Matteo Tonello is Managing Director of ESG Research at The Conference Board, Inc., and Jason D. Schloetzer is Associate Professor of Business Administration at the McDonough School of Business at Georgetown University. This post relates to CEO Succession Practices in the Russell 3000 and S&P 500: Live Dashboard, an online dashboard published by The Conference Board, Heidrick & Struggles, and ESGAUGE.

These Key Findings are based on a dataset downloaded on July 6, 2022 from CEO Succession Practices in the Russell 3000 and S&P 500: Live Dashboard. The Live Dashboard is updated weekly with information on succession announcements about chief executive officers (CEOs) made at Russell 3000 and S&P 500 companies; please browse the Live Dashboard for the most current figures. For comparative purposes, the Live Dashboard includes historical data and breakdowns across business sectors (as classified under the Global Industry Classification Standard, or GICS) and company size groups. See Using this Dashboard for more details.

The project is conducted by The Conference Board and ESG data analytics firm ESGAUGE, in collaboration with executive search firm Heidrick & Struggles.

After declining during the pandemic, the rate of CEO turnover at US public companies is picking up rapidly, as boards regain confidence in their succession plans and recessions concerns prompts some longer-tenured leaders to exit their roles.

During the height of the pandemic, many companies chose to avoid compounding the business risks resulting from the crisis with the uncertainties of a leadership turnover. A clear decline in the 2021 rate of CEO succession indicated that, even in situations where a change might have been planned, many CEOs were asked to prolong their tenure and help to steer the ship. However, preliminary annualized data on the 2022 rate show that those earlier numbers may now be reversing and that this is poised to be a record year for CEO departures. Two factors may help to explain this finding.

During the height of the pandemic, many companies chose to avoid compounding the business risks resulting from the crisis with the uncertainties of a leadership turnover. A clear decline in the 2021 rate of CEO succession indicated that, even in situations where a change might have been planned, many CEOs were asked to prolong their tenure and help to steer the ship. However, preliminary annualized data on the 2022 rate show that those earlier numbers may now be reversing and that this is poised to be a record year for CEO departures. Two factors may help to explain this finding.

First, many CEOs are ready to move on. The pressure of managing during an unprecedented crisis—which, due to the current geopolitical and the looming prospect of a recession, has only accelerated rather than abated—has taken a toll on leaders, especially those who had been planned their retirement for years. Second, boards of directors may be more prepared for change too. In the last two years, they have had the time to stress-test and strengthen their company’s succession plan, gaining more confidence in their ability to execute it.

- In 2021, the CEO succession rate declined from the prior year both in the Russell 3000 (from 11.6 to 9.6 percent) and in the S&P 500 (from 11.1 to 10 percent). However, preliminary annualized data for 2022 show a reversal: As of July 2022, the annualized succession rate was up to 11.6 percent in the Russell 3000 and 11.4 percent in the S&P 500. Another interesting reversal can be observed in the rate of CEO succession by age group: In 2021, the CEO succession rate among CEOs under retirement age (i.e., under 64 years old) declined from the prior year both in the Russell 3000 (from 9.4 to 7.4 percent) and in the S&P 500 (from 8.2 to 7.5 percent), while the rate of retirement-age CEO successions held steady from the prior year in both the Russell 3000 (from 20.5 to 20.8 percent) and in the S&P 500 (from 24.4 to 24.3 percent). Preliminary annualized data for 2022 show a reversal of this trend too: As of May 2022, the annualized succession rate for retirement-age CEOs across both the Russell 3000 and S&P 500 is higher than in 2021 (from 20.8 to 24.2 percent in the Russell 3000 and from 24.3 to 31.5 percent in the S&P 500).

- The upward movement in the CEO succession rate is more pronounced in the utilities, health care, and consumer discretionary sectors (with annualized succession rates for 2022 of 19.6 percent, 13.9 percent, and 13.3 percent), while it is lower among companies in real estate and communication services (7.4 and 8.7 percent, respectively). It is interesting to note how the CEO succession rate in the discretionary sector never really experienced the pandemic-related decline seen across the index. The sector includes many retail companies that, for several years and well before the Covid crisis, have been searching for new leadership talent capable of countering threats such as the consumer shift to online shopping and the demand for new and sustainable products. [1] CEO turnover at consumer discretionary companies has been consistently high for several years; in the last few months alone, major retailers such as Gap Inc., Dollar General Corp., Bed Bath & Beyond Inc. and Under Armour Inc. have announced a change in their top leadership.

- There is no direct correlation between succession rate and the size of the companies. In fact, for smaller companies in the Russell 3000 index (i.e., with annual revenue under $100 million) we are registering an annualized CEO succession rate for 2022 of 14.7 percent, or only slightly higher than the 13.1 percent of their largest counterparts (annual revenue of $50 billion or higher). Mid-size companies report lower rates (e.g., those with annual revenue in the $5-9.9 billion range have an annualized 2022 CEO succession rate of 7.8 percent).

