Maura Hodge, Sam Jeffery, and Julie Santoro are partners at KPMG LLP. This post is based on their KPMG memorandum.

Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) by Lucian A. Bebchuk and Roberto Tallarita; For Whom Corporate Leaders Bargain (discussed on the Forum here) and Stakeholder Capitalism in the Time of COVID (discussed on the Forum here), both by Lucian A. Bebchuk, Kobi Kastiel, and Roberto Tallarita; and Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy—A Reply to Professor Rock (discussed on the Forum here) by Leo E. Strine, Jr.

About the proposal

- On March 21, 2022, the SEC issued proposed rule, The Enhancement and Standardization of Climate-Related Disclosures for Investors.

- The comment period closed on June 17. We have identified key themes from the responses.

- Regardless of this proposal, compliance with existing requirements includes the 2010 climate-related guidance issued by the SEC staff.

Get a recap

- This post assumes a working knowledge of the proposal.

- For a brief recap on the proposal, see our Defining Issues, SEC proposes climate reporting and assurance rules.

- To understand the proposal in more depth, see the Top 10 questions in our talk book, Understanding the SEC’s climate proposal.

Toward a final rule

- The SEC’s Spring 2022 regulatory agenda shows publication of a final rule in October 2022.

- Other ESG-related items on the regulatory agenda include proposals related to human capital management disclosures (October 2022) and corporate board diversity (April 2023); and finalization of ESG requirements for investment companies and investment advisers (see our Defining Issues on the proposals).

1. Our methodology

Sample selection

The SEC received well over 4,000 unique responses to its climate proposal, with the vast majority coming from individual members of the general public.

We chose 150 responses that represented a variety of industries and respondent types. These responses were weighted toward issuers (including FPIs) and industry groups—and are not necessarily representative of the entire population of responses.

Judgment applied

Responses were reviewed to determine respondents’ positions on key provisions of the proposal. The proposal is complex and, in many cases, the discussion was nuanced; therefore, judgment was required in classifying responses.

Classifications were checked within our team, but we cannot rule out that a different team would, in some cases, apply different judgment.

Silence on an issue

If a respondent was silent on a particular issue, except as stated in this post, in most cases we did not attempt to intuit the respondent’s position—resulting in classification on a particular issue as ‘silent’.

Throughout this post, you may find the amount of silence on particular issues surprising. However, the proposal was far-reaching and our overall impression is that most respondents focused on the handful of issues that were particularly important to their own circumstances and perspectives.

2. Standard-setting in general

General standard-setting support

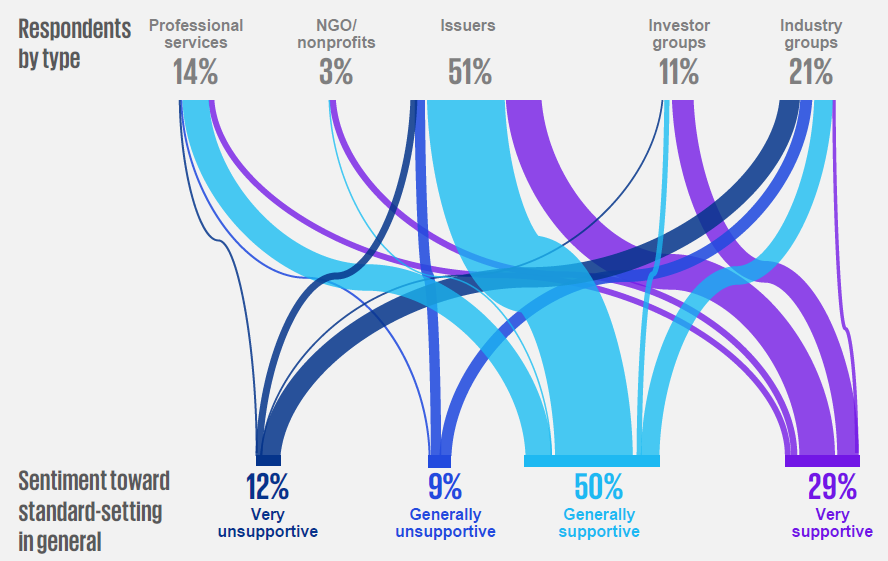

- This diagram shows the relative strength of support for climate standard-setting (in general) by type of respondent.

