Benjamin Colton is Global Head of Asset Stewardship (Voting & Engagement), and Robert Walker is the Global Head of Asset Stewardship (Strategy), at State Street Global Advisors. This post is based on their SSgA memorandum.

Stewardship Activity Report

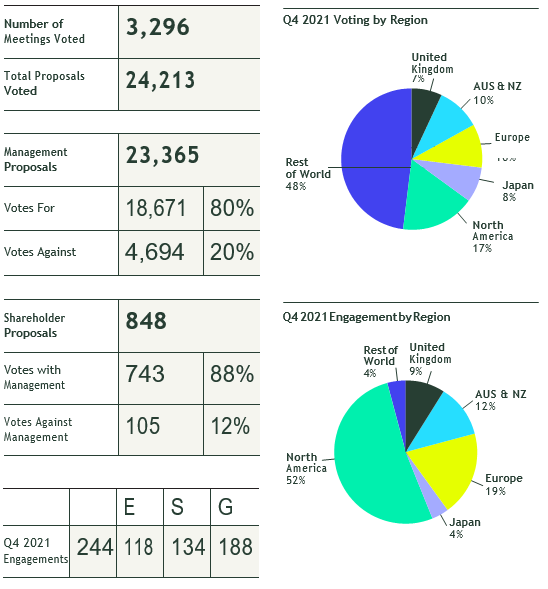

This post covers State Street Global Advisors’ stewardship activities in Q4 2021, including examples of notable successes and resulting outcomes from high-profile engagements, and outlines our stewardship priorities for 2022.

R-Factor™ 2021 Letter Campaign & Expanded Voting Policy

As responsible stewards, we believe in the importance of effective ESG risk management and oversight. Consistent with this perspective, we have continued to make R-Factor™, our proprietary ESG scoring system, central to our stewardship efforts. R-Factor™ encourages companies to manage and disclose material, industry-specific ESG risks and opportunities, thereby reducing investment risk across our own portfolio and the broader market. In 2020, we started taking voting action against board members at companies in major market indices that were “laggards” (i.e. in the lowest 10% in their industries) based on their R-Factor™ scores and could not effectively articulate how they planned to improve their score.

In 2022, we will expand our voting screen to include those companies that have been consistently underperforming their peers on their R-Factor scores for multiple years, and may take voting action unless we see meaningful change. In November 2021, we sent letters to the boards of 21 consistently underperforming companies, notifying them of their low R-Factor™ score and our voting and engagement intentions in 2022. We have held several meaningful engagements, and welcome the continued opportunity to understand how these companies intend to enhance their disclosure and risk management efforts and integrate sustainability into their long-term strategies.

Engagement Campaign: Addressing Deforestation Risk in Supply Chains

Deforestation is a major driver of biodiversity loss and climate change and has significant environmental, social and financial implications for companies and investors. At State Street Global Advisors, we believe that global deforestation—namely its direct linkage to biodiversity loss and climate change—presents a risk to companies with material exposure to deforestation in their supply chains and investments, and should be disclosed and managed like any other business risk.

In 2021, we initiated a series of targeted engagements with our investee companies with direct exposure to deforestation in their supply chains. We engaged 15 of our significant holdings in the Food & Beverage and Consumer Goods sectors, due to their usage or production of the core commodities and activities responsible for the majority of agriculture-related deforestation.

This includes, but is not limited to, cattle, palm oil, cocoa, leather, rubber, soy, timber and mining. Our objective was to learn more about how these companies exercise oversight of their supply chains and how they are managing the various material risks stemming from deforestation.

As a result, we identified the key challenges that companies face and some potential best practices adopted to identify and address deforestation risks across supply chains. In 2022, the Asset Stewardship team will publish a paper detailing our perspectives on addressing deforestation risk and further insights from the campaign.

