Print