Pam Greene is Partner, David Kritz is Associate Partner, and Anna Barrera is Senior ESG Consultant at Aon plc. This post is based on an Aon memorandum by Ms. Greene, Mr. Kritz, Ms. Barrera, and Grant Hinrichsen.

Related research from the Program on Corporate Governance includes Stakeholder Capitalism in the Time of COVID, by Lucian Bebchuk, Kobi Kastiel, and Roberto Tallarita (discussed on the Forum here); Politics and Gender in the Executive Suite by Alma Cohen, Moshe Hazan, and David Weiss (discussed on the Forum here); Will Nasdaq’s Diversity Rules Harm Investors? by Jesse M. Fried (discussed on the Forum here); and Duty and Diversity by Chris Brummer and Leo E. Strine, Jr. (discussed on the Forum here).

Our research into the second year of required human capital management disclosure in companies’ Form 10-Ks finds a continued general lack of quantitative information. However, within the most prevalent topics for disclosure, we are observing more data being included, particularly when it comes to diversity, equity and inclusion.

Public companies in the United States (U.S.) have completed the second year of required disclosure regarding human capital management (HCM), allowing stakeholders to compare year-over-year changes in how companies are disclosing HCM and different topics of interest.

To see how this disclosure is evolving, we analyzed 103 filings from S&P 500 companies for the 2021 fiscal year. In general, the most prevalent topics covered by companies are largely the same as in the first year of the new disclosure rule (see our analysis of year one HCM disclosures here). However, individual companies are disclosing more details on these topics, leading to more robust disclosures.

In this article, we explore the changes year-over-year in disclosure, hot topics of disclosure for the 2021 fiscal year, and how companies can prepare to meet stakeholder expectations for HCM disclosures in the future.

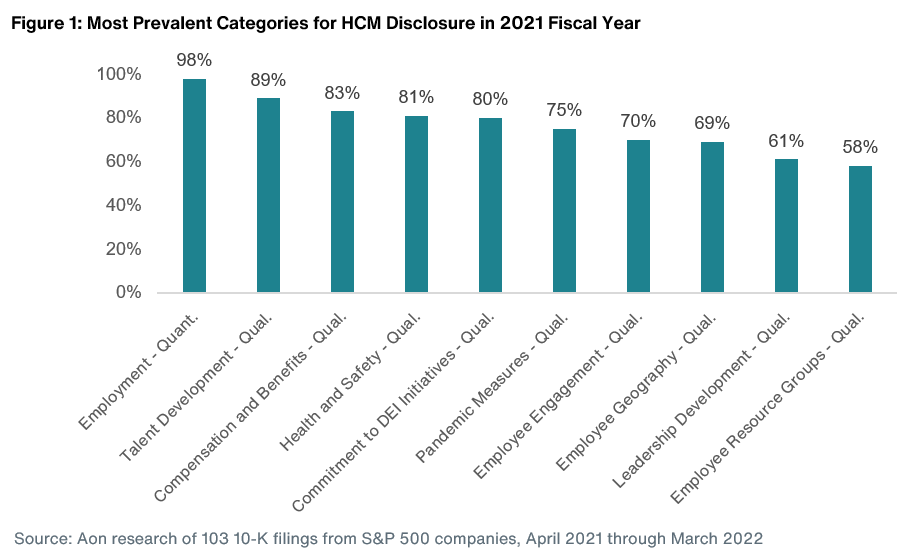

The chart below illustrates the most common categories in year two of the required disclosure.

