Daniel Litowitz and Lara Aryani are Partners at Shearman & Sterling LLP. This post is based on a Shearman & Sterling piece by Mr. Litowitz, Ms. Aryani, George Casey, William Kim and Lucas Wherry and is part of the 20th Annual Corporate Governance Survey publication of Shearman & Sterling LLP. Related research from the Program on Corporate Governance includes Social Responsibility Resolutions (discussed on the Forum here) by Scott Hirst.

OVERVIEW

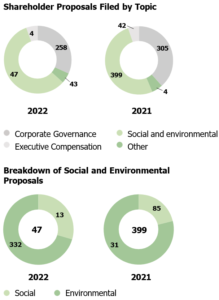

2022 has seen yet another record-setting proxy season,[1] with Russell 3000 companies fielding 813 shareholder proposals filed as of mid-July, 2022, representing approximately a 3% increase from 2021. Companies in the S&P 500 experienced a slightly higher year-over- year increase, receiving 642 proposals this season, representing a 5% increase from 2021. While the number of compensation-related proposals received by Russell 3000 companies remained generally consistent with 2021 and governance proposals decreased by approximately 15% in 2022, environmental and social (E&S)-related proposals continued their upward trend, with a record 471 E&S proposals submitted in 2022, a 15% increase over 2021. The number of E&S proposals continues to represent a majority of all shareholder proposals received by Russell 3000 companies, comprising 58% of proposals in 2022 compared to 51% in 2021.

Source: “Shareholder Voting Trends (2018-2022),” The Conference Board, https://www.conference-board.org/topics/shareholder-voting/trends-2022-brief-1-environmental-climate-proposals and https://www.conference-board.org/topics/shareholder-voting/trends-2022-brief-2-human-capital- management-socialproposals.

In 2022, there was a significant increase in the number of E&S proposals that were put to a vote in comparison with 2021 (from 47% to 59%). This was likely partly an effect of Staff Legal Bulletin No. 14L, issued by the Securities and Exchanges Commission (SEC) in July 2021, which made it harder for companies to exclude E&S proposals from proxy statements under the ordinary business exclusion pursuant to Rule 14a-8(i)(7) or the economic relevance exclusion pursuant to Rule 14a-8(i)(5).[2]

While the number of E&S proposals put to a vote has increased year-over-year, the number of approved E&S proposals decreased from 38 in 2021 to 32 in 2022. While the decline in the number of successful E&S proposals seems incongruent with the increasing support by both activists and institutional investors for E&S initiatives, this is likely due to the fact that a significant number of proposals, particularly those relating to climate change, prescribed specific actions to be taken by the company, in contrast with the historically more successful types of proposals — E&S and otherwise — that contained more general recommendations or enhanced disclosure.

Investor reluctance to support prescriptive proposals also partially explains why companies successfully negotiated a greater number of shareholder proposal withdrawals (across all shareholder proposal types) this year.[3] Institutional investors that have historically been instrumental in the passage of E&S proposals have been vocal about their reluctance to support prescriptive proposals. BlackRock, for example, has actively supported environmental corporate action and shareholder proposals (including Engine No. 1’s proxy contest at Exxon Mobil Corp.)[4] but, in July 2022, it cited overly prescriptive proposals when it announced that it would support proportionally fewer climate related shareholder proposals in the 2022 proxy season compared to 2021.[5] BlackRock noted that it “is more likely to support shareholder proposals that are consistent with our request to companies to deliver information that help us to understand the material risks and opportunities they face … [as opposed to] those that, in our assessment, implicitly are intended to micromanage companies…. includ[ing] those that are unduly prescriptive and constraining on the decision-making of the board or management …”[6]

CLIMATE CHANGE TOPICS PREDOMINATE ENVIRONMENTAL PROPOSALS

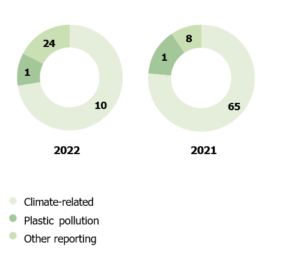

Among the 139 environmental proposals submitted this season, those relating to climate change were the largest group (73%), following a trend from 2021, when 76% of the environmental proposals focused on climate change.

Filed Environmental Proposals by Topic

Source: “Shareholder Voting Trends (2018-2022),” The Conference Board, https://www.conference-board.org/topics/shareholder-voting/trends-2022-brief-1-environmental-climate-proposals and https://www.conference-board.org/topics/shareholder-voting/trends-2022-brief-2-human-capital- management-socialproposals

Submissions this year focused largely on calling on companies to establish greenhouse gas (GHG) reduction targets, and to present enhanced disclosure on how these companies evaluate climate change-related risks.[7] Among the 101 climate-related proposals, 43 were put to a vote and 11 received majority support.

