Matteo Tonello is Managing Director of ESG Research at The Conference Board, Inc. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) and Will Corporations Deliver Value to All Stakeholders?, both by Lucian A. Bebchuk and Roberto Tallarita; and For Whom Corporate Leaders Bargain (discussed on the Forum here) and Stakeholder Capitalism in the Time of COVID, both by Lucian Bebchuk, Kobi Kastiel, and Roberto Tallarita (discussed on the Forum here).

While still recovering from the disruptions of the global pandemic, many companies find themselves grappling with a new and, for the most part, unanticipated emergency. Russia’s invasion of Ukraine requires business leaders to remain in crisis-management mode. Many commentators suggest that what we are witnessing is only the beginning of a new, precarious period of reconfiguration of the world order, with unclear economic and political implications. Whether or not it is true, at this stage of the crisis the main role of the board is to exercise oversight by asking probing questions to ensure the company is planning for multiple scenarios, reducing uncertainty, and adapting its business strategy.

The following are five key probing questions board members should consider posing.

1) What is the business impact of the war?

Directors should ask for management’s view of the immediate business impact of the invasion, including macro concerns such as rising inflation and impaired economic growth, as well as more specific issues pertaining to the safety of employees in the region, the resilience of supply chains, and legal or compliance issues regarding terminated or defaulted contracts with customers or suppliers in Russia or Ukraine. Special attention must be paid to the impact of measures swiftly introduced by many governments, including the US, to sanction Russian banks, state-owned enterprises, and oligarchs and to control exports from Russia. These measures are meant to impair the country’s economic growth by “isolating it from the global financial system” and by curtailing “its access to cutting-edge technology.” [1]

In an interconnected global economy, however, sanctions also have unintended consequences on US businesses operating in Russia or relying on Russian suppliers. In fact, either because of the sanctions or because they have decided to avoid the reputation risks of their continued presence in the country, hundreds of public companies—from the financial services to the consumer discretionary sectors—have announced their decision to suspend business operations in Russia or halt relationships with Russian suppliers. [2] For many Western firms, what was an enticing emerging market at the end of the Cold War may have suddenly become a major balance sheet liability. The boards of companies with an exposure to Russia should request periodic reports from management on the magnitude of this situation and work with the senior leadership on the appropriate mitigation strategy.

2) Does the company have (direct access to) expertise in geopolitical risk?

