Paul Keary is CEO, Ursula Burns is Chair, and Sparky Zivin is a Senior Managing Director at Teneo. This post is based on their Teneo report.

Foreword

The role of today’s CEO is evolving, paralleling the shifting global financial, geopolitical and social landscapes in which they operate. Teneo is fortunate to work with and advise leading CEOs around the world as they navigate this environment.

As the calendar turns from a tumultuous 2022 to the uncertainties of 2023, we surveyed more than 300 global public company CEOs and institutional investors representing approximately $3 trillion USD of combined company and portfolio value to capture views on key issues for the coming year. From the global macroeconomic outlook to innovation and emerging technologies, deglobalization and its knock-on effects, ESG and talent, perspectives are, in many ways, aligned. For example, 86% of CEOs and investors believe that deglobalization is a reality, with almost half of CEOs acknowledging that this will have a significant impact on their companies.

However, tensions appear in several key—and perhaps unexpected—areas, highlighting possible vulnerabilities and opportunities for business leaders in the year ahead. For instance, CEOs and investors have widely divergent views on the economic outlook for the first half of 2023. While 73% of leading CEOs expect worsening conditions in 2023, 76% of investors expect conditions to improve.

This represents just a sampling of the insights highlighted in this report. We hope that the findings prove useful as you plan your strategy for 2023 and beyond.

Executive Summary

Against the backdrop of looming global uncertainty, Teneo surveyed more than 300 global public company CEOs and institutional investors.

The survey finds that an uncertain macroeconomic outlook and deglobalization are among the top issues on the minds of leading CEOs and investors as they plan for 2023. It also uncovers some of the steps corporate leaders are taking in the face of disruptive forces, including economic conditions, geopolitics, ESG, talent and innovation.

In areas of strong agreement, such as preparing for deglobalization and the approach to addressing disruptive social issues, companies can feel confident in staying the course. In areas where perspectives differ, such as investing in emerging technologies, the importance of China and qualifications for next generation CEOs, companies may be advised to rethink their current positions.

The insights in this report are intended to help businesses understand what the market expects of them, highlight areas in which they can stay in front of investor expectations, and better prepare for the immediate and longer term. The stakes have never been higher.

Macroeconomic Outlook

Investors are more bullish on the next six months than CEOs of large companies.

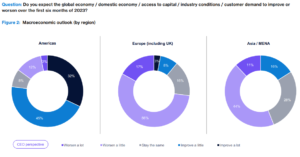

Based on survey results, investors are strikingly more optimistic about the next six months than CEOs of large-cap companies (Figure 1). Perhaps investors are motivated by opportunities to “buy the dip” in the market over the next six months. It is also possible that the sheer complexity and uncertainty of operating large, multinational corporations in today’s environment has CEOs of large cap companies hedging their bets. Regardless, the data raises the possibility that the market will get ahead of the economic reality in the coming months.

The outlook of CEOs from the Americas is less bearish than their counterparts in the rest of the world. 77% of CEOs from the Americas expect improvements over the first six months of 2023, compared to 16% and 11% in Asia / MENA and Europe respectively (Figure 2).

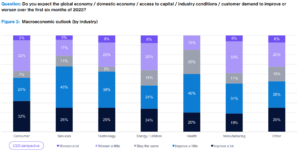

Consumer goods, financial and professional services, and tech CEOs are optimistic on market conditions heading into 2023, while counterparts in manufacturing, energy and healthcare hedge their views (Figure 3). With retail sales a likely lagging indicator, the gloomy outlook from manufacturing CEOs may point to inflation slamming the breaks on consumer spending. Factory orders could very well be the “canary in the coal mine” that consumer CEOs are not yet seeing. It is also interesting to note that none of the CEOs representing the healthcare sector expect a severe worsening. This may speak to the resilience of the sector or the stability of government-funded revenue.

Deglobalization

Is this the end of globalization? When it comes to deglobalization, it’s not a matter of if, but when.

Globalization has been the order of the day for the last 30 years. At its peak, global supply chains drove lower prices. During the pandemic, these supply chains were revealed to be highly vulnerable. Heading into 2023, 86% of CEOs and investors believe that deglobalization is a reality, with almost half indicating that deglobalization is already underway and that it will be a significant event (Figure 4). This suggests that, at least for the moment, completely fungible, global and flexible supply chains are a thing of the past, and companies must fundamentally change the way they operate in the global economy and local markets.