On March 21, 2022, the SEC published a proposed rule that would require public companies to include climate- related disclosure in their registration statements and periodic reports, including climate-related risks that could reasonably have a material impact on the company’s business, results or operations.[8] The proposed rule received a record number of comment letters during the comment period,[9] and the SEC is continuing to consider the scope of the proposal and whether it will be adopted at all. Nevertheless, GHG emissions and related disclosure will likely continue to be a key area of focus for institutional investors and activists generally and in shareholder proposals in the coming proxy season. As such, in anticipation of continuing investor scrutiny, companies should maintain their focus on identifying GHG emissions and other environmental risks in both their own operations and those of their supply chain partners and key customers.[10]

DEI EFFORTS AND POLITICAL SPENDING REMAIN HOT TOPICS IN SOCIAL PROPOSALS; RACIAL JUSTICE AND CIVIL RIGHTS AUDITS GAIN IMPORTANCE

Proposals related to social matters represented the largest category (41%) of all submissions in 2022. As shown below, they covered a wide range of topics. Diversity, equity, and inclusion (DEI) efforts continue to be in the spotlight in 2022, although the number of proposals on EEO-1 disclosure[11] and workforce diversity decreased significantly to 28, down from 61 in 2021. Shareholders also remained focused on issuers’ political spending, both in the context of contributions and lobbying, accounting for 86 proposals in 2022 (a 13% increase from 2021).

Source: “Shareholder Voting Trends (2018-2022),” The Conference Board, https://www.conference-board.org/topics/shareholder-voting/trends-2022-brief-1-environmental-climate-proposals and https://www.conference-board.org/topics/shareholder-voting/trends-2022-brief-2-human-capital- management-socialproposals

DEI proposals focused on diversity in the workplace and in the boardroom. There were also typical requests for data required under EEO-1 and information about gender and racial pay gaps. In this regard, a noteworthy trend from the 2022 proxy season is the growing number of proposals requiring companies to provide disclosure beyond the data collected under EEO-1.[12] Such proposals demand enhanced disclosure on recruitment, retention and promotion rates of employees considering gender, race, and ethnicity.[13]

Additionally, shareholder proposals calling for racial equity and civil rights audits (i.e., an independent evaluation on whether and how a company monitors and manages incidents of discrimination against minority groups within the organization)[14] gained momentum in 2022, growing from 9 submissions last year to 43 in 2022. Institutional Shareholder Services noted in its voting policy for the 2022 proxy season that it would analyze these proposals on a case-by-case basis, taking into account various factors, such as “the company’s established process or framework for addressing inequality and discrimination internally, the company’s recent track record on equity issues, and whether the company’s policies and actions are aligned with market norms on civil rights, and racial or ethnic diversity.”[15]

ANTI-ESG PROPOSALS ON THE RISE

Another notable trend in the 2022 proxy season is the slow rise of anti-E&S proposals seeking to counter the impact of E&S-focused action at the corporate level.[16] Until recently, E&S shareholder proposals have largely pushed companies to take more environmentally friendly and socially progressive action, whereas anti-E&S shareholders and activists have generally relied on means other than shareholder proposals to attempt to influence corporate change. Unsatisfied with abandoning E&S shareholder activism to pro-E&S proponents, anti- E&S activists represent a growing voice, and in 2022 they addressed a range of topics, including racial and gender diversity, climate change and corporate transparency.

Most of the anti-E&S proposals were expressly opposed to existing or proposed E&S initiatives at the subject company. Anti-E&S activists have targeted a vast array of companies. For example, the National Center for Public Policy Research submitted a proposal calling on Johnson & Johnson to audit its DEI efforts, arguing that these efforts do not have their intended effects.[17] In addition, Intel faced a proposal asking that it refrain from publicly displaying the pride flag on the grounds that it created a hostile work environment for religious employees.[18] Following Engine No. 1’s proxy contest at Exxon Mobil in 2021, at Exxon Mobil’s 2022 annual meeting, shareholder activist and lobbyist Steven Milloy submitted a proposal to prohibit all future shareholder proposals that do not have prior board approval, arguing that stock ownership had become politicized and that climate activists were “nuisance shareholders” assailing corporations’ business operations.[19]