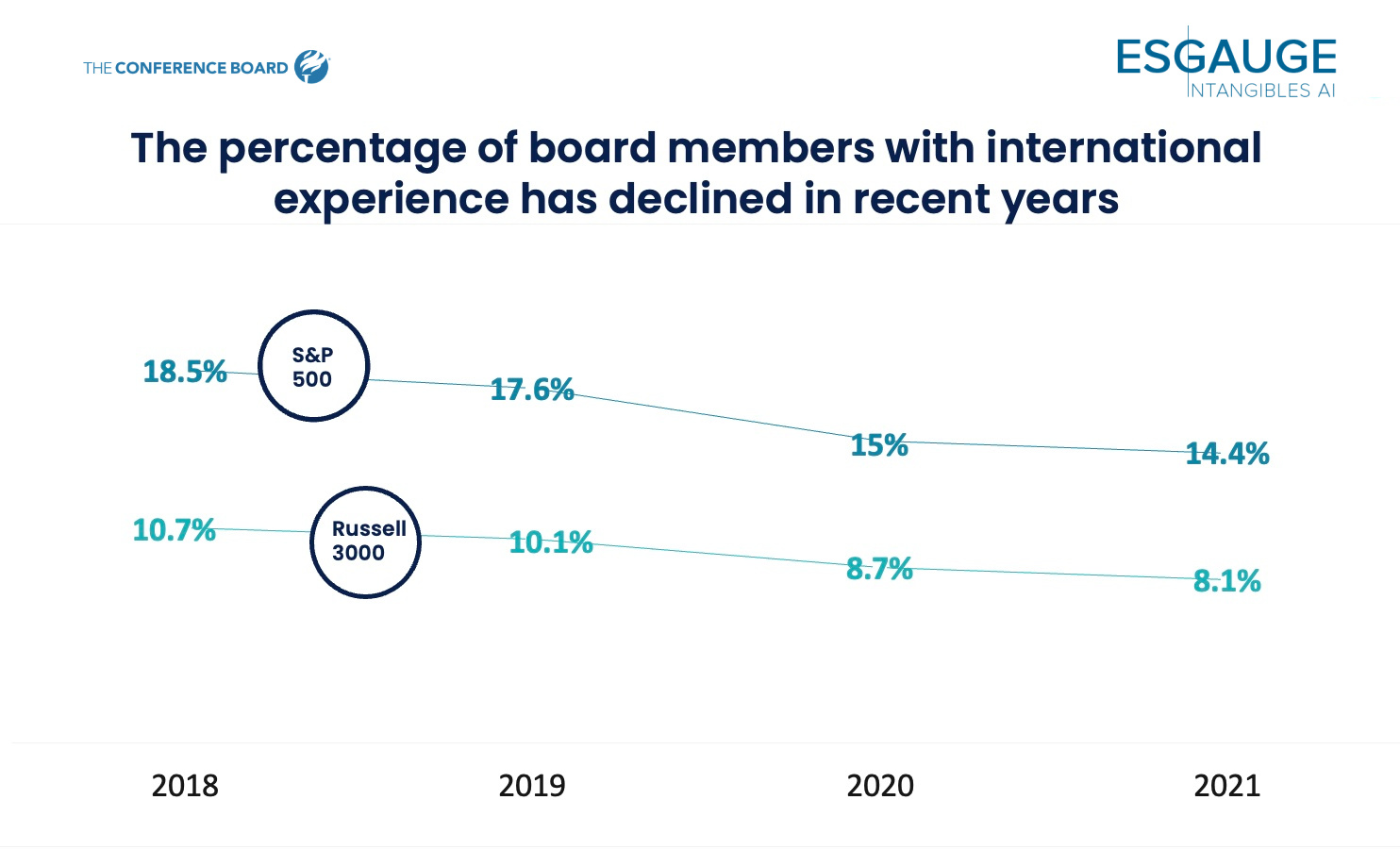

This crisis highlights the major repercussions that geopolitical events may have on the company’s ability to execute its business strategy. The effects could be felt for years to come, as governments revisit their industrial policy to promote self-sufficiency in strategic sectors. The board and the C-suite need to appreciate these complex evolving scenarios not only to identify emerging policy risks but also to capture potential opportunities in a highly volatile environment. In these unprecedented circumstances—amid high inflation, supply chain disruptions, and the possible ripple effects of a Russian default on the US and global financial markets [3]—even those public companies that do not have multinational operations may want to consider seeking outside geopolitical advice. Our research shows that only a small fraction of the director population (which includes CEOs) in the US have international experience, and that their number has in fact declined in recent years. [4] As boards and C-suites continue to refresh their composition and diversify their skillset, they should consider the importance of recruiting individuals who have been exposed to the specific challenges of running multinational business operations.

3) Is the company prepared for heightened cybersecurity threats?

Though experts have been warning business leaders about cybersecurity threats from Russia for years, the matter has become much more urgent since the onset of the Ukrainian war. [5] The concern is that ransomware actors could aim not only at strategic economic sectors—including energy, transportation, technology, and financial companies—but also target, more opportunistically, a variety of businesses large and small to erode citizens’ confidence in the ability of their government to guarantee their safety. [6] This warning may catch many corporate boards unprepared to provide the appropriate risk oversight, as 64 percent of executives recently surveyed by The Conference Board and PwC believe that their board has a fair or poor understanding of cybersecurity. [7] In the words of CISA, the US Cybersecurity and Infrastructure Security Agency, board members and senior management must recognize the present danger and ensure their organizations adopt a “heightened security posture.” [8] In practice, it means: (1) Ensuring a Chief Information Security Officer is involved in key risk management discussions at the company; (2) Lowering reporting thresholds regarding suspicious cyber activity; (3) Ensuring the company periodically tests its response plans while involving not only IT and security staff but also senior executives, board members, and other key employees; and (4) Envisioning worst-case scenarios and seeking assurance that the response plan will ensure the continuity of critical business functions if an attack takes place. Cybersecurity is poised to become a recurring board agenda item, as confirmed by the newly proposed rules by the US Securities and Exchange Commission that would require, among other things, that companies publicly disclose the board’s role in cybersecurity oversight. [9]

4) Do new supply chain disruptions warrant adjustments to the company’s environmental sustainability program?

The war in Ukraine is expected to have a short-term impact on corporate sustainability programs, especially as companies reevaluate the resilience of their supply chains. Even though Russia and Ukraine account for a small fraction of global domestic product, they are major suppliers of oil and wheat, with several countries in the world depending heavily on them. The disruption of such supplies could have rippled effects on the global energy and food markets, and force businesses, in Europe and the US, to temporarily reshape their supply chains. It is hard to predict the duration of these shifts, but they may affect corporate emission reduction targets that were set in the last few years by an ambitious climate change risk mitigation agenda. In the long term, however, the crisis will likely reinforce the need for environmental sustainability planning and become yet another driver of the transition to a renewable energy economy, which is much less susceptible to geopolitical risk. Extensive research shows that, unlike oil and gas, renewable energy sources are available in one form or another across different geographies. The declining cost of clean energy technology will therefore offer a pathway to energy self-sufficiency to all countries rather than just those with direct access to fossil fuels. [10] Ultimately, boards should ensure the impact of the crisis on the supply chain is managed effectively and does not derail the company’s commitment to the long-term pursuit of a sustainable environmental strategy. [11]

5) What corporate citizenship initiatives is the company promoting to bring aid to the people of Ukraine and support employees of Ukrainian origin and their families?