Boards have been reluctant to dismiss CEOs of companies that did poorly in the stock market during the pandemic, given shifting performance targets amid government-mandated shutdowns and an upended business context. This trend appears to be continuing in 2022, amid new geopolitical and economic uncertainties.

In 2021, we recorded a significant decline in the rate of CEO successions among poorly performing companies in the Russell 3000 as well as no instances of dismissal among S&P 500 companies. Preliminary annualized data on the 2022 rates indicate that the trend may continue into the rest of the year or possibly beyond. As shown by our research on performance metrics used in incentive plans, [2] some boards may be adopting a wait-and-see approach with CEOs who are delivering lagging stock performance, providing time for their leaders to adapt corporate strategies to the changed business circumstances. It remains to be seen whether this trend will reverse later in 2022 or in 2023.

In 2021, the share of CEO successions we classified as forced (i.e., CEO is under the retirement age of 64 and the company performed in the bottom quartile of total shareholder return for its industry) declined significantly from the prior year both in the Russell 3000 (from 5.2 to 1.4 percent) and in the S&P 500 (from 10.9 to 0 percent). Preliminary annualized data for 2022 show that the share of forced successions remains below the historical average across the Russell 3000 and S&P 500: As of May 2022, the share of forced successions was only 2.3 percent in the Russell 3000 (relative to the historical average of 5.8 percent) and remains at 0 percent in the S&P 500 (relative to the historical average of 9.8 percent).

In 2021, the share of CEO successions we classified as forced (i.e., CEO is under the retirement age of 64 and the company performed in the bottom quartile of total shareholder return for its industry) declined significantly from the prior year both in the Russell 3000 (from 5.2 to 1.4 percent) and in the S&P 500 (from 10.9 to 0 percent). Preliminary annualized data for 2022 show that the share of forced successions remains below the historical average across the Russell 3000 and S&P 500: As of May 2022, the share of forced successions was only 2.3 percent in the Russell 3000 (relative to the historical average of 5.8 percent) and remains at 0 percent in the S&P 500 (relative to the historical average of 9.8 percent).- This decline in the share of forced CEO successions is broad-based, with communication services, consumer staples, energy, industrials, information technology, materials, real estate, and utilities sectors reporting zero forced CEO departures in 2021. According to the annualized data for 2022, it continues to be zero in all those sectors except for consumer staples and real estate; health care also projects no forced CEO successions for the current year.

- This decline in the share of forced CEO successions is present across companies of all size, with several size groups reporting zero forced CEO successions in 2021 and projecting no forced CEO successions for the current year.

The CEO population remains largely male and white, and the limited progress on gender diversity recorded in the last few years appears to have stalled.

Unlike in boards of directors, the push for diversity in the upper management team of US public companies has not yet had transformative effects. CEOs remain largely male and white. The percentage of sitting female CEOs in both the Russell 3000 and S&P 500 remains flat, and certain business sectors lag far behind the overall index average despite being widely scrutinized for their lack of gender representation. Most companies still omit in their proxy statements any information about the racial or ethnic background of their top leaders, complicating the attempt to track the progress on diversity at this level of the company.

- In 2021, women represented only 5.9 percent of the total CEO population in the Russell 3000 (up from 5.7 percent in the prior year) and 6.1 percent of the S&P 500 (down from 6.4 percent in 2020). Preliminary annualized data do not project any increase for 2022. While for 2021 we recorded a net year-on-year addition of 15 female CEOs in the Russell 3000, the number did not impact the total percentage because of changes in index

- In the S&P 500, only three female CEOs were appointed in 2021, down from seven in each of 2019 and 2020 and well below the record 10 appointments of 2011; in 2021, two female S&P 500 CEOs left their post, for a net gain of just one.

There is a general expectation that companies will become more forthcoming in disclosing the racial diversity of their leadership teams; However, as much as 95.9 percent of Russell 3000 and 88.4 percent of S&P 500 companies did not include in their 2022 disclosure documents any information about the ethnic background of their CEO (the percentages in 2021 were 95.7 and 87.8, respectively). In the Russell 3000, at the companies that did provide this information, 85.6 percent of the CEOs identified as White/Caucasian, 1.6 percent as African American, 4.8 percent as Latino or Hispanic, 4.8 percent as Asian, Hawaiian or Pacific Islander, and 3.2 percent of other ethnic background.

forthcoming in disclosing the racial diversity of their leadership teams; However, as much as 95.9 percent of Russell 3000 and 88.4 percent of S&P 500 companies did not include in their 2022 disclosure documents any information about the ethnic background of their CEO (the percentages in 2021 were 95.7 and 87.8, respectively). In the Russell 3000, at the companies that did provide this information, 85.6 percent of the CEOs identified as White/Caucasian, 1.6 percent as African American, 4.8 percent as Latino or Hispanic, 4.8 percent as Asian, Hawaiian or Pacific Islander, and 3.2 percent of other ethnic background.