How Year Two Disclosure Compares to Year One

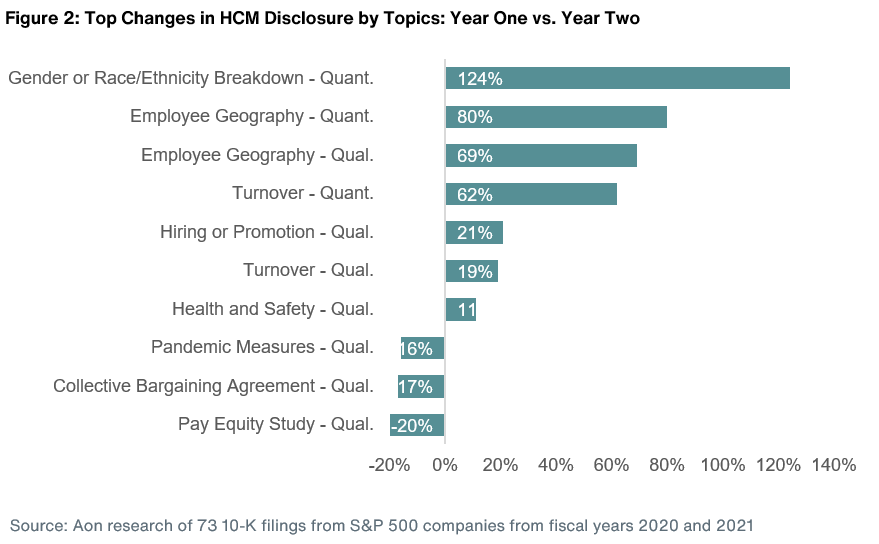

While the categories in HCM 10-K disclosures have not changed meaningfully in this second year, S&P 500 companies are expanding their disclosures to include a broader set of topics and include more in-depth information within each topic. We looked at a subset of 73 companies in the S&P 500 to analyze how their year-over-year disclosures have evolved. The results in Figure 2 show the 10 categories where we saw a greater than 10 percent increase or decrease in disclosure across the same sample of companies.

The category with the most additional information added is gender or race/ethnicity breakdown. Companies disclosing this quantitative data more than doubled in year two compared to year one. We also saw an 80 percent rise in quantitative data reported on employee geography, such as the number of employees by country or region, as well as a 62 percent increase in data on employee turnover (a hot topic many companies are challenged with). However, quantitative turnover was still reported by less than one-third of the companies in the subset.

We also saw a few notable areas where companies reduced the amount of disclosure, including a 20 percent drop in pay equity study disclosures and a 16 percent decline in discussions on pandemic measures. The drop in pay equity study disclosures may indicate that companies are acting on the results that came out of the flood of pay equity audits conducted in 2020, rather than focusing discussion on the audits themselves. Going forward, we may see a cyclical pattern with a surge in pay equity discussions tied to headline pressures and companies’ periodic pay gap analyses.

The increase in topics covered by individual companies may be a move to get in front of additional human capital disclosure requirements in anticipation of potential forthcoming rules that may be issued by the SEC. Chairman Gary Gensler stated in August 2021 that he asked the SEC staff to propose recommendations for enhanced HCM metric disclosures beyond the number of employees, such as workforce turnover, skills and development training, compensation, benefits, workforce demographics including diversity, and health and safety.

“As the SEC rule is principles-based disclosure, we expect the types of information provided by companies to continue to be refined over the coming years,” says Pamela Greene, Aon’s head of North America Corporate Governance and ESG Advisory group. “Just as we have seen an evolution within Compensation Discussion & Analysis disclosures over the last 15 years, we expect human capital disclosures to similarly progress in their structure, issue-coverage and depth over time, reflecting dynamic investor expectations,” she says.

Key Themes From Year Two Disclosures

Most of the disclosures in our analysis from fiscal year 2021 began with a workforce overview. Indeed, 98 percent include data on the size of their workforce and 61 percent provide details on their geographic footprint. Following this information, half of companies provide a statement on the existence of collective bargaining agreements (CBAs); of the companies subject to CBAs, 60 percent provide quantitative data such as number of CBAs or number of employees covered by CBAs.

Topics of disclosure can be largely grouped into four categories. These include hiring and retaining talent; diversity, equity and inclusion; employee engagement; and COVID-19, health and safety.

We explore each of these sections in more detail below to provide trends on HCM actions and disclosures to help organizations consider for next year the level of disclosure around their HCM strategy.