- Respondents who were “very supportive” were more concentrated in professional services and the technology industry.

- Respondents who did not support climate standard-setting were not concentrated in any specific industries.

But concerns about the proposal

- The level of support for climate-related standard-setting in general should not be read as wholesale support for the SEC’s specific proposal.

- As we outline in this post, concerns were raised in all areas of the proposal.

3. Financial statement disclosures

Operability was primary concern

- Some respondents who did not support information being included in the audited financial statements nonetheless made suggestions to improve the operability of the disclosures if the SEC proceeds.

- In that case, their responses were captured in the other results (e.g. wanting investor materiality to be used).

- Of the 80 respondents (53%) who specifically discussed whether there were operational issues with the proposal, 74 (93%) believed there were.

Bright-line sentiment

- The majority of respondents who supported a bright-line threshold (including the SEC’s proposed 1%) were investor groups (including advisers) and nonprofits.

4. GHG emissions disclosures

Organizational boundary

- 43 respondents (28%) requested changes to the SEC’s proposed organizational boundary.

- Of those who requested changes, 35 (81%) requested alignment with the GHG Protocol.

Methodologies

- 39 respondents (26%) requested changes related to measurement methodologies in general.

- Of those who requested changes, 21 (54%) requested that the GHG Protocol be used. Other respondents suggested that the SEC consider alignment with existing requirements of the EPA or simply existing practices.

5. GHG emissions attestation

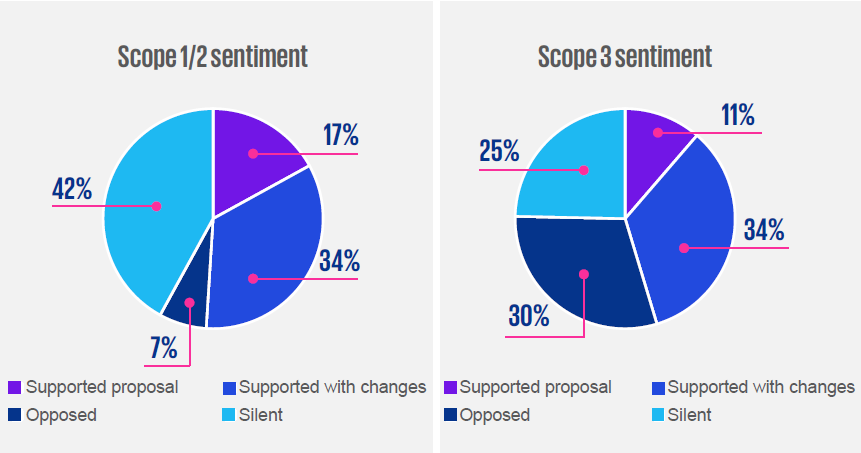

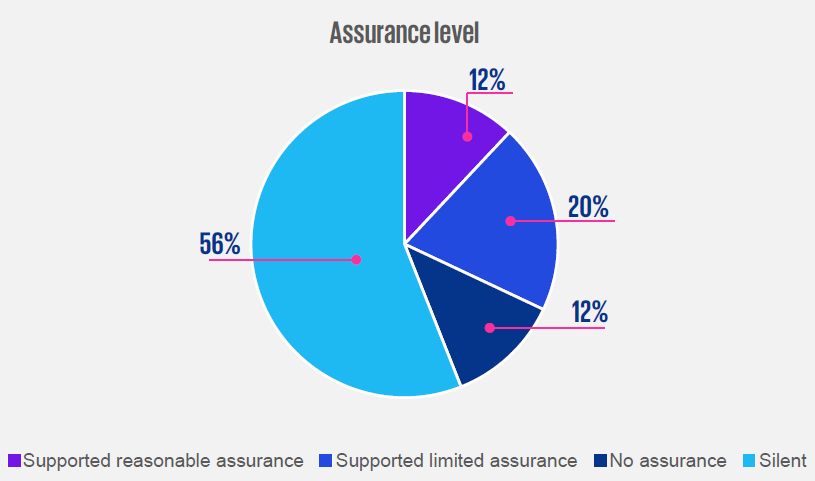

Split in attestation sentiment

- 66 respondents (44%) weighed in on the proposed attestation requirements.

