Laura D. Richman is a Counsel, John R. Ablan is a Partner, and Kwaku D. Osebreh is an Associate at Mayer Brown LLP. This post is based on their Mayer Brown memorandum. Related research from the Program on Corporate Governance includes Insider Trading via the Corporation (discussed on the Forum here) by Jesse M. Fried.

On December 14, 2022, the Securities and Exchange Commission (the “SEC”) unanimously adopted amendments (the “amendments”) to Rule 10b5-1 under the Securities Exchange Act of 1934 (the “Exchange Act”) and related disclosure obligations for public companies. The amendments (i) add new conditions to the availability of the affirmative defense to insider trading liability contained in Rule 10b5-1 designed to address concerns about the rule’s abuse by insiders to trade securities on the basis of material nonpublic information (“MNPI”) and (ii) enhance public disclosure by issuers and insiders of trading plans designed to comply with Rule 10b5-1. This Legal Update summarizes the principal changes made by the amendments and discusses some practical considerations.

Background

Section 10(b) of the Exchange Act and Rule 10b-5 promulgated thereunder prohibit purchases or sales of a security on the basis of MNPI about that security or the issuer, in breach of a duty owed to such issuer or the shareholders of such issuer or to any person who is the source of that MNPI. This prohibited conduct is more commonly referred to as “insider trading.” Rule 10b5-1 provides an affirmative defense to insider trading liability for trades undertaken pursuant to a binding contract, an instruction to another person to execute the trade for the instructing person’s account or a written plan (collectively, a “10b5-1 Plan”) adopted when the trader was not aware of MNPI. 10b5-1 Plans must be entered into in good faith and not as part of a scheme to evade the prohibitions of the insider trading rules.

Since the adoption of Rule 10b5-1 in 2000, the SEC, courts, members of Congress, academics and others have grown increasingly concerned that Rule 10b5-1 has allowed traders to escape liability by trading on the basis of MNPI while still technically satisfying the Rule’s requirements. To address these concerns, the SEC issued a proposal about a year ago consistent with prior statements made by SEC Chair Gary Gensler, as well as recommendations made to the SEC by the Investor Advisory Committee, with respect to 10b5-1 Plans. [1] The proposal included new conditions to the availability of the Rule 10b5-1 affirmative defense, such as cooling-off periods between adoption of a 10b5-1 Plan and the first trade thereunder, limitations on multiple overlapping 10b5-1 Plans and limits on single-trade 10b5-1 Plans, as well as new disclosure requirements. The SEC received over 180 comment letters on the proposed amendments.

The adopted amendments, while generally consistent with the proposal, do take into account concerns raised by commenters. “[B]ased on feedback from the public,” SEC Chair Gensler noted “we have modestly changed the proposed cooling-off period for insiders, are not adopting a cooling-off period for issuers, and are providing a phased implementation for disclosures for smaller reporting companies.” [2]

Amendments to Rule 10b5-1

COOLING-OFF PERIODS FOR DIRECTORS AND OFFICERS

Prior to the effective date of the amendments, Rule 10b5-1 did not require any waiting or “cooling-off” periods between the date on which a 10b5-1 Plan is adopted and the date of the first transaction made pursuant to such plan, although some plans voluntarily included, and some companies required, such a cooling-off period. Under the amendments, in order to qualify for the affirmative defense provided by Rule 10b5-1:

- Trading under a 10b5-1 Plan adopted by a director or “officer,” as defined in Rule 16a-1(f), [3] must not begin until the later of (1) 90 days following plan adoption or “modification” (as described below) and (2) two business days following disclosure of the issuer’s financial results for the fiscal quarter in which the plan was adopted or modified (but not to exceed 120 days following plan adoption or modification); and

- Trading under a 10b5-1 Plan for persons other than issuers or directors and officers (which includes non-officer employees who enter into 10b5-1 Plans) must not begin until 30 days following plan adoption or modification.

For purposes of the director and officer cooling-off period, the amendments provide that an issuer will be considered to have disclosed its financial results at the time it files a Form 10-Q or Form 10-K, or, in the case of foreign private issuers (FPIs), when such FPIs file a Form 20-F or furnish a Form 6-K that discloses financial results.

A longer cooling-off period of 120 days for directors and officers was initially considered in the proposed rules and some commentators advocated for shorter periods. SEC Commissioner Hester Peirce (while voting in favor of the amendments) expressed her disagreement with the adopted 90-day period stating,

“…the new regime in the final rule is unnecessarily restrictive. For example, the final rule imposes a lengthy cooling-off period. Although the new cooling-off period is shorter than proposed, it is longer than necessary for directors and officers. Many commenters reasonably called for a period as short as 30 or 60 days. A longer period could discourage the use of 10b5-1 plans.” [4]

In an important change from the proposal, issuers are not subject to a cooling-off period.