Question: Which of the following is closest to your own view about the potential for deglobalization?

• Deglobalization has already begun and will be a significant event.

• Deglobalization has already begun and will be a minor event.

• Deglobalization will happen in the future and will be a significant event.

• Deglobalization will happen in the future and will be a minor event.

• Deglobalization will not happen.

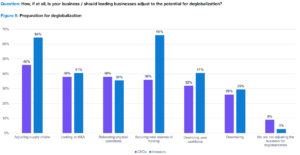

91% of CEOs (Figure 5) are already taking steps to prepare their businesses for the effects of deglobalization.

Even so, investors are looking for much more active adaptations than CEOs are prepared for. Most notably, 65% of investors are expecting companies to make material adjustments in supply chains and start securing new sources of funding, while only 46% and 36% of CEOs respectively are actively taking steps in these areas. While investors are hyper-focused on these areas, CEOs are thinking across a much broader set of issues including looking at M&A (38%), relocating physical operations (38%) and onshoring workers (32%).

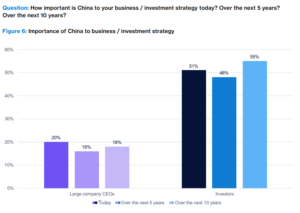

It is virtually impossible to discuss the reordering of the global economy without acknowledging China’s importance. Surprisingly, only 20% of CEOs responded that China is important to their business strategy today, while 51% of investors responded that China is important to their investment strategy today (Figure 6). It is unclear whether investors are focused on China because they want companies to unwind current operations or if they are, in fact, bullish on China in the long-term and want companies to increase their current levels of investment.

Regardless, it is clear that the role of China remains essential to corporations and investors both today and over the next 10 years.

However, the slight dip in China’s perceived importance at the five-year mark for both CEOs and investors suggests that the amount of weight allocated to China in the broader landscape is still very much in flux.

The U-shaped curve representing the importance of China to business and investment strategy underscores that, though critical over the long-term, China’s importance over the next five years is unclear.

Innovation

While investors embrace investment in a wide range of disruptive technologies, CEOs are more cautious, particularly on the metaverse and crypto.

Teneo collected survey data for a four week period beginning November 9, 2022. Two days later, FTX filed for bankruptcy protection in the U.S.[1] While it is unclear how these headlines may have influenced responses, investors clearly demonstrate a growing expectation for companies to invest in and adopt emerging technologies (Figure 7). CEOs, on the other hand, are indicating a much more measured approach, particularly with regard to the metaverse and cryptocurrency.

Investment in AI is one area of strong alignment between CEOs and investors. Enthusiasm around AI continues, with 48% of companies having already adopted AI into their operating models and 58% actively investing in additional capabilities (Figure 8).

Disruption

CEOs and investors overwhelmingly agree that companies must be more nimble to effectively manage black swan events.

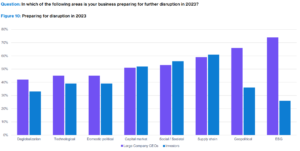

In an environment of pervasive uncertainty, disruption is a given. Heading into the first half of 2023, CEOs and investors alike are expecting wide-ranging areas of upheaval (Figure 9) to present significant challenges and opportunities.

While top issues vary by region, CEOs of the world’s largest companies are anticipating and preparing to mitigate risk in geopolitics and ESG at a far greater rate than investors. This suggests that CEOs are more focused on these issues than investors expect them to be. Meanwhile, investors believe that CEOs should step up their current preparation for supply chain, societal and capital market disruption even further (Figure 10; Figure 14).

CEOs of the world’s largest companies are far more likely to expect further geopolitical and ESG disruption in 2023.

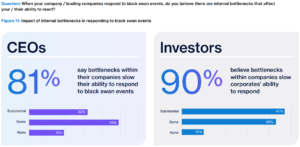

More than 80% of CEOs and 90% of investors believe that internal bottlenecks significantly affect a company’s ability to react or even capitalize on opportunities amid disruptive events. Almost half of investors believe that these internal obstacles represent a substantial threat to an effective response.

