Equidam partner GreenTec Capital Partners invests in African startups that target some of the most pressing Sustainable Development Goals. They use capacity building, process optimization and a diverse team of international experts to help founders scale their operations and their business across Africa and beyond.

We spoke to Tomi Davies, CIO of GreenTec Capital Partners, to learn more about the dynamics of startup fundraising in Africa, and how they support entrepreneurs solving the big problems.

“Using Equidam enables GreenTec to apply a consistent approach to assessing risks and determining valuations for our prospective start-ups. As start-up valuations can be contentious, Equidam’s tool provides a clear and objective framework at determining a fair value for a venture.”

What is the mission of GreenTec Capital Partners?

GreenTec Capital is a Germany-based impact investor that focuses on supporting and investing in African start-ups and SMEs with the goal of combining social and environmental impact with financial success. We focus on Sub-Saharan and Northern Africa with particular interest in Egypt, Senegal, Ivory Coast, Kenya, Nigeria, and Ghana. We look for impactful companies with strong founding teams that we support through custom tailored advisory and Venture Building support.

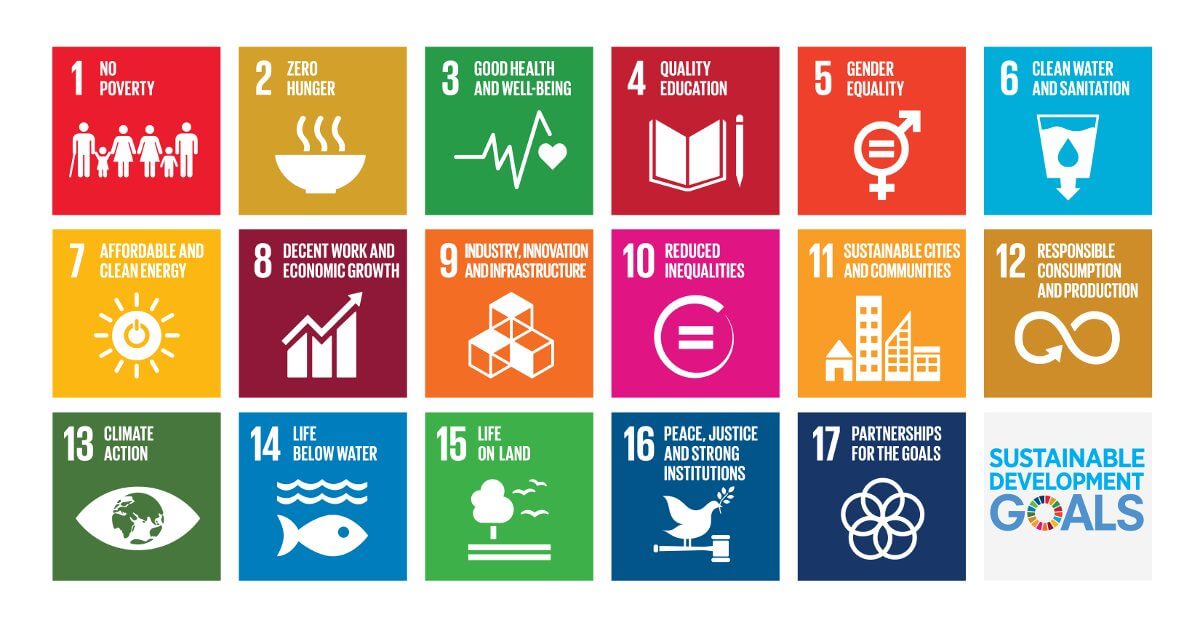

Our focus sectors include AgriTech, EduTech, SaaS, Mobility, FinTech, Food & Agriculture, Healthcare, and Renewable Energies. Generally, we look at investing in 2 broad categories: ‘essentials for living,’ such as clean water, food, education, and renewable energy; and ‘platforms’ that will be instrumental to delivering the goods and services that Africans need. As an impact investor, we are looking to support companies making contributions to the UN’s Sustainable Development Goals (SDGs). In particular, we aim to support companies addressing the following SDGs: SDG2, SDG3, SDG4, SDG5, SDG7, SDG8, SDG9 and/or SDG13.

Fintech represents 1/3 of early-stage deals in Africa, 2021 YTD. Which other sectors do you think could approach that level of interest in future?

Fintech remains the VC darling and has continued to attract about half of Q3’s deal volume. The other sectors to watch are EduTech, CleanTech, e-Commerce, and Biotech. Our own investment thesis centers on an optimistic wager on the growing demography of the African continent. Africa’s growing population is driving the world’s highest rate of urbanization. We believe that tomorrow’s winners will solve the problems of how the residents of African cities live, learn, move about, work, get health care, find entertainment, and most importantly procure their food. Addressing the significant demand being created by Africa’s expanding population is providing the opportunity for tomorrow’s winners on the continent.

Fundraising activity in Africa didn’t appear to be slowed by the pandemic, was that your experience?

The investment opportunities in Africa have always been attractive for venture capital and the entrepreneurial ecosystem on the continent has really been developing quite quickly over the last decade. Although the Covid-19 pandemic disrupted countries all over the world it also showed the resilience of tech-enabled businesses to adapt to opportunities and challenges. Generally, 2021 fundraising seems to be driven by a sustained high interest in Fintech, as well as large rounds by established companies raising capital to expand in Africa.

What are the broader challenges with early-stage investing in Africa? How does Equidam play a role there?

There are a number of unique challenges related to early-stage investing in Africa. It is a large and diverse continent with vast differences in the risk profiles, cultures and economies in the top 5 markets. There is also a large shadow from Africa’s colonial legacy, creating vastly different Arabic, Anglophone and Francophone territories in which startups operate. Despite initiatives such as the OHADA treaty, and the recently enacted AfCFTA, the heterogeneity of regulatory and business environments creates a dizzying array of factors for investors to consider before making investment decisions. This heterogeneity contributes to a lack of consistent data which furthers a perception of non-transparency and increased risk. All of these factors contribute to making start-up valuations difficult to objectively assess. Using Equidam enables GreenTec to apply a consistent approach to assessing risks and determining valuations for our prospective start-ups. As start-up valuations can be contentious, Equidam’s tool provides a clear and objective framework at determining a fair value for a venture. In many cases this valuation provides the starting point for a company’s valuation and the start of negotiations for the investment round.