Amit Batish is Director of Content at Equilar, Inc. This post is based on an Equilar memorandum by Mr. Batish and Courtney Yu. Related research from the Program on Corporate Governance includes The Perils and Questionable Promise of ESG-Based Compensation by Lucian A. Bebchuk and Roberto Tallarita (discussed on the Forum here); and Paying for Long-Term Performance by Lucian Bebchuk and Jesse Fried (discussed on the Forum here).

The 2022 proxy season is now in full swing. Over the next two months, thousands of U.S. public companies will file proxy statements highlighting trends pertaining to their governance practices, including those related to executive compensation. In this post, Equilar examines a sample of early DEF14A proxy filings from Equilar 500 companies—the 500 largest U.S. public companies by revenue—as of March 18, 2022, to offer a preview of how executive compensation was structured in 2021, as well as key trends to watch through the remainder of proxy season.

CEO Pay Appears to Bounce Back Strongly From Pandemic “Woes”

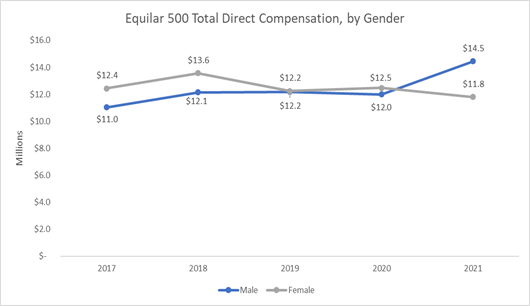

Following the onset of the COVID-19 pandemic, several companies adjusted their executive pay packages to ease the burden of the pandemic on employees. For example, many CEOs saw salary cuts, adjustments to bonus payouts, changes in long-term incentive plans (LTIPs) and more. Ultimately, many companies restored those adjustments, but median CEO pay declined from $12.2 million in 2019 to $12 million in 2020 (Figure 1).

Two years after the start of the pandemic, the early data shows that CEO pay is back on the rise. In 2021, median total direct compensation for companies included in the analysis increased to $14.3 million. This change from $12 million in 2020 would represent a near 20% increase, should the trend persist. Over the last two years, many companies elected to award their CEOs for staying on board and guiding their organizations through turbulent times, likely contributing to the increase in pay.

Figure 1: CEO Total Direct Compensation (Equilar 500)

The CEO Pay Ratio Rises, While Median Employee Pay Declines

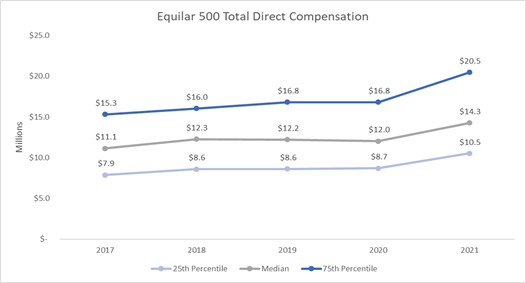

With CEO compensation increasing, the CEO Pay Ratio—the ratio of CEO-to-typical-worker compensation—is following suit. According to the analysis, the median CEO Pay Ratio so far in 2021 is 245:1, representing a 27.6% increase from 192:1 in 2020 and a 35.4% increase from 181:1 in 2018 (Figure 2). The median CEO Pay Ratio increased in each year of the study period, and if the current trend for 2021 holds, then it would be the largest year-over-year increase since the ratio became a required SEC disclosure during the 2018 proxy season.

Figure 2: CEO Pay Ratios (Equilar 500)

The spike in the CEO Pay Ratio for 2021 is being driven by both increased CEO pay as well as a decline in compensation for the median employee. Median employee compensation for companies that have reported thus far for 2021 is $61,396, an 8.3% decrease from 2020. Prior to 2021, compensation for the median employee increased every year since 2018.

Figure 3: Median Employee Compensation (Equilar 500)

It’s worth noting that the lower value in median employee pay is a function of the types of companies that have filed their proxies thus far. A large portion of consumer companies, which are more likely to have seasonal or part-time employees, have filed earlier than other sectors, resulting in a lower median employee compensation value for 2021. Another trend that may be driving this value down further is that the sectors that typically make up the bottom half of median employee pay—healthcare, industrials, consumer defensive and consumer cyclical—currently represent 60% of the early filings.

Regardless of the composition of companies featured in the early trends, many critics still argue that booming CEO pay packages following a year of shutdowns and financial struggles for so many Americans is unjust and reflects poorly on an organization, particularly as median employee pay remains low. While the CEO Pay Ratio has yet to garner the impact that many key stakeholders initially thought it would have prior to its implementation, a change may be on the horizon. Lawmakers in Washington D.C. last year introduced legislation targeted at excessive CEO pay packages. Coined the “Tax Excessive CEO Pay Act,” the legislation would penalize companies that pay CEOs or other executives 50 times more than median employee pay.

While the bill faces an uphill battle through Congress, there is no question stakeholders will pay closer attention to the CEO Pay Ratio, particularly if the early trends continue. If the pandemic taught us one thing, it’s that a company’s greatest asset is its people. Ensuring employees are treated adequately will be critical in the years ahead, and oftentimes this will come in the form of competitive compensation.

A Gender Pay Gap Looms

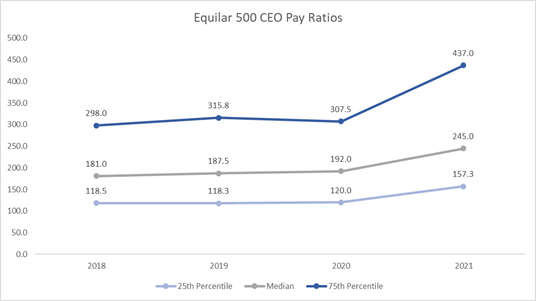

Over the last few years, men have largely dominated representation in the CEO role. Despite the low representation, women in CEO positions at the largest U.S. companies have out-earned their male counterparts during the same period. During the first four years of the study, CEO pay for women outpaced compensation for men, with the one exception being 2019 when pay was the same for both men and women at $12.2 million.

From a first look at early proxy filings, this trend has flipped. Median pay for women CEOs in the Equilar 500 was $11.8 million in 2021, more than 18% lower than the median $14.5 million awarded to men. Since 2018, this represents a 13.2% decrease in pay for women, while pay for men increased by nearly 20% during the same time period.

Figure 4: Total Direct CEO Compensation by Gender (Equilar 500)

Similar trends were observed in an early look analysis in 2021, but among the companies that have reported in 2022, 7% have CEOs who are women, slightly higher than the average of women-led companies during the study period. As conversations around gender equity continue to grow louder, this will certainly be a looming trend to keep a close eye on as proxy season progresses.

The state of CEO compensation continues to draw interest from several stakeholders, to no surprise. The trends uncovered in this analysis could paint a picture of overall trends not only in 2021, but also what to expect in 2022 and beyond. Ultimately, time will tell how CEO pay evolves, and investors and other stakeholders will watch closely how the 2022 proxy season unfolds.

Print

Print

One Comment

What was the median revenue for the female sample size compared to the revenue for the male sample size? With pay heavily tied to revenue is it possible that is driving some of the disparity or did you control for that?