Ingolf Dittmann is a Professor of Finance, Amy Yazhu Li is a PhD candidate, and Stefan Obernberger is an Associate Professor of Finance at Erasmus University Rotterdam, and Jiaqi Zheng is a PhD candidate in Finance at the University of Oxford. This post is based on their recent paper. Related research from the Program on Corporate Governance includes Short-Termism and Capital Flows by Jesse M. Fried and Charles C.Y. Wang (discussed on the Forum here); and Share Repurchases, Equity Issuances, and the Optimal Design of Executive Pay by Jesse M. Fried (discussed on the Forum here).

The growth in buyback volumes over the past two decades has raised concerns that CEOs are misusing share repurchases to maximize their own personal wealth at the expense of long-term shareholder value. The main concern is that CEOs use share repurchases to temporarily increase the stock price above its fundamental value so that they can sell their shares at higher prices. Share repurchases would then constitute a transfer of wealth from non-selling to selling shareholders, implying a negative effect on long-term shareholder value. In 2018, SEC Commissioner Robert J. Jackson Jr. backed up this concern in a speech posted to this forum, claiming that “what we are seeing is that executives are using buybacks as a chance to cash out their compensation at investor expense.”

While this concern has received a lot of attention from U.S. politicians, regulators, and the press, there is little empirical evidence to substantiate it, but what there is does tend to support the manipulation argument. For example, earlier research finds that insiders (Bonaime et al., 2013) and specifically the CEO (Moore, 2020) are more likely to sell equity when firms buy back stock. More notably, Edmans et al. (2021) present evidence consistent with stock price manipulation around the vesting of CEOs’ equity.

In our paper, we take a fresh look at the question of whether CEOs use share buybacks to sell equity at inflated stock prices. The major insight of our paper is that both the timing of buyback programs and the timing of equity compensation, i.e., the granting, vesting, and selling of equity, are largely determined by the corporate calendar. We define the corporate calendar as the firm’s schedule of financial events and news releases throughout its fiscal year, such as blackout periods and earnings announcements. We argue that this calendar determines when firms implement decisions about buyback programs and equity compensation and when firms and CEOs can execute trades in the open market. As a consequence, share repurchases and equity compensation are positively correlated. However, this correlation disappears once we account for the corporate calendar. Therefore, we conclude that the correlation between share repurchases and equity compensation is spurious and should not be interpreted causally. Consistent with this insight, we do not find systematic evidence of price manipulation when the CEO’s equity vests or when the CEO sells her vested equity. In conclusion, we find no evidence to support the claim that CEOs systematically misuse share repurchases at the expense of shareholders.

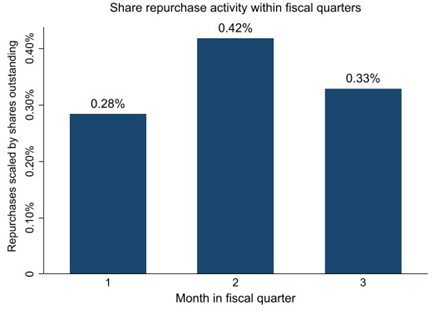

To understand the significance of the corporate calendar for the firm’s repurchase activity, we should look at repurchases from the perspective of the firm’s fiscal calendar. In the figure presented below, we use average monthly repurchases across all firms and all fiscal quarters. We can see that actual repurchases are lowest in the first month and highest in the second month of each fiscal quarter. From the first to the second month of the fiscal quarter, repurchase volumes increase by 50% on average. We identify two drivers of this pattern: first, we find that the announcement of a repurchase program often falls on the same day as the announcement of the quarterly earnings, normally taking place at the beginning of the second month of the fiscal quarter. Repurchase activity is highest at the beginning of the program because firms front-load their buyback programs to minimize price risk, causing repurchase activity to peak in the second month of the fiscal quarter (Hillert et al., 2016). Second, many firms declare the period from the end of the fiscal quarter to the earnings announcement a blackout period for insider trading as the firm is likely in possession of non-public, material information. Many firms also suspend their repurchase activity during this period to avoid litigation, causing repurchase activity to be particularly low in the first month of the quarter.

We find that the patterns for the granting, vesting, and sale of equity are very similar to those documented for repurchases. The CEO’s equity grants cluster in the 10 days after the earnings announcement date. Granted equity normally vests at the exact same date n years or n quarters in the future. Therefore, the vesting of equity is also correlated with earnings announcements. Finally, CEOs tend to sell their equity right after it vests, creating a correlation between earnings announcements and CEO sales, too. Note that earnings announcement dates are determined and publicly announced well ahead of the earnings announcement and, therefore, their timing is exogenous with respect to both buyback programs and equity grants.

Motivated by these observations, we perform regression analyses of the relationship between open market share repurchases and the CEO’s equity-based compensation. We find an economically and statistically significant relation between share repurchases and equity grants, and between share repurchases and vesting equity. However, these correlations disappear once we control for blackout periods and fiscal quarter-months in our regressions. We conclude that neither the granting of equity nor the vesting of equity has a direct influence on the execution of buyback programs in the open market.

Contrary to earlier research, we find that CEOs tend to buy more and sell significantly less when firms buy back shares. These results hold irrespective of whether we account for the corporate calendar, but accounting for the corporate calendar makes these findings stronger. We acknowledge that these results cannot be interpreted causally; nonetheless they can certainly not be interpreted as evidence that the CEO trades against the firm.

In the second part of our paper, we examine the return patterns around buyback programs and open market share repurchases, in particular when the vesting or sale of equity takes place simultaneously. One hypothesis put forward in earlier research states that CEOs use share repurchases to manipulate stock prices to the benefit of their equity-based compensation. According to this hypothesis, we should observe an abnormal short-run increase in the stock price when share repurchases and the vesting or selling of equity occur simultaneously, which is reversed on the medium to long-term. As an alternative hypothesis, we propose that equity-based compensation increases the CEO’s propensity to launch a buyback program when share repurchases have a positive impact on long-term shareholder value. This hypothesis is rooted in the observation that equity grants and subsequent equity sales are not singular events for a CEO. As granted equity periodically vests over a time horizon of several years, CEOs are more likely to profit from long-term increases in shareholder value than from short-term price manipulation at the expense of long-term shareholder value. Hence, under this alternative hypothesis, share repurchases should have a positive impact on shareholder value on both the short run and the long run.

The results of our analysis of (long-run) returns do not support the claim that CEOs systematically misuse share repurchases at the expense of shareholders. To the contrary, we find that equity compensation increases the propensity to launch a buyback program when buying back shares is beneficial for long-term shareholder value, which is consistent with our alternative hypothesis.

The complete paper is available for download here.

Print

Print