Hiring and Retaining Talent

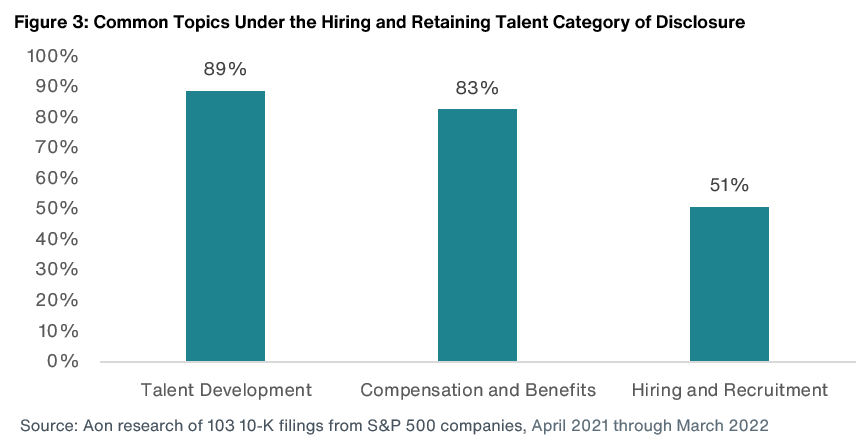

The majority of companies address the current competitive job market by highlighting their hiring and talent development strategies: fifty-two percent of companies discussed recruitment and hiring, with a quarter of those companies including quantitative data predominantly around new-hire statistics.

As in the first year of disclosure, talent and leadership development was an area of focus, with 89 percent of companies covering this topic. Companies discussed training and mentorship programs, including quantitative data on participation rates.

In addition to employee development, 83 percent of companies discussed the competitiveness of their compensation and benefits as a hiring and retention strategy. Some companies discussed the shift in their benefit programs to address the effects of the pandemic on their workforce, such as the expansion of mental health and wellness benefits.

Diversity, Equity and Inclusion (DEI)

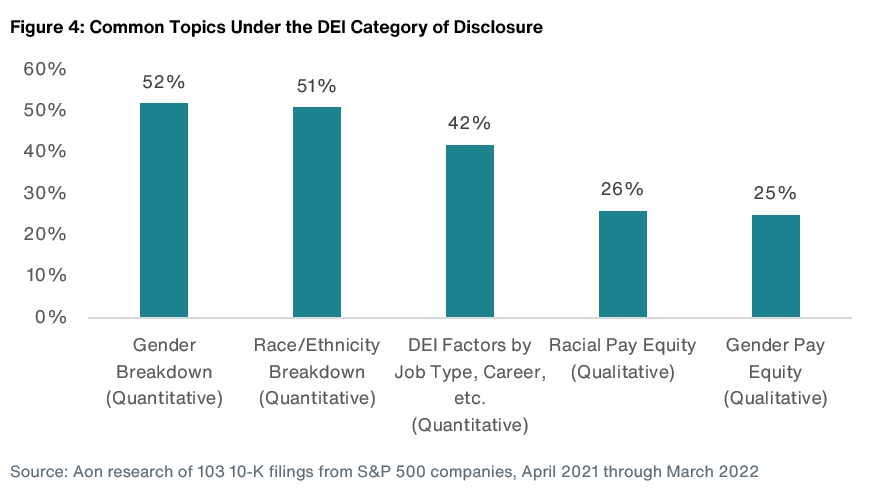

Most companies discussed DEI in their human capital management disclosure. Eighty percent discussed specific DEI initiatives, such as unconscious bias training, diverse candidate recruitment and employee resource groups.

We also saw an increase in quantitative DEI disclosures compared to the prior year. Just over half of companies disclosed both gender and race/ethnicity breakdowns of their workforce. In addition, 41 percent of companies overlay these quantitative diversity metrics with job type, career levels and other categories, presenting a more in-depth look at their workforce diversity.

As mentioned, we did see a decline in disclosure of pay equity studies from the prior year, but about a quarter of companies still mentioned conducting gender and race/ethnicity pay equity studies, and 40 percent of those included quantitative data. Examples of this include the percentage of pay disparity and cents on the dollar earned by women or people of color compared to men or non-minority employees.

Employee Engagement

Employee engagement was a popular topic in this second year of disclosure, with 71 percent including it. Of that group, 32 percent included quantitative metrics, such as participation rates in pulse surveys or the results of those surveys. Employee resource groups were discussed in 58 percent of disclosures, which oftentimes intersected with DEI initiatives. Employee turnover—frequently an indicator of employee engagement—was mentioned by nearly a quarter of companies. Of those, 84 percent disclosed quantitative turnover data.