Board Accountability in Germany: Follow-up Action

In August 2020, State Street Global Advisors led a collaborative letter campaign where we, alongside a group of like-minded investors representing in aggregate $8.3 trillion of assets under management, called on DAX 30 companies to voluntarily adopt a three-year election cycle for shareholder-elected supervisory board members. Our collaborative initiative was in response to the decision of the German Governance Code Commission not to add a three-year election limit to the new Code despite calls by both international and local investors.

German companies continue to lag their European peers, with supervisory board members usually elected for the maximum five-year term permitted by law. This is in direct contrast to other European markets, which have embraced investor-led efforts for more frequent board election cycles.

In Q4 2021, as a follow-up action to the August 2020 collaborative letter, we undertook a targeted engagement campaign with DAX401 companies in order to track progress and understand their sentiment towards shortening the terms of office of supervisory board members.

We view board accountability as fundamental to strong corporate governance. In particular, annual director elections provide increased accountability and encourage board members to be more responsive to shareholder interests, thus improving board quality.

Through the 29 engagements we conducted in Q4 2021, we learned that there is a clear tendency among large German companies to shorten the length of historically five-year board terms, as shown in the table below:

| Term Length (in years) | No. of Cos/% of DAX40* |

|---|---|

| 1 | 1 (2.5%) |

| 2 | 2 (5%) |

| 3 | 3 (7.5%) |

| 4 | 15 (37.5%) |

| 5 | 17 (42.5%)** |

*The data is for 38 companies, as two DAX40 companies are Dutch issuers listed in Germany and their corporate governance practices reflect Dutch market practice where board accountability is not problematic.

** Of the 17 companies, 5 have informed us of their intention to decrease the length of board term to 4 (most likely) or 3 years before the next board election.

As German companies continue to lag their European peers on this issue, starting in the 2022 proxy season, we will vote against the (re)election of any supervisory board members at DAX40 companies whose term of office exceeds four years.

Australian Proxy Season

Australian proxy season occurs during the last three months of the year. In Australia, the season coincided with the aftermath impact from extended lockdowns, border closures and business disruptions associated with the COVID-19 pandemic, as well as accompanying recovery from the economic fallout.

As such, many of our conversations focused on how companies adapted post-lockdown and its impact on human capital, governance and executive remuneration. Further, continuing the trend in other markets, climate risk was a focus area of voting and engagement across industries.

For further insights into voting and engagement on the 2021 Australian proxy season including climate change, executive compensation and shareholder proposals, please refer to our Q3 2021 Stewardship Activity Report.

2022 Stewardship Priorities

Every year, State Street Global Advisors identifies strategic priorities that inform the focus of our stewardship activities. We develop priorities based on several factors, including:

- Client feedback received in the past year

- Emerging ESG trends

- Clients’ portfolio exposure

- Developing macroeconomic conditions and regulation

- Insights derived from our R-Factor™ scores

Our 2022 Stewardship Priorities are Climate Change; Human Capital Management; Diversity, Equity, and Inclusion; and Effective Board Leadership.

Climate Change

In April 2021, State Street Global Advisors became a signatory of the Net Zero Asset Managers initiative. As part of our commitment to holding our portfolio companies and ourselves accountable for reducing carbon emissions, beginning in 2022 we will take voting action against companies that fail to provide sufficient disclosure in accordance with the recommendations of the Taskforce on Climate-related Financial Disclosures (TCFD). Further, we will continue to engage companies with a focus on understanding companies’ plans and progress toward long-term climate goals as well as alignment with our expectations on this topic.

Human Capital Management

Human capital management is a priority for our team, especially given the context of the pandemic and current labor market dynamics. We will leverage our engagements to ensure that companies are aligned with our expectations on this topic.

Diversity, Equity, and Inclusion

We have elevated our longstanding focus on diversity, equity, and inclusion by including race and ethnicity, and by escalating our approach to voting on this topic. We will continue holding companies accountable for progress in our engagements and through our updated proxy voting policies.