However, anti-E&S proposals failed to receive support or were excluded from voting altogether at higher rates than their E&S counterparts. Generally, anti-ESG proposals received an average of less than 3% of support in 2022, and as such, are not eligible to be resubmitted in 2023 as they failed to meet the SEC’s 5% threshold requirements for resubmission.[20]

For shareholders, it is not always easily discernable from the plain text of the proposal whether it is pro or anti-E&S in nature.[21] A subset of anti-E&S proposals attempt to advocate against corporate E&S efforts by taking advantage of the SEC’s procedural rules regarding the exclusion of future shareholder proposals on similar topics, but do so in a manner different from the intended effect of these rules.[22]These anti-E&S proposals usually have resolutions that are drafted in language that is identical to an E&S proposal on the same issue, but supporting statement accompanying the resolution makes clear the proponent is critical of the E&S initiative behind the resolution. Thus, anti-E&S activists can put forward a proposal substantially similar to an E&S proposal and cause a future E&S proposal attempting to address the same action to be barred from future shareholder meetings as a result of the SEC’s rules against duplicative shareholder proposals.

While anti-E&S proposals have often been easily excluded or defeated and therefore have minimally impacted corporate action, the level of anti-E&S activism is likely to continue to grow in the coming years. Shareholder engagement and communication has always been the antidote of choice for boards and management to contend with shareholder activism. Understanding the issues that shareholders have been most recently focused on is an important way to help inform companies as they prepare to navigate the proxy seasons ahead.

Endnotes

1Unless noted otherwise, information on shareholder proposals submitted, voted and/or withdrawn were extracted or derived from data published by The Conference Board, a non-profit and research group organization, and data analytics firm ESGAUGE, in cooperation with advisory firm Russell Reynolds Associates and Rutgers Center for Corporate Law and Governance. The presented data covered the period from January through mid-July 2022 for constituents of the Russell 3000 index (unless otherwise indicated as the S&P 500 index). See “Shareholder Voting Trends (2018-2022),” The Conference Board, https://www.conference- board.org/topics/shareholder-voting/trends-2022-brief-1-environmental- climate-proposals and https://www.conference-board.org/topics/ shareholder-voting/trends-2022-brief-2-human-capital-management- socialproposals.(go back)

2For more information about the Staff Legal Bulletin No. 14L, see our publication “SEC Proposes Narrowing Grounds for Excluding Shareholder Proposals,” https://www.shearman.com/en/perspectives/2022/07/sec- proposes-narrowing-grounds-for-excluding-shareholder-proposals(July 18, 2022).(go back)

323% in 2022 compared to 21% in 2021.(go back)

4See Matt Phillips, “Exxon’s Board Defeat Signals the Rise of Social-Good Activists,” The New York Times, https://www.nytimes.com/2021/06/09/ business/exxon-mobil-engine-no1-activist.html (June 9, 2021).(go back)

5See BlackRock Investment Stewardship, “2022 climate-related shareholder proposals more prescriptive than 2021,” at 3 (2022).(go back)

6Id., at 2(go back)

7See ISS, “2022 United States Proxy Season Preview: Environmental & Social,” at 8, https://insights.issgovernance.com/posts/2022-united-states- proxy-season-preview-environmental-social (March 30, 2022).(go back)

8See U.S. Securities and Exchange Commission, “SEC proposes rules to enhance and standardize climate-related disclosures for investors,” https://www.sec.gov/news/press-release/2022-46 (March 21, 2022).(go back)

9See Lee Reiners and Morgan Smith, “Summary of Comment Letters for the SEC’s Proposed Climate Risk Disclosure Rule, Climate Risk Disclosure Lab,” Duke Financial Economics Center, https://sites.duke. edu/thefinregblog/2022/09/01/summary-of-comment-letters-for-the-secs- proposed-climate-risk-disclosure-rule (September 1, 2022).(go back)

10For more details about the proposed rule by the U.S. Securities and Exchange Commission, see our publication “After Years of Debate, Climate Change Impact Reporting Gets Real,” at page 7 of this publication.(go back)

11EEO-1 report is a mandatory workforce data collection required from private employers with 100 or more employees, as well as federal contractors with 50 or more employees, that is shared with the U.S. Equal Employment Opportunity Commission. Information collected includes data by race/ethnicity, sex and job categories.(go back)

12See Georgeson, An Early Look at the 2022 Proxy Season, at 15, https:// www.georgeson.com/us/insights/2022-early-proxy-season-review (2022).(go back)

13See ISS, “2022 United States Proxy Season Preview: Environmental & Social,” at 9, https://insights.issgovernance.com/posts/2022-united-states- proxy-season-preview-environmental-social (March 30, 2022).(go back)

