Maria Castañón Moats is Leader, Paul DeNicola is Principal, and Matt DiGuiseppe is Managing Director at the Governance Insights Center at PricewaterhouseCoopers LLP. This post is based on their PwC memorandum. Related research from the Program on Corporate Governance includes Social Responsibility Resolutions (discussed on the Forum here) by Scott Hirst.

The 2022 proxy season saw a marked increase in the number of shareholder proposals and lower support for both say on pay and directors. What do boards need to be focused on as they head into the fall?

Looking back on the 2022 proxy season, the story on shareholder proposals stands out. Overall, support for shareholder proposals fell for the first time in years, although pockets of strong support in the areas of climate and human capital deserve attention. Support for say on pay also continued to fall, as investors appear to be taking a more critical posture. [1] Finally, overall support for director elections also retreated. [2] As boards undertake their annual governance reviews and make the decisions that will feature in the 2023 proxy statement, considering these results can lead to a smoother season next year.

Shareholder proposals

Proposal count breaks records

After several years of being relatively stagnant, the number of shareholder proposals voted on has

been growing since 2020. In 2022, the number of proposals that went to a vote at Russell 3000 companies increased significantly to 555, a 25% increase over last year. This jump reflects two trends. First, the number of proposals filed increased by approximately 17%. Second, the number of

no-action requests granted by the SEC, which allow companies to exclude proposals from their proxy

statement, dropped by 40%. Part of the decline likely reflects the SEC staff’s change in approach to the ‘ordinary business’ and ‘economic relevance’ exceptions, announced in Staff Legal Bulletin 14L in November 2021.

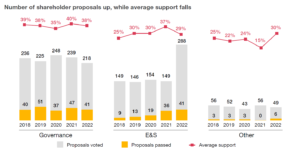

Not surprisingly given the number of proposals up for a vote, a record number also received majority support, primarily related to ESG. Just under half of the passing proposals covered standard governance topics that commonly receive significant support, such as majority voting in director elections and giving shareholders the ability to call a special meeting. The same amount were environmental and social (E&S) proposals. However, despite the record number passing, overall average support for E&S proposals actually fell from 2021’s record high of 37% to 29% in 2022.

Investors take a nuanced approach to voting environmental and social proposals

While 41 proposals on environmental and social topics received majority support in 2022, investors’ support was dependent on the proposal details rather than the overall topic being addressed. Within the broad categories of environmental proposals—which can include measures addressing climate risk and reducing plastics—support fell overall, but varied significantly topic to topic. The same held true within social proposals. In both of these categories, the number of proposals effectively doubled and we saw a significant increase in the diversity of topics being addressed.

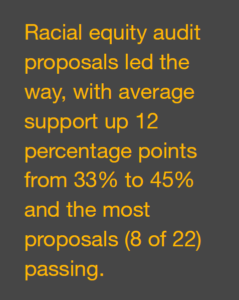

As a broad category, diversity and human capital was the most common of all the E&S topics voted on in 2022, with 82 proposals. It was also the category with the broadest range of issues being addressed and the highest variety of shareholder positions on those issues. While overall support for the category was down, proposals asking for a racial equity audit and reports on concealment clauses and pay equity bucked the trend. Racial equity audit proposals, which ask the company to investigate its business practices for unintentional biases, led the way, with average support up 12 percentage points from 33% to 45% and the most proposals (8 of 22) passing. Support for reporting on the risks associated with concealment clauses, which limit employees’ disclosure of employment related matters, and gender/racial pay equity was also strong, with average support of 49% (4 of 8 passing) and 39% (2 of 7 passing), respectively.

Following significant success in 2021, the number of climate proposals offered by shareholders nearly doubled this year. However, so too did the range of proposal topics, expanding from a focus on the reporting of direct emissions and risk management to include indirect emissions and sustainable packaging. Consistent with 2021, shareholders continued to be supportive of proposals asking for the adoption of GHG emissions reduction or net-zero targets, with 7 of 14 of these proposals passing. However, they were less likely to support proposals focusing on indirect emissions and low-carbon economy transition plans, none of which passed.

Executive compensation

Say-on-pay support continues to decline

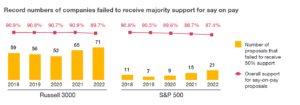

As the 2022 proxy season wrapped up, record numbers of companies failed to receive majority support for say on pay. Average support at companies in the S&P 500 and Russell 3000 hit record lows since the vote was introduced 11 years ago, at 87% and 90% respectively. In the S&P 500, 21 companies failed their say-on-pay vote, with 207 companies receiving below 70% support. The number of failed votes at Russell 3000 companies hit 71.

