On August 16, 2022, President Biden signed the Inflation Reduction Act into law. As part of this legislation, there are several extensions and expansions of tax credits related to electric vehicles (EVs).

While these enhanced credits certainly incentivize the adoption of EVs and support domestic production, there are several limitations to be aware of from a taxpayer’s perspective. And while we won’t dive into it too much here, the requirements have become wildly more complicated for manufacturers.

So, let’s take a deeper look at the requirements and limitations around the expanded clean vehicle credits and how to provide guidance to clients.

Sec. 13401 – Clean Vehicle Credit

As part of the continued push for the widespread adoption of EVs, the new qualified plug-in electric drive motor vehicle (or NQPEDMV) credit has been rebranded and expanded as the more aptly named clean vehicle credit [IRC Sec. 30D].

This credit, which is worth up to $7,500 for buyers of new all-electric cars and hybrid plug-ins, has been extended through 2032. Under the new rules, taxpayers get a $3,750 credit for meeting the critical minerals requirement and a $3,750 credit for meeting the battery component requirement. Obviously, the burden for meeting these more technical requirements fall on the manufacturers of batteries and electric vehicles.

Additionally, the seller of a new clean vehicle is required to furnish a report to the buyer and the IRS containing the name and taxpayer identification number of the buyer; the vehicle identification number (VIN) of the vehicle; the battery capacity of the vehicle; and other verification related to providing the credit to the taxpayer.

Final assembly requirement

In an effort to support domestic EV production, the Act requires that final assembly of the vehicle occurs in North America to qualify for the clean vehicle credit. This requirement applies to vehicles sold after the date of enactment of the Act, or August 16, 2022.

For reference, the NHTSA’s VIN decoder can verify the location of final assembly and is publicly accessible at vpic.nhtsa.dot.gov/decoder.

Transfer of credit

As a fully transferable credit, the taxpayer who acquires a new clean vehicle can elect, on or before the purchase date, to transfer the clean vehicle credit to the dealer (eligible entity) who sold the vehicle in return for full payment of the credit amount.

The credit transfer rules apply to vehicles placed in service after December 31, 2023.

Manufacturer limitation eliminated

One piece of good news for manufacturers is the elimination of the phase-out of the tax credit once a manufacturer reaches 200,000 of EVs sold. This means Tesla, GM and others are back in the game.

The elimination of the manufacturer limitation applies to vehicles sold after December 31, 2022.

Price and income limitations

From the tax practitioner’s perspective, the legislation includes new price and income limits which may make it harder for consumers to qualify and/or find EVs that are eligible. Let’s take a look at those limitations in detail.

Manufacturer’s suggested retail price limitation

The clean vehicle credit is not allowed for an EV with a manufacturer’s suggested retail price in excess of the applicable limitation.

-

- For vans, sport utility vehicles, and pickup trucks, the applicable limitation is $80,000.

- For any other vehicle, the applicable limitation is $55,000.

MAGI limit

From a taxpayer income perspective, no clean vehicle credit is allowed for any tax year if the lesser of the modified adjusted gross income (MAGI) of the taxpayer for the current or preceding tax year exceeds the threshold amount.

The threshold amounts (with no phase-out of the limitation) are:

-

- $300,000 for taxpayers filing joint returns or surviving spouses;

- $225,000 for heads of household; and

- $150,000 for other taxpayers

It’s important to note that a credit recapture may be required if, for example, the taxpayer’s MAGI was too high to claim credit, but the buyer already received payment from the dealer.