- Information technology, energy, and financial services continue to lag other business sectors in CEO gender diversity, with their 2022 share of female CEOs (3, 3.2, and 4.1 percent, respectively) sitting at about half the average rate for the entire Russell 3000 index. Two of 11 GICS business sectors analyzed reported a net decrease in female CEOs in 2021 (energy and utilities, each with a net decrease of one),

while seven (communications services, consumer staples, energy, financials, information technology, materials, and real estate) projected no change in the number of female CEOs for 2022. The information technology sector had just one more female CEO in 2022 (or 12) than it did in 2017 (when female CEOs were 11). The energy and utilities sector had fewer female CEOs in 2022 than in 2017.

while seven (communications services, consumer staples, energy, financials, information technology, materials, and real estate) projected no change in the number of female CEOs for 2022. The information technology sector had just one more female CEO in 2022 (or 12) than it did in 2017 (when female CEOs were 11). The energy and utilities sector had fewer female CEOs in 2022 than in 2017. - The Russell 3000 analysis by company size shows that most of the gains took place among small and mid-size companies. In total, manufacturing and nonfinancial services companies with annual revenue under $5 billion added 11 female CEOs in 2021 and six female CEOs in the January 1-July 6, 2022 period, compared to none in manufacturing and nonfinancial services companies with annual revenue of $25 billion and over.

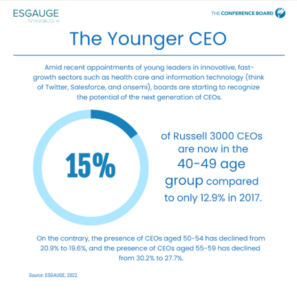

Amid recent appointments of young leaders in innovative, fast-growth sectors such as health care and information technology, boards are starting to recognize the potential of the next generation of CEOs.

Companies such as Twitter (NYSE: TWTR), Salesforce (NYSE: CRM), onsemi (Nasdaq: ON), and Apollo Medical Holdings (NASDAQ: AMEH) have recently made headlines for appointing CEOs in their late 30s or early 40s (Parag Agrawal of Twitter is 38 years old; Brett Taylor, co-CEO of Salesforce, and Hassane El-Khoury of onsemi are both 41; and Apollo Medical’s Brandom Sim is only 28). Those cases are indicative of a broader trend, especially among smaller companies, as shown by the growing percentage of CEOs in the age groups below 50 in the last five years.

- The percentage of Russell CEOs in the younger age groups has increased in the last five years. Specifically, CEOs in the 40-49 age group were 12.9 percent of the total in 2017 and now represent 15 percent. In the 30-39 age group, their percentage has grown from 0.9 to 1.9. On the contrary, the presence of CEOs aged 50-54 has declined from 20.9 to 19.6 percent and the presence of CEOs aged 55-59 has declined from 30.2 to 27.7 percent.

Unlike in the S&P 500, where it has remained stable at 58 years of age, the average age of sitting CEOs in the Russell 3000 index has declined in recent years, from 57.2 in 2017 to 56.8 in 2022. The typical incoming CEO is 54 in the Russell 3000 and 55 in the S&P 500.

- CEO age can differ significantly across business sectors. The lowest median CEO age in the Russell 3000 (56 years) is seen in the information technology, consumer discretionary, and health care sectors. Financials and energy companies report the highest median (59 years). It is also notable that the youngest leaders in the index are seen in the more innovative sectors of the economy and are often the company founders. Among the 25 youngest CEOs in the Russell 3000, six are at healthcare companies, five in information technology, and five in consumer discretionary. Instead, the more traditional, old-economy real estate and industrials sectors have four and five of the 25 oldest CEOs in the index. No real estate CEO makes the list of the 25 youngest in the index.

- There is a direct correlation between median CEO age and company size. For example, of companies in manufacturing and nonfinancial sectors, those with annual revenue under $100 million reported a median CEO age of 55.5, compared to 58 in the group with revenue of $50 billion or higher. Among financial and real estate companies, those with asset value under $500 million have a median CEO age of 54, compared to 61.5 in the group with asset value of $100 billion or higher. The highest percentage of CEOs under 50 is found in the smallest group of companies (25.5 percent in the group of manufacturing and nonfinancial services companies with annual revenue under $100 million, compared to only 3.2 percent in the group of companies with annual revenue between $25 and $4.9 billion and 8.3 percent in the group of companies with revenue of $50 billion or higher).