What’s driving these results? Common (and perennial) issues include pay and performance alignment, one-time awards, uncommon pay structures, and unchallenging performance targets. The results this year indicate that investors are growing more comfortable casting no votes when these issues arise.

Given the current market uncertainty, it is important to note that the timing of market movements relative to compensation decisions can result in unintended outcomes. When equity values are depressed, boards sometimes take actions to enhance existing compensation packages that have been devalued. But a quick rebound, as we saw in the latter half of 2020, can result in unintentionally high reported values that could negatively impact next year’s say-on-pay vote.

Linking compensation to ESG goals

The inclusion of ESG metrics in executive compensation has received tremendous attention recently as a new trend in corporate pay plans. Many compensation committees have made adjustments to their plan targets to include new goals, and are offering additional disclosure about how their compensation plans support the company’s ESG strategy. But how is the issue affecting shareholders’ say-on-pay votes? While investors are generally supportive of tying ESG performance to compensation, they are not voting against pay at companies that don’t include them. Instead, we saw cases where ESG metrics in plans may have actually spurred votes against say on pay. Shareholders expect any pay metrics to be clearly linked to the company’s fundamental strategy. Where the metric doesn’t fit that requirement, even if it is an ESG metric, shareholders warn that it could result in pay outcomes they would vote against. As boards look to future changes in their compensation plans, it will be critical to maintain alignment between ESG metrics and strategy.

Director elections

Director election support ticks down

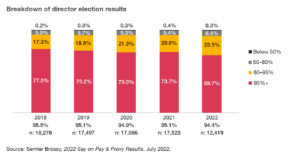

Director elections rarely receive significant attention if there isn’t a proxy fight or vote “no” campaign. However, overall support for director elections in the Russell 3000 has fallen below 95%. [3] While that level is still extremely high, the vast majority of those elections are routine and small changes in the top line support can indicate significant changes in individual situations. The percentage of directors receiving 50-95% support has increased from 22% to 30% over the past five years, while the percentage failing to receive majority support has remained stable.

Discrete issues drive votes against directors

The drop-off in director support is likely being driven by a host of reasons. Common reasons for voting against directors include lack of board diversity, oversight failures, poor climate risk management disclosure, failed engagement activities, executive compensation issues, and overboarding. When one or more of these concerns exist, director support can quickly dip below 90% and even result in a failure to receive majority support. By reviewing the voting guidelines of the company’s major investors, boards can preemptively address issues during fall engagement activities to reduce the likelihood of investors taking voting action.

Board diversity has quickly emerged as an area where investor views have converged, making it a topic that boards can’t ignore. Originally focused primarily on gender diversity, shareholders have expanded their lens over the past few years to include racial diversity and established expectations for detailed disclosures on board demographics. The fact that many investors have similar voting guidelines means that when a company fails to meet their expectations, the impact can be significant. Based on investor guidelines, lack of board diversity was a contributing factor in at least 12% of situations where a director failed to receive majority support, up from 10% last year.

Looking ahead to 2023

As boards look ahead to fall engagement activities and shareholder proposal filing deadlines, they should expect shareholders to continue to focus on companies’ ESG practices and strategic integration. While proponents may have crafted some proposals looking to drive specific company actions too narrowly to receive widespread support this year, they are likely to take the market feedback into consideration when re-writing proposals for 2023, leading to a potential rebound in overall support.

The drop in support for director elections and say on pay makes it clear that shareholders are scrutinizing board actions more than they have in the past. As directors look ahead to the 2023 proxy season they should ask the following questions:

Shareholder engagement

- Have we identified priority topics for shareholder engagement?

- Should the topics be addressed by board members or management?

- Can we address any potential issues with director elections proactively?

Shareholder proposals

- How are we addressing any proposals that were on our ballot this year?

- If a proposal didn’t pass, are there actions we can take to reduce support in case it is refiled?

- How would we respond to the shareholder proposal topics that are commonly receiving majority support?

Executive compensation

- Are we monitoring the overall alignment between pay and stock price performance?

- How do our executive compensation plans reflect our ESG priorities?

- If we use ESG metrics in our plans, how are they aligned with our core business strategy?

Endnotes

1Unless otherwise noted, voting data on shareholder proposals and say-on-pay resolutions has been provided by Proxy Analytics.(go back)

2Semler Brossy, 2022 Say on Pay & Proxy Results, July 2022.(go back)

3Semler Brossy, 2022 Say on Pay & Proxy Results, July 2022.(go back)

Print

Print