Owner Profile: What are Your Transition Choices?

Business Sales M&A

MARCH 23, 2021

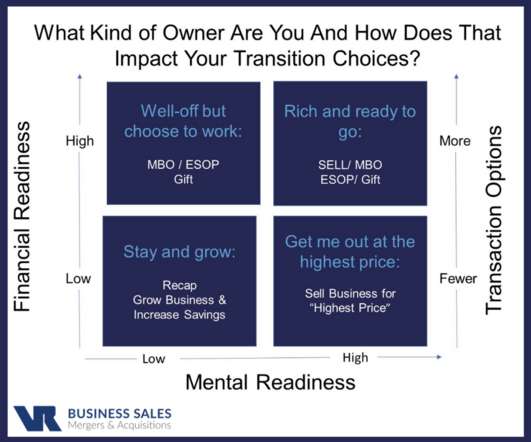

What kind of owner are you? How does that impact your transition choices? Owners that are approaching a time when they wish to exit their business need to undertake a realistic appraisal of how ready they are financially and mentally. The options that are available to them depend upon the results from this assessment. Over the years, our firm has used a matrix to help define these options.

Let's personalize your content