In the last few years, boards of directors and C-suites have embarked on a debate on the purpose of their corporation—or the appropriate role their business should perform with respect to a broad set of societal interests affecting their stakeholders. [12] While each company’s board and management need to exercise their business judgment in determining the appropriate course of action, a geopolitical crisis of this magnitude, just like the global health crisis of the last two years, may be viewed as an important litmus test for those corporate commitments. To be sure, many US public companies have decades-long experience helping communities affected by natural disasters—last, but not least, the COVID-19 pandemic. While there are important distinctions between a natural disaster and an active war zone, [13] many practices in that playbook can serve them well in this new emergency, too. [14] They can also inspire and guide their counterparts in Europe, which is more reliant on publicly funded programs and has a much less established tradition of corporate philanthropy. Directors can be helpful in many ways: They can participate in discussions on how to reprioritize important resources and they can use their contacts to help build alliances with other businesses and humanitarian organizations. While often prompted by the new sanctions, the decision to cut ties with Russia may also be part of the corporate citizenship response, as it is overwhelmingly supported by the US public, including customers and employees. [15]

Unlike other crises faced in recent times, the war in Ukraine brings unique challenges to the urgent attention of corporate directors and senior leaders—including unanticipated geopolitical scenarios, the unintended consequences for businesses from an unprecedented regime of sanctions, and a whole new level of cybersecurity risk exposure. However, just like others before, this crisis can galvanize corporate leadership and employees around commonly shared values and ultimately help companies to further build their muscle memory in crisis management and strengthen their ESG practices.

Endnotes

1Joined by Allies and Partners, The United States Imposes Devastating Costs on Russia, US White House, Press Release, February 24, 2022.(go back)

2See the list maintained by the Yale School of Management and based on public statements made by companies. For guidance to companies facing a similar decision, see Paul Washington and Merel Spierings, Cutting Ties with Russia: A Guide to Decision-Making Now and in the Future, The Conference Board, March 8, 2022; and Denise Dahlhoff, Six Steps to Guiding Corporate Reputation While Responding to the Crisis in Ukraine, The Conference Board, March 8, 2022.(go back)

3See Dana M. Peterson et al., Will the War in Ukraine Lead to Recession?, The Conference Board, March 08, 2022.(go back)

4For up-to-date figures on director qualifications and skills, see the online dashboard on Corporate Board Practices in the Russell 3000, the S&P 500 and S&P MidCap 400, published by The Conference Board and ESG analytics firm ESGAUGE. Also see Paul Washington and Merel Spierings, Governance During a Geopolitical Crisis, Chief Executive, March 3, 2022.(go back)

5CISA and FBI Publish Advisory to Protect Organizations from Destructive Malware, US Cybersecurity and Infrastructure Security Agency (CISA), February 26, 2022.(go back)

6Michael L. Gross et al., Cyberterrorism: Its Effects on Psychological Well Being, Public Confidence and Political Attitudes, Journal of Cybersecurity, Vol. 3, Issue 1, March 2017, pp. 49-58.(go back)

72021 Board Effectiveness: A Survey of the C-Suite, PwC/The Conference Board, November 2021.(go back)

8Shields Up: 5 Urgent Cybersecurity Actions for Executives, CISA, February 25, 2022.(go back)

9Cybersecurity Risk Management, Strategy, Governance, and Incident Disclosure, US Securities and Exchange Commission, Release No. 33-11038; 34-94382, March 9, 2022.(go back)

10See Floros Flouros, et al., Geopolitical Risk as a Determinant of Renewable Energy Investment, Energies, February 2022, 15, p. 1498. Also see A New World: The Geopolitics of Energy Transformation, International Renewable Energy Agency, 2019, p. 23.(go back)

11See Paul Washington and Thomas Singer, Sustainability During a Geopolitical Crisis, The Conference Board, March 1, 2022.(go back)

12See, among others, Holly Gregory, The Corporate Purpose Debate, Practical Law Journal, January 2020; Timothy Powell, Corporate Purpose: A Primer for Marketing & Communications, The Conference Board, November 18, 2021; and Thomas Singer, Purpose-Driven Companies: Lessons Learned, The Conference Board, October 29, 2020.(go back)

13See Paul Washington and Jeff Hoffman, Corporate Citizenship During a Geopolitical Crisis (Part 1): War Is Different, The Conference Board, March 2, 2022.(go back)

14Paul Washington and Jeff Hoffman, Corporate Citizenship During a Geopolitical Crisis (Part 2): How the Natural Disaster Playbook Can Help, The Conference Board, March 3, 2022.(go back)

15Survey Finds 60% of US Consumers Believe Brands Should Reconsider Doing Business in Russia, Gartner, Press Release, March 11, 2022. Also see Businesses Face Pressure to Rethink Russia Operations, The New York Times, March 13, 2022 and Andrew Hill, Companies’ Flight From Moscow Sets Some Hard Precedent, Financial Times, March 13, 2022.(go back)

Print

Print