Diageo buys Don Papa rum brand for initial €260mn

Financial Times M&A

JANUARY 17, 2023

Distiller to potentially pay additional €178mn subject to performance

Financial Times M&A

JANUARY 17, 2023

Distiller to potentially pay additional €178mn subject to performance

IVSC

JANUARY 19, 2023

IVSC is pleased to announce that Susan DuRoss has been appointed the new Chair of the Standards Review Board (“SRB”). Susan will take up the role in March 2023 and takes over from Mark Zyla who has led the board since 2017. Susan is Executive Director, Global Valuations, at Harvest Investments and has been a member of the SRB since October 2018. She will oversee the work of the Board for an initial three-year term.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Harvard Corporate Governance

JANUARY 14, 2023

Posted by Nicola Higgs, Betty M. Huber, and Arthur S. Long, Latham & Watkins LLP, on Saturday, January 14, 2023 Editor's Note: Nicola Higgs , Betty M. Huber , and Arthur S. Long are Partners at Latham & Watkins LLP. This post is based on a Latham memorandum by Ms. Higgs, Ms. Huber, Mr. Long, Pia Naib , Anne Mainwaring , and Deric Behar. On December 2, 2022, the Board of Governors of the Federal Reserve System (Federal Reserve) published proposed Principles for Climate-Related Financial R

Mckinsey and Company

JANUARY 19, 2023

Generative artificial intelligence (AI) describes algorithms (such as ChatGPT) that can be used to create new content, including audio, code, images, text, simulations, and videos. Recent new breakthroughs in the field have the potential to drastically change the way we approach content creation.

Speaker: Susan Spencer, Principal of Spencer Communications

Intent signal data can go a long way toward shortening sales cycles and closing more deals. The challenge is deciding which is the best type of intent data to help your company meet its sales and marketing goals. In this webinar, Susan Spencer, fractional CMO and principal of Spencer Communications, will unpack the differences between contact-level and company-level intent signals.

Benzinga

JANUARY 17, 2023

Shiba Inu (CRYPTO: SHIB ) surpassed Litecoin (CRYPTO: LTC ) to become the thirteenth largest cryptocurrency by market capitalization early on Wednesday. What Happened: At the time of writing, SHIB’s market cap stood at $6.9 billion, while Litecoin’s market cap was at $6.3 billion. Shiba Inu saw a spike in its price after short bets worth nearly $790,000 were liquidated.

BVR

JANUARY 20, 2023

Check out the attendee survey results from the BVR webinar: 2023 Overview of the Marijuana Industry: The Coming Wave of Consolidation and Beyond. Opportunities Abound!

Business Valuation Zone brings together the best content for business valuation professionals from the widest variety of industry thought leaders.

Mckinsey and Company

JANUARY 18, 2023

COVID-19 may no longer be a pandemic, but the disease likely reduced the availability of the US workforce by as much as 2.6 percent in 2022—a burden on productivity that could last for years.

Benzinga

JANUARY 18, 2023

Pune, India, Jan. 18, 2023 (GLOBE NEWSWIRE) -- The global cryptocurrency market size was valued at USD 826.6 million in 2020. It is projected to rise from USD 910.3 Million in 2021 to USD 1902.5 Million by 2028 at a CAGR of 11.1% during the forecast period. Fortune Business Insights™ has published these insights in its latest research report titled, "Cryptocurrency Market Forecast, 2023-2028.".

LaPorte

JANUARY 20, 2023

Jennifer Bordes, Tax Director at LaPorte, recently authored an article on estate planning for New Orleans CityBusiness. Jennifer is the leader of LaPorte’s Estate Planning… The post Tax Director Authors Article for CityBusiness first appeared on LaPorte.

Harvard Corporate Governance

JANUARY 17, 2023

Posted by Mary Beth Houlihan, Diane Blizzard, and Scott A. Moehrke, Kirkland & Ellis LLP, on Tuesday, January 17, 2023 Editor's Note: Mary Beth Houlihan, Diane Blizzard , and Scott A. Moehrke are Partners at Kirkland & Ellis LLP. This post is based on a Kirkland & Ellis memorandum by Ms. Houlihan, Ms. Blizzard, Mr. Moehrke, Norm Champ , Dan Kahl , and Alexandara Farmer.

Speaker: Wayne Spivak - President and Chief Financial Officer of SBA * Consulting LTD, Industry Writer, and Public Speaker

The old adages that "cash is king" and "you can’t spend profits" still hold true today. But however well-known these sayings might be, it requires a change in mindset to properly implement a cash flow management system that predicts your business's runaway as accurately as possible. Key to this new mindset is understanding the difference between the Statement of Cash Flows, a historical look at the source and uses of cash, and the Cash Flow Statement, which uses transaction history and forward-l

Mckinsey and Company

JANUARY 17, 2023

McKinsey analyzed 14 new trends in its latest report on the most significant emerging technologies. Here are three for leaders to focus on right now.

