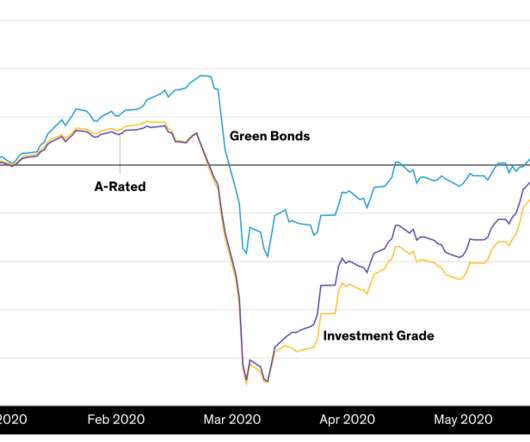

Assessing ESG-Labeled Bonds

Harvard Corporate Governance

MAY 6, 2022

Posted by Salima Lamdouar, Patrick O'Connell, and Tiffanie Wong, AllianceBernstein, on Friday, May 6, 2022 Editor's Note: Salima Lamdouar is Portfolio Manager of Sustainable Fixed Income, Patrick O’Connell is Director of Fixed Income Responsible Investing Research, and Tiffanie Wong, CFA is Director of Fixed Income Responsible Investing Portfolio Management at AllianceBernstein.

Let's personalize your content