- Respondents supporting limited assurance generally felt that reasonable assurance is not necessary. However, some respondents in this category requested “at least” limited assurance.

- Many respondents believed that pushing out the effective date of implementation would allow issuers to better prepare for attestation. See Item 8 below.

6. TCFD-like disclosures

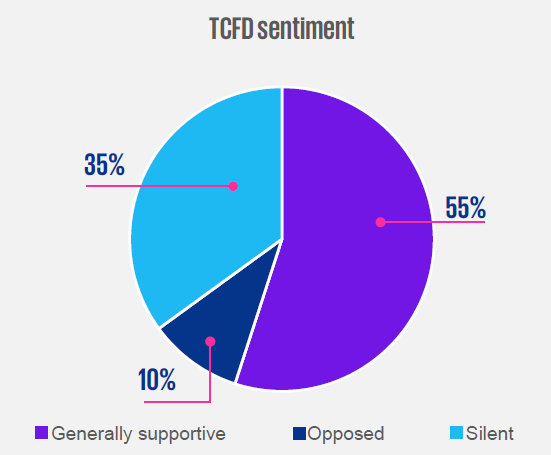

Opposition to ‘disclose if’

- Although only 10% of respondents (15) outright opposed TCFD-like disclosures, 17% (26) opposed the disclosure of scenario analysis. Some respondents requested clarification that “if used” means “publicly available.”

- Among respondents who were generally supportive of TCFD-like disclosures, 13% (11) were opposed to disclosures about internal carbon pricing, with 12% (10) opposed to disclosure relating to targets, goals and transition plans.

Zip codes and board expertise

- Some of the most requested changes by respondents related to the proposals to disclose detailed location information (e.g. ZIP codes), and information about board-level climate expertise.

7. Location and timing

Timing and liability a concern

- 28% of respondents (41) cited concerns with the proposed timing of the annual disclosures (i.e. including the information in the annual report).

- Many of these respondents expressed a preference for certain or all of the disclosures to be provided later than the Form 10-K filing deadline.

- 66 respondents (44%) requested expanded safe harbor for issuers, including some requests for safe harbor for board members designated as climate experts.

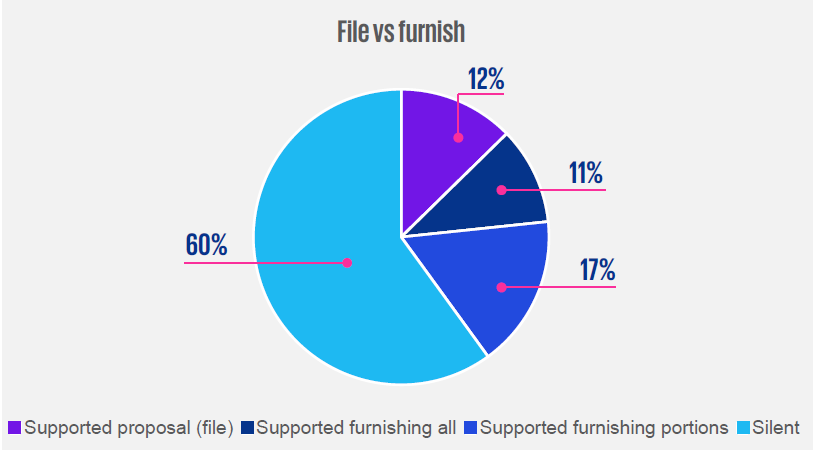

Furnishing GHG emissions data

- As seen in the diagram, 28% of respondents (41) would like some or all of the climate disclosures furnished.

- GHG emissions data was the most common item requested to be furnished at a date later than the Form 10-K filing. Respondents noted the timing of receiving data underlying the disclosures, which in many cases comes from third parties.

