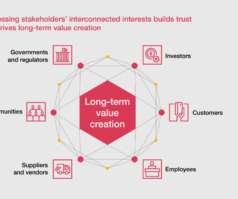

The board’s role: building trust in a multi-stakeholder world

Harvard Corporate Governance

JANUARY 3, 2023

Posted by Maria Castañón Moats, Paul DeNicola, and Matt DiGuiseppe, PricewaterhouseCoopers LLP, on Tuesday, January 3, 2023 Editor's Note: Maria Castañón Moats is Leader, Paul DeNicola is Principal, and Matt DiGuiseppe is Managing Director at the Governance Insights Center at PricewaterhouseCoopers LLP. This post is based on their PwC memorandum.

Let's personalize your content