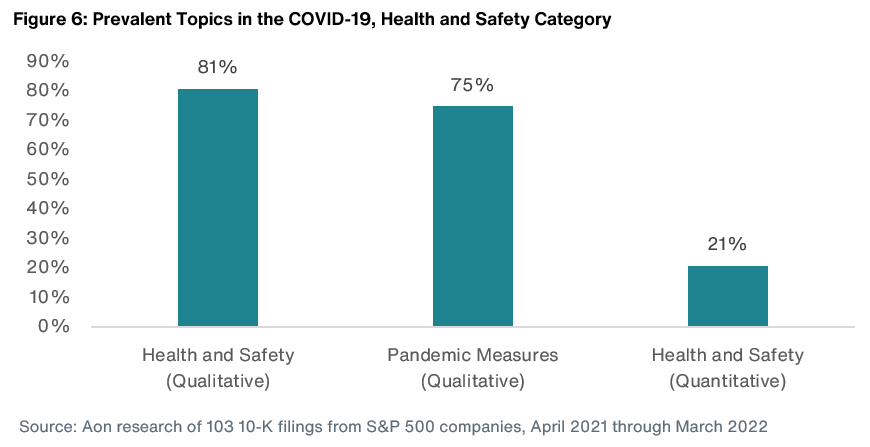

COVID-19, Health and Safety

Although there was a year-over-year decline in COVID-19 coverage, pandemic measures continued to be a prevalent topic with three-quarters of our sample companies including this topic. The pandemic was often discussed with regards to location strategies and protocols. Eighty-one percent of companies discussed the health and safety of their workforces, including mental health and wellbeing. Of those that covered health and safety, 27 percent included quantitative data such as injury rates in their disclosure.

Staying Current on Hot Topics in Disclosure

The four key themes above represent topics that most organizations believe to be material. If your human capital management disclosure does not include these topics, consider adding this information in next year’s 10-K disclosure to align with general market practice.

It is also important to monitor topics that have begun to gain significant traction, such as disclosing quantitative DEI factors by job type or career, discussing pay equity studies and addressing turnover. This information may become more commonplace next year; companies can prepare now by gathering this information and presenting it to the full board or a board committee so they can be apprised of these metrics and understand the year-over-year changes and reasons for it.

In addition to these key themes, there are other sector or company-specific issues that may be relevant to include as well. Looking to industry peer practices can help ensure company disclosures are aligned with the market on issues and metrics.

Next Steps

Put simply, investors, proxy advisors and employees want to see more detailed and quantitative human capital management disclosures. When addressing these topics, companies consider the following:

- Provide detail that demonstrates the depth of your HCM strategy to best meet stakeholder expectations.

- Include information on leadership responsibility, relevant programs, established publicly disclosed goals and targets (including employee engagement scores, pay equity and diversity), as well as recognitions and metrics.

- For calendar year-end companies, begin thinking about revisions to your 2023 HCM disclosure now rather than waiting until the end of 2022 or the start of 2023.

- Consider peer benchmarking to identify any gaps in your disclosure and needed policy updates in light of changes in the business environment over the past year. For example, determine whether COVID-19 safety measures and pandemic-era employee benefits should be omitted from the 2023 disclosure. Likewise, consider whether the adoption of a hybrid or virtual work model or benefits to stave off the high employee turnover should be added to the disclosure.

- Keep in mind that the company will need to review the proposed disclosures with the board committee responsible for human capital oversight. Build in time for this review so the company can consider and incorporate feedback well in advance of next year’s 10-K filing deadline.

Print

Print

2 Comments

This is Zabihollah (Zabi) Rezaee from the University of Memphis. I have written several books on business sustainability including HCM. I find your study very relevant to my research on “Determinants and Consequences of HCM Disclosure”. Would you please consider sharing your HCM data to advance my research project?

Thank you and be well,

Zabi

If peer benchmarking is to enter into the equation, how are we to verify that those enterprises we are benchmarking against are in fact worthy to be measured against?

A whole raft of companies have recently shown themselves to be failing, although giving no outward signs.