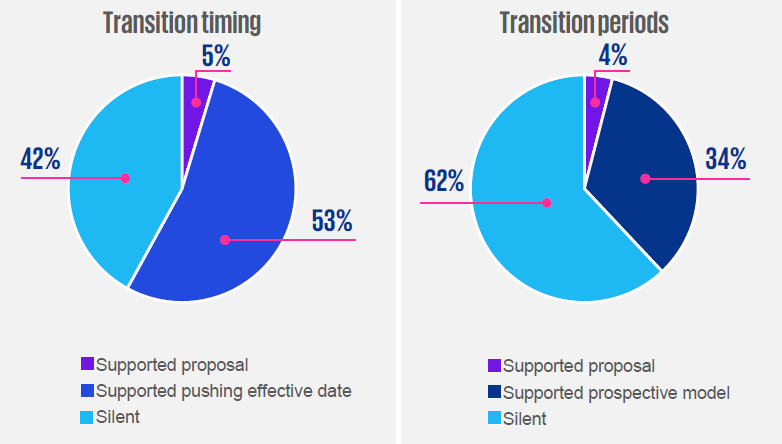

8. Transition

Transition a challenge

- The 53% of respondents (80) who supported pushing out the effective date included both respondents who requested a general delay in implementation (i.e. for all disclosures) and those who suggested a delay for only specific disclosures (e.g. GHG emissions).

- The most cited reason for delaying the effective date was the implementation of systems, processes and controls to gather and validate the required data.

- Support for pushing out the effective date was broad across all industries.

Prospective adoption

- 34% of respondents (51) supported a prospective implementation model—i.e. without the presentation of historical periods upon adoption.

- Support for prospective implementation was again broad across all industries.

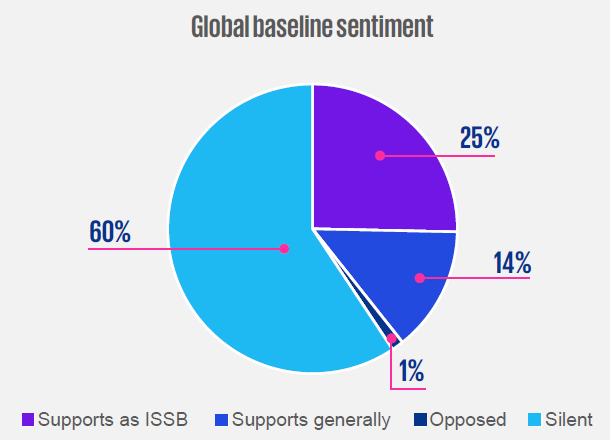

9. Global baseline and FPIs

Support for a global baseline

- 61 respondents (40%) discussed achieving baseline disclosures globally that can be built upon by individual jurisdictions. All FPIs except one raised the issue, dropping to 19% (11) of domestic issuers.

- Of those who commented, 62% (38) noted their support for the ISSB as an alternate framework for FPIs, while others spoke more generally about the acceptance of other frameworks.

- Among the 38 respondents who expressed support for the ISSB, 18% (7) supported the use of ISSB standards as an alternate framework for reporting by all issuers, including domestic issuers.

10. What do you need to do now?

Determine how ready you are

… by assessing the current state of your climate reporting – e.g. in your Form 10-K, proxy, annual report or on your website, through stand-alone ESG reports, TCFD reports or CDP responses – against the proposal.

Educate your organization

… including management and the board, on the proposal – including the people, processes and technologies that would be needed to implement it. Begin to assemble a cross-functional working group to project manage the effort.

Apply existing process to climate disclosure

… by having the financial statement disclosure committee review and understand your current climate reporting.

Take the next step on GHGs

… to meet investors demands today. If you haven’t started, develop a GHG inventory; if you need assurance, assess your gaps and engage an assurance provider; if you already receive limited assurance, move to reasonable assurance.

A final rule

The SEC’s Spring 2022 regulatory agenda shows publication of a final rule in October 2022.

Abbreviations and key terms

- CDP: Formerly the Carbon Disclosure Project

- EPA: US Environmental Protection Agency

- ESG: Environmental, Social and Governance

- FASB: Financial Accounting Standards Board

- FPI: Foreign Private Issuer

- GHG: Greenhouse gases

- GHG Protocol: Greenhouse Gas Protocol

- ISSB: International Sustainability Standards Board

- MD&A: Management Discussion and Analysis

- NGO: Non-governmental organization

- SEC: US Securities and Exchange Commission

- TCFD: Task Force on Climate-related Financial Disclosures

Print

Print