Unplanned CEO departures due to death or illness rose in the last couple of years, suggesting the importance for boards to have an emergency succession and communication plans. Both indexes also reported a higher percentage of changes in leadership due to business combinations.

In 2021 and 2022, we recorded in both the Russell 3000 and S&P 500 indexes a higher rate of leadership successions that were explained for the death of the CEO or for his/her incapacitation to continue to perform the duties of the office. In addition to prompting a debate on how much information companies should be disclosing on the deteriorating health of their top leaders while safeguarding their privacy, these instances suggest the importance for boards of directors to maintain an emergency succession plan, including a protocol on communications to employees and outside stakeholders.

- Among S&P 500 companies, 10 percent of CEO successions in 2021 and 6.9 percent of those announced until July 2022 were due to death or physical or mental incapacitation, up from 3.6 percent in 2020 and 4.5 percent in 2019. In the Russell 3000, cases of CEO death or illness triggering a turnover event rose from 2.3 percent of the total in 2020 to 3.5 percent in 2021 and 2.9 percent in 2022.

While CEO dismissals have declined in 2021 and 2022, both indexes reported an increase in the 2021 percentage of cases of CEO turnover due to business combination transactions—including mergers or acquisitions with other organizations. In the Russell 3000, these cases grew from 2.6 percent of the total in 2020 to 4.2 percent in 2021; in the S&P 500, they rose from 3.6 percent to 4.1 percent.

- Energy companies (12.5 percent), industrial companies (8.3 percent), and materials companies (also 8.3 percent) reported the highest percentages of 2021 CEO turnovers due M&A transactions. Eight of the 11 GICS business sectors had no instances of forced CEO succession (dismissal) in 2021. The sectors that reported dismissals were consumer discretionary (1.9 percent), financials (2.6 percent), and health care (3.2 percent).

- The analysis by annual revenue and asset value shows no correlation between the size of the company and the instances of CEO succession prompted by business combinations.

Boards are promoting insiders to the CEO role at a record rate. In addition to resulting from the improvements boards have made in the last couple of decades in succession planning, this finding could be a sign of the importance attributed to knowledge of the organization and familiarity with the corporate culture.

Inside promotions to the CEO position continue to increase, with insider appointments among the S&P 500 reaching the highest rate (or almost nine out of 10) since The Conference Board and ESGAUGE began tracking this statistic in 2011. Moreover, in 2021, inside appointments had an average company tenure of 18 years, eclipsed only by the 19 years we had recorded in 2002. The share of “seasoned executives”—or those with at least 20 years of company service—also reached historic highs among US public companies. The prevalence of insider appointments appears to be continuing according to preliminary annualized data on the 2022 succession events.

Just like other recent findings discussed in this post, the number of insider promotions to the CEO role may be explained by the challenges of the Covid crisis and the prolonged uncertainties that are now being forecast by most market analysts: More specifically, directors may believe that more experienced, seasoned business leaders with direct knowledge of the organization are better suited to navigate the risks posed by these exacting times. The pandemic has also accentuated the importance of valuing human capital to achieve sustainable business success, and many directors may conclude that an individual who understand the corporate culture is more likely to ensure a smooth leadership transition and avoid attritions.

- In 2021, the rate of appointment of inside promotions to the CEO position increased from the prior years both in the Russell 3000 (from 66.7 to 71.1 percent) and in the S&P 500 (from 74.5 to 86 percent). Both rates are the highest since The Conference Board and ESGAUGE began tracking these statistics. Preliminary annualized data for 2022 show that this trend is continuing: As of June 2022, the rate of inside promotions to the CEO position was up to 72.7 percent in the Russell 3000 and 86.2 percent in the S&P 500.

- The upward rate is even more pronounced in the utilities, financials, and industrials sectors (with insider succession rates for 2021 of 100 percent, 84.2 percent, and 80.6 percent), while it is lower among companies in the materials and real estate sectors (a decline in 2021, compared to 2020, of 33.3 percent and 11.9 percent, respectively).

- There is no correlation between the insider appointment rate and the size of the companies.

Endnotes

1See, most recently, Suzanne Kapner and Sarah Nassauer, From Gap To Dollar General: Retail Chief Exit As Challenges Grow, The Wall Street Journal, July 14, 2022; and Melissa Repko and Lauren Thomas, From Gap to GameStop, There’s A Retail Executive Exodus Underway—And More Departures Are Coming, CNBC, July 20, 2022.(go back)

2Incentive Design Changes in Response to Covid-19. An Ongoing Review of Russell 3000 Disclosure, The Conference Board/ESGAUGE, October 31, 2021.(go back)

Print

Print