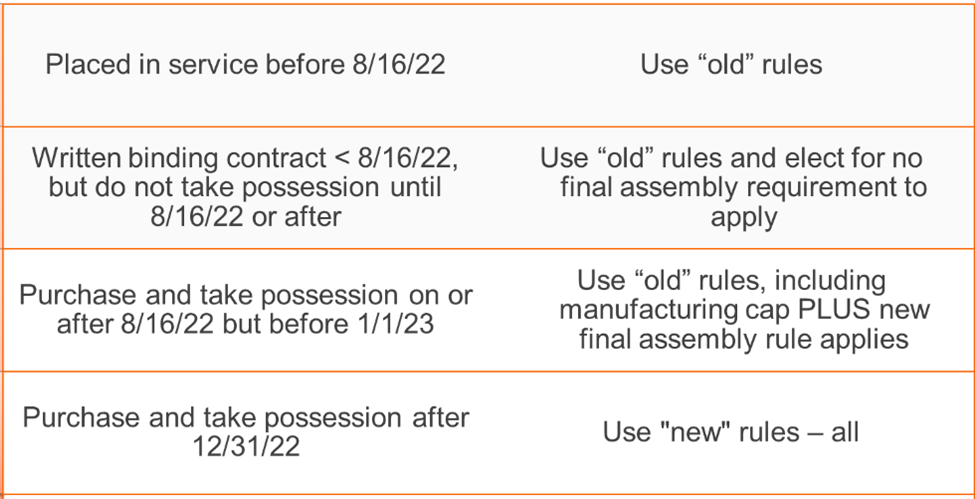

Providing guidance to clients on the Clean Vehicle Credit

When advising clients on how to best maximize the clean vehicle tax credit, the following chart can be helpful in comparing previous rules to new requirements included within the Inflation Reduction Act.

Sec. 13402 – Credit for Previously-Owned Clean Vehicles

Starting January 1, 2023, consumers are eligible for a tax credit for used or previously owned clean vehicles.

A qualified buyer who acquires and places in service a previously owned clean vehicle after 2022 is allowed an income tax credit equal to the lesser of $4,000 or 30% of the vehicle’s sale price [IRC Sec. 25E].

A previously owned clean vehicle is defined as a motor vehicle:

-

- the model year of which is at least two years earlier than the calendar year in which the taxpayer acquires it;

- the original use of which starts with a person other than the taxpayer;

- is acquired in a qualified sale; and

-

- which generally meets the requirements applicable to vehicles eligible for the clean vehicle credit for new vehicles.

The credit will not be allowed for any vehicle acquired after December 31, 2032.

Sec. 13403 – Qualified Commercial Clean Vehicles

The Inflation Reduction Act also adds IRC Sec. 45W, a new component of the IRC Sec. 38 general business credit, effective for qualifying commercial use clean vehicles acquired after December 31, 2022.

From a commercial use perspective, the credit per vehicle is the lesser of:

-

- 15% of the vehicle’s basis (30% for vehicles not powered by a gasoline or diesel engine) or

- the incremental cost of the vehicle over the cost of a comparable vehicle powered solely by a gasoline or diesel engine. The incremental cost of any qualified commercial clean vehicle is an amount equal to the excess of the purchase price for the vehicle over the price of a comparable vehicle.

A qualified commercial clean vehicle is defined as a vehicle that:

-

- meets requirements of IRC Sec. 30D(d)(1) (the general clean vehicle credit rules);

- must be acquired for use or lease by the taxpayer, and not for resale;

- must be manufactured for use on public streets, roads, and highways, or be mobile machinery as defined in IRC Sec. 4053(8);

- must have a battery capacity of not less than 15 kilowatt hours (7 kilowatt hours for vehicles weighing less than 14,000 pounds) and be charged by an external electricity source.

Qualifying vehicles must be depreciable property (special rules apply to tax-exempt entities) and only vehicles made by qualified manufacturers, who have written agreements with, and provide periodic reports to the Treasury, can qualify. Qualified commercial fuel cell vehicles are also eligible for the credit.

The maximum credit per vehicle is $7,500 for vehicles with gross vehicle weight ratings (GVWR) of less than 14,000 pounds, or $40,000 for heavier vehicles.

No credit will be available for commercial use clean vehicles acquired after December 31, 2032.

Learn More About Inflation Reduction Act Tax Credits

Want to learn more about the Inflation Reduction Act and other hot topics that impact your practice? Thomson Reuters Checkpoint Edge is the industry’s leading tax and account research solution. Not subscribed? Start your free 7-day trial today.