14See Georgeson, An Early Look at the 2022 Proxy Season, at 16, https://www.georgeson.com/us/insights/2022-early-proxy-season-review (2022); see also Saijel Kishan, “What are civil rights audits, and why are companies doing them?,” Bloomberg, https://www.bloomberg.com/news/ articles/2022-05-03/what-civil-rights-audits-are-and-why-firms-do-them- quicktake?leadSource=uverify%20wall (May 3, 2022).(go back)

15See ISS, “2022 United States Proxy Season Preview: Environmental & Social,” at 13, https://insights.issgovernance.com/posts/2022-united-states- proxy-season-preview-environmental-social (March 30, 2022).(go back)

16In 2022, close to 52 anti-ESG proposals were submitted, in comparison with 26 in 2021 (see Georgeson, An Early Look at the 2022 Proxy Season, at 7, https://www.georgeson.com/us/insights/2022-early-proxy-season- review (2022)); see also Ruth Saldanha, “Anti-ESG Sentiment Gains Spotlight but Not Support,” Morningstar, https://www.morningstar.com/ articles/1109374/anti-esg-sentiment-gains-spotlight-but-not-support (August 15, 2022); see also Martha Carter, Matt Filosa, Sydney Carlock & Sean Quin, “ESG and the Bear: What to Make of the 2022 Proxy Season,” Teneo, https://www.teneo.com/esg-and-the-bear-what-to-make-of-the-2022-proxy- season (August 15, 2022).(go back)

17See Ruth Saldanha, “The Rise of Anti-ESG Shareholder Proposals,” Morningstar, https://www.morningstar.com/articles/1086978/the-rise-of-anti- esg-shareholder-proposals (April 1, 2022).(go back)

18See U.S. Securities and Exchange Commission, “Intel Corporation; Rule 14a-8 no-action letter,” https://www.sec.gov/divisions/corpfin/cf- noaction/14a-8/2022/hotzintel031822-14a8.pdf (March 18, 2022).(go back)

19See ExxonMobil, “Notice of 2022 Annual Meeting and Proxy Statement,” https://corporate.exxonmobil.com/-/media/Global/Files/investor-relations/ annual-meeting-materials/proxy-materials/2022-Proxy-Statement.pdf (April 7, 2022); see also Corbin Hiar, “Conservative shareholders attack ‘climate clown show’,” E&E News, https://www.eenews.net/articles/ conservative-shareholders-attack-climate-clown-show (June 10, 2022).(go back)

20See Martha Carter, Matt Filosa, Sydney Carlock & Sean Quin, “ESG and the Bear: What to Make of the 2022 Proxy Season,” Teneo, https://www. teneo.com/esg-and-the-bear-what-to-make-of-the-2022-proxy-season (August 15, 2022).(go back)

21At companies such as Duke Energy, General Electric, Eli Lilly and Pfizer, anti-E&S proposals largely copied from the pro-ESG proposals in order to get on the ballot (see “The Rise of Anti-ESG Shareholder Proposals,” Morningstar, https://www.morningstar.com/articles/1086978/the-rise-of-anti- esg-shareholder-proposals (April 1, 2022)).(go back)

22Under Rule 14a-8(i)(11), companies can exclude proposals that substantially duplicate another proposal previously submitted, and Rule 14a-8(i) (12) raises the voting thresholds required for any defeated proposal to be brought again. A failed shareholder proposal may not be resubmitted for three years unless it receives the support of at least 5% of the voting shareholders in its first submission. Proposals submitted two and three times in the prior five years must receive 15% and 25% support, respectively, in order to be eligible for resubmission in the following three years (see U.S. Securities and Exchange Commission, “SEC Adopts Amendments to Modernize Shareholder Proposal Rule,” https://www.sec. gov/news/press-release/2020-220 (September 23, 2020). This is higher than the 3%, 6%, and 10% support thresholds that was applicable prior to the amendment of Rules 14a-8(i) (11) and 14a-8(i)(12) in 2020. In July 2022, the SEC proposed amendments to Rules 14a-8(i)(11) and (14)a-8(i)(12) that would reduce the number of proposals that would be excluded, including by finding that a proposal is duplicative only if it “addresses the same subject matter and seeks the same objective by the same means.” (seeU.S. Securities and Exchange Commission, “Fact Sheet: Shareholder Proposals Under Rule 14a-8: Proposed Rules,” https://www.sec.gov/files/34- 95267-fact-sheet.pdf. (go back)

Print

Print