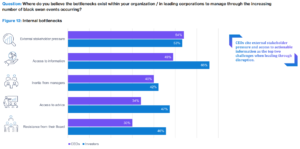

What are these internal pressure points? Investors flag a far wider variety of internal bottlenecks, with almost 70% citing access to information as a significant roadblock (Figure 12). Both CEOs and investors agree (more than 50% of each data set) that external stakeholder pressure is a material consideration, raising the question of how much influence external stakeholders exert in how priorities are set internally. An area of disconnect between CEOs and investors is around resistance from boards, with only 30% of CEOs citing this as a significant issue, while 46% of investors flagged this as a roadblock. CEOs clearly must do more to reassure the market that they are aligned with their boards during critical decision-making moments.

ESG

Even in the face of a looming recession, CEOs and investors are not ready to give up on ESG ambitions.

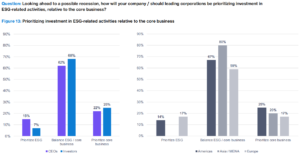

Despite recessionary pressures and the underperformance of some ESGfocused funds, CEOs and investors are still working to balance company performance and ESG commitments (Figure 13). In fact, 15% of CEOs are prioritizing investment in ESG over business performance, and more than 60% of CEOs and investors indicate a commitment to both priorities heading into 2023. This percentage is even higher in Asia and Europe, where CEOs are more likely to balance ESG and business needs, while CEOs in the Americas lean toward refocusing on operations.

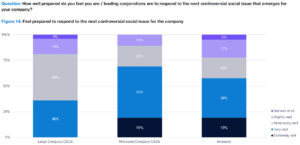

Despite the ongoing commitment to ESG-related activities, many largecompany CEOs (nearly one in five) feel unprepared to handle the next controversial social issue (Figure 14). This lack of confidence also emerges in Figures 9 and 10 as CEOs cite addressing societal disruption as a major consideration. Meanwhile, mid-sized company CEOs are very confident in their ability to respond, which sits well with investors who believe that CEOs are generally well-prepared to respond when the next crisis erupts.

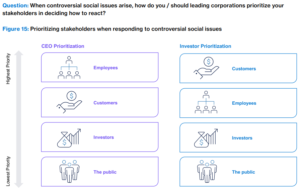

When the next crisis does arise, both CEOs and investors agree that addressing the issue with employees and customers first (before investors or the public) is the best course of action when building their social issue management strategy (Figure 15).

People

Investors want to see CEOs double the representation of voices of the next generation in today’s C-suite, which are firmly grounded in the past and present.

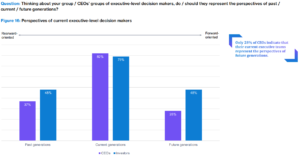

The current C-suite is clearly grounded in the past and present, with surprisingly few (28%) CEOs indicating that their executive teams represent the perspectives of future generations (Figure 16). The fact that investors (48%) have assumed that the current C-suite represents a much more future-/forward-leaning perspective is a missed expectation that companies need to address. CEOs risk setting strategy based on the perspectives of today’s stakeholders when investors are nearly twice as likely to expect a course based on future stakeholders.

Today’s decision makers and investors differ on the qualities they believe will define the most effective CEOs of tomorrow. This suggests that companies have an opportunity to expand the lens through which they identify and equip the next generation of C-suite leadership.

Methodology

Teneo’s Vision 2023 CEO and Investor Outlook Survey was conducted by the firm’s in-house data, insights and analytics team. The survey includes the views of more than 300 global CEOs and institutional investors representing approximately $3 trillion USD of company and portfolio value.

CEOs represent a global distribution of publicly traded companies with a minimum annual revenue of $1 billion USD or greater. Large companies are defined as $10 billion+ USD in annual revenue; mid-sized companies are defined as $1 billion USD — $9.99 billion USD in annual revenue.

Investors include a global sampling of professional investors in investment banking, institutional investing, venture investing, asset management, private equity and hedge funds. The survey was conducted between November 9 and December 6, 2022.

Note: Some columns throughout the report may total to more than 100% due to rounding. Asia / MENA is a small sample size relative to other geographic regions.

Endnotes

1FTX on Twitter: “Press Release https://t.co/rgxq3QSBqm” / Twitter(go back)

Print

Print