Effective Board Leadership

We value the critical role that effective boards play in keeping companies focused on their long-term goals whether it is climate-related targets or redefining their approach to human capital management. Amid the environment of elevated culture of shareholder engagement and broadened expectations of material risk oversight by board of directors, we will engage with companies and their directors to understand boards’ approaches to providing effective oversight of an increasing range of material issues. We will continue to hold independent board leaders responsible via our R-Factor™ voting framework, ensuring boards manage and disclose material industry-specific ESG risks and opportunities.

Global Engagement Highlights

| Company | Amcor Plc |

|---|---|

| Geography and Industry | USA/AUS SICS Sector: Resource Transformation SICS Industry: Containers and Packaging |

| Key Topics | Governance practices, diversity, business strategy, ESG risks and opportunities, remuneration |

| Asset Class | Equity |

| Key Resolutions | Director elections |

| Background | We analyzed Amcor Plc using our proprietary R-Factor™ scoring system that measures the performance of a company’s business operations and governance as it relates to financially material ESG factors facing the company’s industry. We withheld our support from the senior independent board member at the company’s AGM in November 2020 due to the company’s failure to meet our expectations related to ESG disclosure relative to its industry peers. |

| Activity | We engaged with the Amcor board ahead of the AGM to discuss the company’s strategy and its governance practices. Our discussions focused on how the company manages its environmental footprint by addressing responsible packaging, commitments around recyclable and reusable packaging, as well as how Amcor integrates sustainability and innovation into its products. We also shared our expectations with regards to racial and ethnic diversity disclosures. The company recently moved its listing to the NYSE and, as such, we have applied our US proxy voting policies in line with our published guidelines. |

| Outcome | As a result of the constructive dialogue, we are encouraged to see the company’s commitment to enhance disclosure of its racial and ethnic diversity practices for inclusion in the 2022 proxy statement. In considering board responsiveness, we supported the election of directors at the 2021 AGM, and we look forward to enhanced disclosures in 2022. Additionally, in the most recent review, the company scored as an R-Factor™ outperformer (i.e., top 30%) relative to industry peers as a result of improved governance practices and disclosure. |

| Company | Domino’s Pizza, Inc. |

|---|---|

| Geography and Industry | United States SICS Sector: Food & Beverage SICS Industry: Restaurants |

| Key Topics | ESG Disclosure Practices |

| Asset Class | Equity |

| Key Resolutions | Director elections, election of senior independent Board member |

| Background | We withheld our support from the senior independent board member nominee at Domino’s Pizza’s 2021 AGM due to the company’s failure to meet our expectations related to ESG disclosure relative to its industry peers. |

| Activity | In December 2021, we continued our engagement with the company to better understand the board’s role in overseeing material ESG risk management, and its plans for enhancing the company’s ESG disclosures. |

| Outcome | In response to the engagements with the company, Domino’s Pizza released its inaugural sustainability report in 2021, including metrics aligned with the GRI and SASB frameworks, and debuted climate targets. The board also formalized its oversight across several material ESG areas, including GHG emissions, diversity, equity, and inclusion, and delegated formal reporting responsibilities on these topics among the management team to ensure continued accountability and dialogue.

As a result of these efforts, the company has improved to an “average” R-Factor™ (i.e., middle 30–70%) industry rating, providing investors with more transparency on how the company is effectively managing material ESG-related risks and planning on achieving business-related targets across these areas. |

| Company | Mizuho Financial Group, Inc. |

|---|---|

| Geography and Industry | Japan SICS Sector: Financials SICS Industry: Commercial Banks |

| Key Topics | Climate-related disclosure, climate-related target setting, shareholder feedback |

| Asset Class | Equity |

| Key Resolutions | Shareholder proposal: Amend Articles to Disclose Plan Outlining Company’s Business Strategy to Align Investments with Goals of Paris Agreement |

| Board Recommendation | (2020) AGAINST |

| Our Vote | (2020) FOR Shareholder proposal asking company to disclose its plan to align its investments with the goals of Paris Agreement |

| Background | In June 2020, Mizuho Financial Group (“Mizuho”) received a shareholder proposal asking the company to disclose its plan to align its investments with the goals of the Paris Agreement.

