In a new paper, we compare the main models of corporate governance (Schoenmaker, Schramade and Winter, 2022). One is the stakeholder model, which recognizes that companies have responsibilities to society that are broader than just making a profit. A problem with that model, though is that it includes multiple goals, making it difficult to hold management accountable. Moreover, the traditional stakeholder model tends to focus on stakeholders who are directly involved with the company, such as employees and customers. Stakeholders without such a direct relation are given short shrift, even though the company’s conduct clearly affects them – and future stakeholders – through, for example, ecological damage and climate change.

We develop an integrated model for corporate governance that allows for a systematic inclusion of future stakeholders (Schoenmaker, Schramade and Winter, 2022). The integrated model is built on the concept of integrated value, which combines financial, social, and ecological value for decision-making and accountability. The integrated value measure addresses the problem of multiple goals and masters posed by Tirole (2001) and Bebchuk and Tallarita (2021).

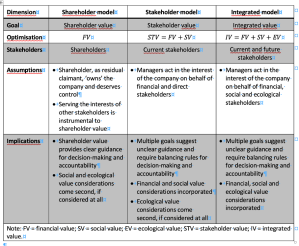

Analyzing the control structure of companies, Tirole (2001) shows that the implementation of the stakeholder model leads to deadlocks in decision-making and a lack of a clear mission for management. The reason for these problems is the absence of a measure of the aggregate welfare of the stakeholders (including investors). Tirole (2001) argues that it is harder to measure a firm’s contribution to the welfare of employees, suppliers, or customers than to measure profitability. There is no market value of the impact of past and current management decisions on the future welfare of stakeholders (i.e. the counterpart of the stock market measurement of the firm’s assets). Table 1 provides an overview of the three models.

Table 1: Comparing corporate governance models

Source: Schoenmaker, Schramade and Winter (2022)

Recent advances in impact valuation enable companies to measure social and ecological effects, express them as amounts of money using cost-based or welfare-based prices (Serafeim, Zochowski and Downing, 2019) and aggregate them. Building on these impact valuation methods, Schramade, Schoenmaker and De Adelhart Toorop (2022) develop a measure of integrated value, which combines financial, social, and ecological value. This integrated measure allows managers to balance several types of value (financial, social, and ecological) at the same time, which often involves trade-offs. Schramade et al. (2022) derive decision rules that help managers make investment decisions. The integrated value measure can also be used to hold managers accountable after they make their decisions.

The basic integrated value IV measure is: IV = FV + SV + EV, whereby FV, SV, and EV represent the financial, social, and ecological value. In our new book (Schoenmaker and Schramade, 2023), we show a more elaborate version of the integrated value model to balance the three components.

It should be acknowledged that the integrated value measure is not absolute. Not every aspect of various stakeholder interests, including interests of future stakeholders, can be measured and expressed in terms of money. But applying an integrated value measure may provide useful and necessary guidance for boards in their decision-making by counterbalancing the bias to prioritize the clearly measurable financial value. This helps boards to widen the scope of their concerns and thus to explicitly balance the various interests for which they are responsible (e.g. Mayer, Strine and Winter, 2020; Winter, 2020).

The measure provides guidance for decision-making that balances the interests of current and future stakeholders. The integrated value measure serves also to hold management accountable. There are several mechanisms to include stakeholder interests in decision-making. One is to formulate formal board mandates for sustainability within companies. Another is to create a stakeholder council. Providing incentives could also play a role. While variable executive pay is mainly related to financial performance, companies are starting to include sustainability targets in executive compensation. Using an international sample of ISS Executive Compensation Analytics, Ormazabal, Cohen, Kadach and Reichelstein (2022) show that the adoption of sustainability metrics in executive compensation contracts is rising fast: from 1 percent of companies doing so in 2011 to 38 percent in 2021. They also find that adoption of sustainability variables in management performance is accompanied by improvements in sustainability performance and meaningful changes in the compensation of executives. Linking executive compensation to sustainability goals helps boards to hold management accountable for sustainability performance.

REFERENCES

Bebchuk, L. and R. Tallarita (2021), ‘The Illusory Promise of Stakeholder Governance’, Cornell Law Review, 106(1): 91-178.

Mayer, C., L. Strine and J. Winter (2020), ‘The Purpose of Business is to Solve Problems of Society, Not to Cause Them’, in: L. Zingales, J. Kasperkevic and A. Schechter (eds), Milton Friedman 50 Years Later, ProMarket & Stigler Center, Chicago, 65-68.

Ormazabal, G., S. Cohen, I. Kadach and S. Reichelstein (2020), ‘Executive Compensation Tied to ESG Performance: International Evidence’, CEPR Discussion Paper DP17267.

Schoenmaker, D. and W. Schramade (2023), Corporate Finance for Long-Term Value, Springer, Berlin, forthcoming.

Schoenmaker, D., W. Schramade and J. Winter (2022), ‘Corporate governance beyond the shareholder and stakeholder model’, Working Paper, Available at: https://ssrn.com/abstract=4238927.

Schramade, W., D. Schoenmaker and R. de Adelhart Toorop (2022), ‘Decision Rules for Integrated Value’, Working Paper, Erasmus Platform for Sustainable Value Creation, available at: https://ssrn.com/abstract=3779118.

Serafeim, G., R. Zochowski and J. Downing (2019), ‘Impact-Weighted Financial Accounts: The Missing Piece for an Impact Economy’, White Paper, Harvard Business School, Boston.

Tirole, J. (2001), ‘Corporate Governance’, Econometrica, 69(1): 1-35.

Winter, J. (2020), ‘Addressing the Crisis of the Modern Corporation: the Duty of Societal Responsibility’, available at: https://ssrn.com/abstract=3574681, published in abbreviated form as ‘Towards a Duty of Societal Responsibility of the Board’, European Company Law Journal, 17( 5): 192-200.

This post comes to us from professors Dirk Schoenmaker and Willem Schramade at Erasmus University’s Rotterdam School of Management and Jaap W. Winter at Vrije Universiteit Amsterdam. It is based on their recent paper, “Corporate Governance Beyond the Shareholder and Stakeholder Model,” available here.

Sky Blog

Sky Blog