Benzinga

JANUARY 20, 2023

Leading mobile gaming company Playtika Holding Corp (NASDAQ: PLTK ) submitted a revised takeover proposal to the board of Rovio Entertainment Corp for €9.05 per share in cash. The takeover offer implied a premium of 55% over Rovio's closing share price on Jan. 18, 2023. Also Read: Full story available on Benzinga.

Law 360 M&A

JANUARY 20, 2023

Angry Birds franchise owner Rovio said on Friday that it is assessing a €683 million ($738 million) cash offer from an Israeli mobile gaming company, after the Finnish developer was blindsided by the proposed acquisition.

Harvard Corporate Governance

JANUARY 18, 2023

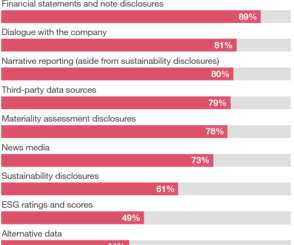

Posted by James Chalmers, Nadja Picard, and Hilary Eastman, PricewaterhouseCoopers LLP, on Wednesday, January 18, 2023 Editor's Note: James Chalmers is Global Assurance Leader, Nadja Picard is Global Reporting Leader, and Hilary Eastman is Head of Global Investor at PricewaterhouseCoopers LLP. This post is based on their PwC memorandum. Related research from the Program on Corporate Governance includes How Much Do Investors Care about Social Responsibility?

Speaker: Joe Apfelbaum, CEO of Ajax Union

In this webinar, Joe Apfelbaum, CEO of Ajax Union and business strategist, will take you through the ABCs of intent data. You'll learn how to effectively use it to drive business results, with practical tips on how to leverage both company and contact intent data to maximize your marketing efforts. Whether you're a seasoned marketer or just getting started, this webinar is a must-attend for anyone looking to stay ahead in the ever-evolving world of digital marketing.

Mckinsey and Company

JANUARY 16, 2023

Will the world move to solve its structural problems and make superior short-term choices? Yes or no: that’s the first question on the test.

Benzinga

JANUARY 19, 2023

Live Ventures Inc (NASDAQ: LIVE ) has acquired the outstanding equity interests of Flooring Liquidators Inc , in a transaction valued at approximately $84 million. Founded by Steve Kellogg in 1997, Modesto, California-based Flooring Liquidators provides floor, cabinets, countertops, and installation services in California and Nevada, operating 20 warehouse-format stores and a design center.

Rhythm Systems

JANUARY 18, 2023

5 Benefits of Attending a Strategy Execution Conference. Rhythm Systems is getting ready to host its 2023 annual breakthrough execution conference on April 26-27, 2023, in Charlotte, NC. The gathering of fast-growing middle market firms from around the world will assemble for a meeting of the minds to deliver breakthrough execution.

Harvard Corporate Governance

JANUARY 20, 2023

Posted by Adam J. Shapiro, Michael J. Schobel, and Erica E. Bonnett, Wachtell, Lipton, Rosen & Katz, on Friday, January 20, 2023 Editor's Note: Adam J. Shapiro , Michael J. Schobel , and Erica E. Bonnett are Partners at Wachtell, Lipton, Rosen & Katz. This post is based on their Wachtell memorandum. Economic volatility dominated the corporate landscape in 2022, with inflation and stock price declines making headlines throughout the year, while the labor market remained surprisingly resil

Mckinsey and Company

JANUARY 18, 2023

Five steps could help to bring broadband and digital equity to every Black household in the United States—urban and rural—while bolstering efforts to create a more inclusive economy.

Benzinga

JANUARY 17, 2023

Michael Lee Strategy founder Michael Lee has an interesting take on what drove Elon Musk's Twitter takeover and the subsequent decline in Tesla Inc (NASDAQ: TSLA ) shares. "He can say it's all about free speech. For Elon, it's about having a machine to control narrative because when you're that rich, you need one," Lee said Tuesday afternoon on Benzinga's " Stock Market Movers.

Exit Strategy

JANUARY 17, 2023

No matter how motivated the buyer and seller, selling a business is always a challenge. There’s a lot that can go wrong, and deals can fall through at any time. Delays are one of the biggest problems contributing to deal failure. The longer the process drags on, the more likely it is that a) someone […]. The post Avoiding costly M&A delays and deal failure appeared first on Exit Strategies Group, Inc.

Harvard Corporate Governance

JANUARY 15, 2023

Posted by Sonia K. Nijjar, Jenness E. Parker, Lauren N. Rosenello, Skadden, Arps, Slate, Meagher & Flom LLP, on Sunday, January 15, 2023 Editor's Note: Sonia K. Nijjar and Jenness E. Parker are Partners, and Lauren N. Rosenello is an Associate at Skadden, Arps, Slate, Meagher & Flom LLP. This post is based on their Skadden memorandum. Takeaways.

Mckinsey and Company

JANUARY 19, 2023

After one of its most successful years, Europe’s private banking industry will now need to navigate an uncertain macroeconomic outlook and evolving client needs.