In the past few years, the majority of climate-related shareholder resolutions were aimed at energy companies globally, which are often targeted because of that industry’s higher absolute GHG emissions. The 2020 proxy season saw the emergence of a new trend of climate-related shareholder resolutions targeting financial institutions. When analyzing the proposal, we considered how the company was managing climate-related risks. Specifically, we evaluated decision-making regarding financing of fossil fuel activities, as well as commitments the company had made to address climate change. |

| Activity | While Mizuho had committed to the Paris Agreement, it had not provided any disclosure around its strategy or targets for accomplishing these goals. As a result, we supported this shareholder resolution.

To couple this voting action with direct dialogue, we engaged with members of Mizuho’s board in 2021 to hear how they are approaching setting meaningful, science-based targets and their plans for improving disclosure efforts. While we maintain reservations regarding the company’s disclosure practices on its efforts and lack of details on climate-related targets, we were encouraged in our engagement with the board regarding the initial steps taken since the 2020 AGM, and their commitment to provide enhanced transparency both in the company’s 2022 TCFD-aligned report and Scope 3 targets by the end of FY 2022. |

| Outcome | In November 2020, Mizuho was the first financial institution in Japan to carry out measurement and disclosure based on PCAF’s Global GHG Accounting and Reporting standards, and formally joined the PCAF partnership in July 2021 as the first Japanese financial institution. In May 2021, Mizuho pledged to stop financing new thermal coal mining projects from June 2021, the first major Japanese lender to make such a pledge. In October 2021, Mizuho formally joined the Net-Zero Banking Alliance, committing to setting medium- to long-term science-based climate targets, formulate concrete action plans and advance disclosure efforts detailing progress. |

| Company | Pfizer Inc. |

|---|---|

| Geography and Industry | USA SICS Sector: Health Care SICS Industry: Biotechnology and Pharmaceuticals |

| Key Topics | Participation in the political process |

| Asset Class | Equity |

| Key Resolutions | Shareholder proposal: Report on Political Contributions and Expenditures |

| Board Recommendation | (2021) AGAINST |

| Our Vote | (2021) ABSTAIN on the shareholder proposal asking the company to provide a report analyzing the congruency of political and electioneering expenditures against the company’s publicly stated corporate values and policies. |

| Background | In April 2021, Pfizer Inc. (“Pfizer”) received a shareholder proposal asking the company to provide a report analyzing the congruency of political and electioneering expenditures against the company’s publicly stated corporate values and policies. The proposal to ‘Report on Political Contributions and Expenditures’ is a fairly new class of shareholder proposals and represents an evolution of the ‘Climate Lobbying’ proposals which we have seen for the past several years. It expands the focus on just climate change to an alignment of broad corporate values and that of the company’s political activities. This was the first time that Pfizer had been asked to produce a report comparing its political contributions to its stated values or positions. |

| Activity | State Street Global Advisors engaged with the Pfizer management team in 2021 in order to discuss its 2021 AGM proxy, including the ‘Report on Political Contributions and Expenditures’ proposal. During the engagement, we expressed our view that participation in the political process can present risks to companies and we expect enhanced disclosure of the alignment of political contributions to the company’s stated values or positions.

While the company had not disclosed the information requested in the shareholder proposal, we Abstained on the proposal due to our productive engagement with the company and understanding that Pfizer would enhance its political participation disclosures. In 2021, we had a follow-up engagement with the company to check on its responsiveness to our vote and the previous engagement. During the call, Pfizer stated that it will enhance its political participation disclosures in response to the submitted shareholder proposal. |

| Outcome | The ‘Report on Political Contributions and Expenditures’ proposal ultimately failed, although it received a high level (47%) of shareholder support. In December 2021, Pfizer responded to State Street Global Advisors’ request to enhance its political participation disclosure and for the first time published a report analyzing the incongruencies between its political positions and those of its industry associations. |

The complete publication, including footnotes, is available here.

Print

Print