James Chalmers is Global Assurance Leader, Nadja Picard is Global Reporting Leader, and Hilary Eastman is Head of Global Investor at PricewaterhouseCoopers LLP. This post is based on their PwC memorandum. Related research from the Program on Corporate Governance includes How Much Do Investors Care about Social Responsibility? (discussed on the Forum here) by Scott Hirst, Kobi Kastiel, and Tamar Kricheli-Katz; The Illusory Promise of Stakeholder Governance (discussed on the Forum here) and Does Enlightened Shareholder Value Add Value? (discussed on the Forum here) both by Lucian A. Bebchuk and Roberto Tallarita; and Companies Should Maximize Shareholder Welfare Not Market Value (discussed on the Forum here) by Oliver Hart and Luigi Zingales.

The role of high-quality information in building trust

Investors use a wide array of sources to get information about how companies manage risks and opportunities, with financial reporting topping the list.

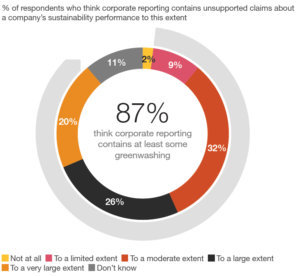

Investors’ concerns about greenwashing erode trust in what companies say about how they are addressing the sustainability risks and opportunities facing their business. These concerns also make it difficult for the investment profession to allocate capital to where it needs to go.

Investors are mostly concerned about the threats businesses face in the near term from inflation and economic volatility. Climate and cybersecurity risks move up investors’ list of concerns in the medium term.

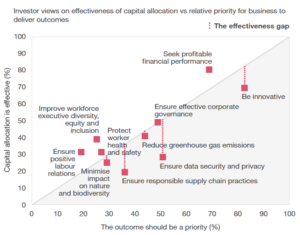

Investors have an expectation that businesses should prioritise being innovative and profitable. After all, if a company can’t adapt or runs out of cash, it won’t survive long enough to address the other issues it faces.

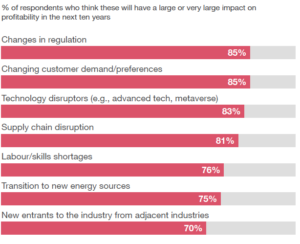

Changes in regulation and customer preferences top the list of disruptors investors think will have an impact on profitability over the longer term.

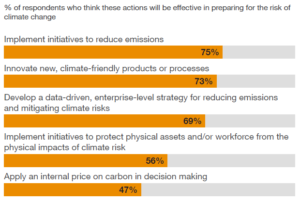

As exposure to the threat of climate change rises, investors have ideas for actions companies can take to manage the risk effectively.

Investors think governments can play a part by implementing measures to incentivise sustainable corporate behaviour.

| 54% think imposing taxes on unsustainable activities would be effective |

54% think adopting corporate disclosure requirements that provide transparency on corporate actions taken to address sustainability related risks and opportunities would be effective |

48% think providing subsidies to companies that undertake activities or initiatives that address government sustainability priorities would be effective |

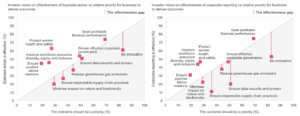

There is an execution gap between how well investors think business is doing to deliver on some of the top priorities. A reporting gap also emerges, highlighting the challenge investors face in assessing how well business is achieving them. This may explain why investors prioritise some information sources over others in assessing how well companies manage risks and opportunities, as highlighted above.

If investors view corporate reporting as insufficient in helping them assess some of their top priorities for business to deliver, it is difficult for them to allocate capital to those priority areas.

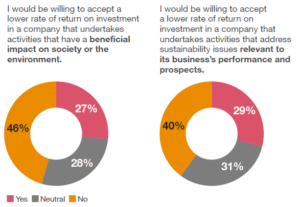

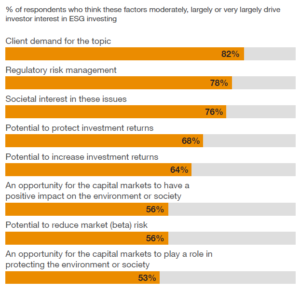

Investors’ willingness to accept a lower rate of return on investment in companies taking action to address sustainability issues is likely to be linked to the need for asset managers to respond to client demand for ESG investing products that help clients meet their financial goals, and adhere to a regulatory environment that prioritises fiduciary duty.

How companies can respond

| 73% want to see the cost to meet the sustainability commitments the company has set |

69% want to see the relevance of sustainability factors to the company’s business model |

| 70% want to see the effect of sustainability risks and opportunities on the company’s financial statement assumptions |

66% want to see the governance and oversight over sustainability risk and opportunities |

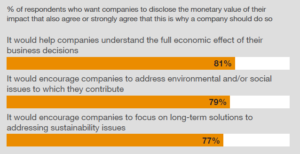

Having information about a company’s impact on the environment or society in which it operates is important for investment analysis and decision making.

| 60% want companies to report the impact they have on the environment or society now and in the future |

66% of those who want impact information also want to see companies disclose the monetary value of that impact |

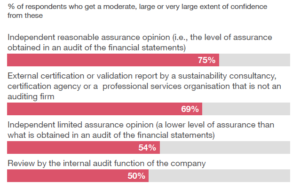

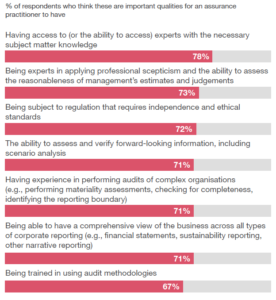

Investors value assurance as a way to give them confidence in corporate reporting on sustainability. Top of their list is reasonable assurance, which is the same level as the financial statement audit. They also want to know that a company has actually done what it says it has done, as well as that the reporting is in line with a recognised reporting framework.

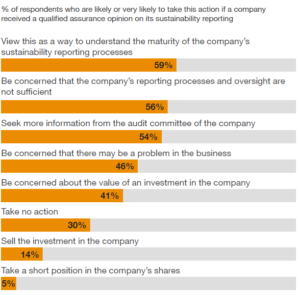

The organisation that provides the assurance is less important to investors than the qualities they expect of the assurance practitioner. As the level of assurance gets more rigorous over time, investors will first look to understand the reasons for any qualified assurance opinions before they will take action to sell their shares.

Research methodology

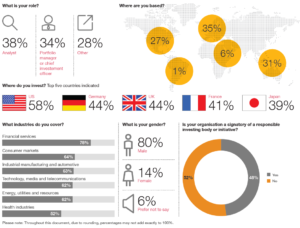

In September and October 2022, PwC conducted an online survey in which we received responses from 227 investment professionals across 43 territories. We also conducted 13 in-depth interviews with investors and analysts in five territories. The respondents to the online survey were spread across a range of industries, roles and specialisms, with assets under management ranging from US$500 million to US$1 trillion or more. The online research was undertaken by PwC Research, our global centre of excellence for primary research and evidence-based consulting services. The ind-epth interviews were conducted by partners and staff of PwC.

The complete publication, including disclaimers, is available here.

Print

Print