Benzinga

JANUARY 17, 2023

SNDL Inc. (NASDAQ: SNDL ) completed the previously disclosed acquisition of all of the issued and outstanding common shares of The Valens Company Inc. (NASDAQ: VLNS ) (TSX:VLNS), other than those held by SNDL and its subsidiaries, pursuant to a plan of arrangement under the Canada Business Corporations Act, for total consideration of approximately CA$138 million ($103 million) consisting of common shares of SNDL and assumption of Valens' CA$60 million non-revolving term loan facility.

Appraisers Blog

JANUARY 18, 2023

Folks, I was in a USPAP class last Friday, during the day I was sent the tribute message below from another appraiser who knew Bill King very well, and who has been in touch with Bill’s wife. I’ve been looking for the obit. The one below was published on Sunday January 15, in the Anchorage Daily News: Orbituary William Edward King, 67, of Palmer, Alaska, passed away on Jan. 7, 2023.

Harvard Corporate Governance

JANUARY 19, 2023

Posted by Virginia Milstead, William J. O'Brien III, Skadden, Arps, Slate, Meagher & Flom LLP, on Thursday, January 19, 2023 Editor's Note: Virginia Milstead is a Partner, and William J. O’Brien III is Counsel at Skadden, Arps, Slate, Meagher & Flom LLP. This post is based on their Skadden memorandum. Key Points State courts are enforcing federal forum provisions for cases under the Securities Act, encouraging companies to amend their charters or bylaws to add these clauses.

Mckinsey and Company

JANUARY 17, 2023

Resilience is the ability to not only recover quickly from a crisis but to bounce back better—and even thrive.

Benzinga

JANUARY 16, 2023

Activist investor Ryan Cohen has reportedly acquired a stake in Chinese e-commerce giant Alibaba Group Holding Ltd. (NYSE: BABA ) worth hundreds of millions of dollars and is privately nudging the company to hasten its share-repurchase program. Cohen and others built the stake during the second half of last year, reported the Wall Street Journal, citing sources.

Accountancy Today

JANUARY 17, 2023

There were 1,964 company insolvencies in December 2022, up 32% compared with December 2021 (1,489) and 76% higher than the number registered three years previously, according to the latest figures from the Insolvency Service. It found there were 183 compulsory liquidations in December 2022, more than three and a half times as many as in December 2021 and 8% higher than in December 2019.

Harvard Corporate Governance

JANUARY 20, 2023

Posted by the Harvard Law School Forum on Corporate Governance, on Friday, January 20, 2023 Editor's Note: This roundup contains a collection of the posts published on the Forum during the week of January 14-19, 2023 Federal Reserve Proposes Climate Risk Guidance for Large Financial Institutions Posted by Nicola Higgs, Betty M. Huber, and Arthur S. Long, Latham & Watkins LLP, on Saturday, January 14, 2023 Tags: Banks , Climate change , climate risk , Federal Reserve , Financial institutions

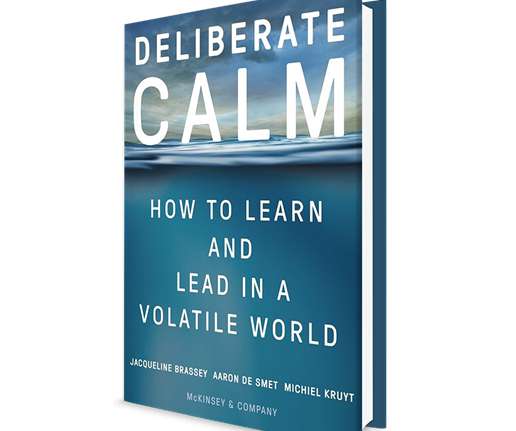

Mckinsey and Company

JANUARY 19, 2023

Leaders faced with volatility and uncertainty will benefit from building a keen awareness of both themselves and the operating environment around them.

Benzinga

JANUARY 17, 2023

Emerson Electric Co (NYSE: EMR ) shares are trading lower Tuesday after the company announced a proposal to acquire National Instruments Corp (NASDAQ: NATI ). What Happened: Emerson Electric said it submitted a proposal to the National Instruments board to acquire the company for $53 per share in cash. The offer implies an enterprise value of $7.6 billion.

NYT M&A

JANUARY 17, 2023

Investors are seeking billions of dollars in damages for their losses after Mr. Musk posted a proposal on Twitter that never materialized.

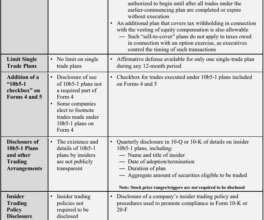

Harvard Corporate Governance

JANUARY 17, 2023

Posted by Michael S. Kesner, Pay Governance LLC, on Tuesday, January 17, 2023 Editor's Note: Mike S. Kesner is a Partner at Pay Governance LLC. This post is based on his Pay Governance memorandum. Related research from the Program on Corporate Governance includes Insider Trading via the Corporation (discussed on the Forum here ) by Jesse M. Fried.

Let's personalize your content