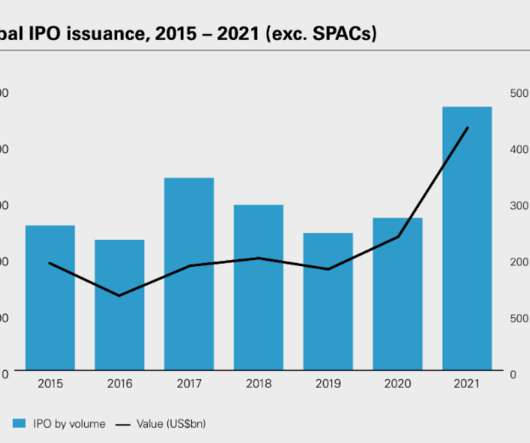

Backed by SPACs, IPOs Hit New Heights in 2021

Harvard Corporate Governance

MARCH 24, 2022

Posted by Joel Rubinstein, Michael Immordino, and John Guzman, White & Case LLP, on Thursday, March 24, 2022 Editor's Note: Joel Rubinstein , Michael Immordino , and John Guzman are partners at White & Case LLP. This post is based on a White & Case memorandum by Mr. Rubinstein, Mr. Immordino, Mr. Guzman, Kaya Proudian , and John Vetterli.

Let's personalize your content