The amendments clarify that a “modification” of an existing 10b5-1 Plan would be deemed to be a termination of such 10b5-1 Plan and would restart the applicable cooling-off period. The amendments provide that “any modification or change” to the amount, price, or timing of the purchase or sale of the securities underlying a 10b5-1 Plan is treated as a termination of the plan and the adoption of a new plan. To the extent that insiders seek to continue to rely on the affirmative defense, they would be subject to a new cooling-off period. [5] Additionally, cancellation of one or more trades would constitute a “modification.” However, modifications that do not change the sales or purchase prices or price ranges, the amount of securities to be sold or purchased or the timing of transactions under a 10b5-1 Plan (such as an adjustment for stock splits or a change in account information) will not trigger a new cooling-off period. The amendments do not provide any de minimis modification exception. In other words, a modification need not be “material” in order for it trigger a new cooling-off period.

DIRECTOR AND OFFICER CERTIFICATIONS

Under the amendments, at the time a 10b5-1 Plan is adopted (or modified), directors and officers are required to include a representation in the 10b5-1 Plan certifying they (i) are not aware of MNPI about the issuer or its securities and (ii) are adopting (or modifying) the 10b5-1 Plan in good faith and not as part of a scheme to evade the prohibitions of the Exchange Act’s Section 10(b) or Rule 10b-5. In a change from the proposal, and to eliminate any additional burden separate documentation may create, directors and officers are required to include the certification in the plan documents as representations rather than as a separate certification to the issuer. The final rules do not require directors and officers to retain the certification for ten years, as was originally proposed, although it is prudent for them to maintain accurate records, including the representations, to establish they have satisfied the conditions of the affirmative defense.

PROHIBITION ON OVERLAPPING 10B5-1 PLANS AND LIMITS ON SINGLE-TRADE 10B5-1 PLANS

The amendments eliminate Rule 10b5-1’s affirmative defense for trades by any trader other than the issuer (i.e., beyond directors and officers) who establishes multiple overlapping 10b5-1 Plans. The proposal had included issuers within this prohibition, and it is a significant change that issuers are not subject to this aspect of the adopted amendments.

The amendments provide a few limited exceptions to the multiple overlapping plan prohibition. To address an insider’s use of multiple brokers to execute trades pursuant to a single 10b5-1 Plan that covers securities held in different accounts, the amendments treat a series of formally distinct contracts with different broker-dealers or other agents as a single “plan,” if taken together, the contracts otherwise satisfy the applicable conditions of Rule 10b5-1. In addition, the amendments provide that a broker-dealer or other agent executing trades on behalf of the insider pursuant to the 10b5-1 Plan may be substituted by a different broker-dealer or other agent as long as the purchase or sales instructions applicable to the substituted broker and the substitute are identical, including with respect to the prices of securities to be purchased or sold, the dates of the purchases or sales to be executed and the amount of securities to be purchased or sold. This means an insider will not lose the benefit of the affirmative defense when closing a securities account with a financial institution and transferring the securities to a different financial institution. An insider also may maintain two separate Rule 10b5-1 Plans at the same time so long as trading under the later-commencing plan is not authorized to begin until after all trades under the earlier-commencing plan are completed or expire without execution, subject to compliance with applicable cooling-off period requirements.

The amendments also authorize certain “sell-to-cover” transactions in which an insider instructs its agent to sell securities in order to satisfy tax withholding obligations at the time an award vests so the insider will not lose the benefit of the affirmative defense with respect to an otherwise eligible 10b5-1 Plan if the insider has another plan in place that would qualify for the affirmative defense, so long as the additional plan or plans only authorize qualified sell-to-cover transactions. A plan authorizing sell-to-cover transactions qualifies for the new provision where the plan authorizes an agent to sell only such securities as are necessary to satisfy tax withholding obligations incident to the vesting of a compensatory award, such as restricted stock or stock appreciation rights, and the insider does not otherwise exercise control over the timing of such sales.

Transactions with the issuer not executed on the open market, such as employee stock purchase plans (“ESPPs”) or dividend reinvestment plans (“DRIPs”) would be excluded from the prohibition of overlapping plans.

The amendments also limit the availability of the affirmative defense by persons other than the issuer to one “single-trade” 10b5-1 Plan during any 12-month period.

ACTING IN GOOD FAITH

Rule 10b5-1 previously required 10b5-1 Plans be entered into in good faith and not as part of a plan or scheme to evade the insider trading rules. In order to clarify that cancellations or modifications of a 10b5-1 Plan may not be conducted in a manner to benefit from MNPI, the amendments require 10b5-1 Plans be entered into in good faith and the person who has entered into the plan must act in good faith throughout the duration of the trading arrangement.

The adopting release explains that good faith, with respect to trading under a 10b5-1 Plan, applies to activities within the insider’s control. For example, an insider would not be operating a 10b5-1 Plan in good faith if the insider, while aware of MNPI, directly or indirectly induces the issuer to publicly disclose that information in a manner that makes their trades under a 10b5-1 Plan more profitable (or less unprofitable). On the other hand, the adopting release indicates that trading suspensions directed by the issuer, which are outside the control or influence of the insider, such as an issuer-imposed trading halt due to a possible merger, may not, by themselves, implicate the good faith condition.

New Disclosure Requirements for Public Companies and Insiders

PUBLIC COMPANY DISCLOSURES

Prior to the effective date of the amendments, there were no disclosure requirements concerning the adoption, termination or use of 10b5-1 Plans by issuers or insiders, and issuers were not required to disclose their insider trading policies or procedures. The amendments add a new Item 408 to Regulation S-K and make certain amendments to Forms 10-Q, 10-K and 20-F.

Public companies using domestic reporting forms (e.g., Forms 10-Q and 10-K) will be required to provide quarterly disclosure of the adoption or termination of 10b5-1 Plans and other trading arrangements for directors and officers. In a significant change, as adopted, Item 408’s disclosure requirements apply only to an issuer’s directors and officers 10b5-1 Plans and not to the issuer’s.

Disclosures must include the material terms of the 10b5-1 Plan or other arrangement, such as the name and title of the director or officer, adoption or termination date, the duration of the 10b5-1 Plan or arrangement, the aggregate number of securities to be sold or purchased pursuant to the 10b5-1 Plan or arrangement, and whether the arrangement is intended to satisfy the requirements for use of Rule 10b5-1’s affirmative defense. However, the disclosure is not required to include the pricing terms of the trading arrangement.

Public companies will also be required to disclose whether they have adopted insider trading policies and procedures reasonably designed to promote compliance with the insider trading laws. Companies that have adopted insider trading policies and procedures will be required to file such policies and procedures as an exhibit to their annual report on Form 10-K or 20-F. If a company has not adopted such policies and procedures, it will be required to disclose why it has not done so. Public companies that use domestic reporting forms would be required to make these disclosures annually in their annual reports on Form 10-K, and FPIs would similarly be required to include this information in their annual Form 20-F filings. [6]

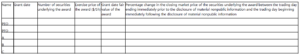

The amendments also create new obligations for executive compensation disclosure. Specifically, new tabular disclosures are required that identify, for each director and named executive officer:

- each award of stock options, SARs, or similar option-like instruments (i.e., the grant date, the number of securities underlying the award, exercise price of the award, and the grant date fair value of the award) granted during a period starting four business days before, and ending one business day after, the filing of a periodic report on Form 10-Q or Form 10-K or the filing or furnishing of a current report on Form 8-K that discloses MNPI (other than a Form 8-K disclosing a material new option award grant);

- the market value of the underlying securities the trading day before disclosure of the MNPI; and

- the market value of the underlying securities one trading day after disclosure of MNPI.

The table format is as follows:

In addition to the tabular disclosures, the amendments require narrative disclosure about the company’s option grant policies and practices regarding the timing of option grants and the release of MNPI, including how the board determines when to grant options and whether, and if so, how, the board or compensation committee takes MNPI into account when determining the timing and terms of an award. This disclosure is required to be included in annual reports on Form 10-K [7] and proxy and information statements related to the election of directors, approval of compensation plans or solicitations of advisory votes to approve executive compensation. Unlike some other executive compensation disclosure, emerging growth companies and smaller reporting companies (“SRCs”) are not be exempt from these disclosure requirements.

INSIDER OBLIGATIONS UNDER SECTION 16 OF THE EXCHANGE ACT

Persons reporting transactions on a Form 4 or Form 5 pursuant to Section 16 under the Exchange Act will be required to identify whether the reported transaction was executed pursuant to a plan “intended to satisfy the affirmative defense conditions” of Rule 10b5-1 by checking a new checkbox on Form 4 and Form 5.

Relatedly, the amendments require that bona fide gifts of securities, whether or not part of a 10b5-1 Plan, be reported on a Form 4 by the end of the second business day following the gift. Currently, these transactions are reportable on a Form 5, which is filed once a year within 45 days after the issuer’s fiscal year end.

INLINE XBRL

The amendments require public companies to tag the narrative disclosures, as well as quantitative amounts within the narrative disclosures, in Inline XBRL, in accordance with Rule 405 of Regulation S-T and the EDGAR Filer Manual.

EFFECTIVE DATE AND PHASE-IN PERIOD

The amendments will go into effect 60 days after the date they are published in the Federal Register.

Public companies, other than SRCs, must comply with the disclosure and Inline XBRL tagging requirements in Forms 10-Q, 10-K and 20-F, and any proxy or information statements required to include the Item 408 and/or Item 402(x) disclosures, beginning with the first such filing covering the first full fiscal period beginning on or after April 1, 2023.

SRCs will be required to provide and tag the disclosures after an additional six-month transition period or in the first filing covering the first full fiscal period beginning on or after October 1, 2023.

This means that annual reports on Form 10-K and 20-F for the year ended December 31, 2022 will not need to include the disclosures required by Items 408 and 402(x). Likewise, proxy statements that contain Part III information for such annual reports on Form 10-K will not need to include these disclosures.

Section 16 reporting persons will be required to comply with the amendments to Forms 4 and 5 for beneficial ownership reports filed on or after April 1, 2023.

PRACTICAL CONSIDERATIONS

There is no phase-in period for the amendments to Rule 10b5-1. Therefore, companies must make their Rule 10b5-1 practices align with the amendments before they become effective. To the extent companies permit their directors, officers and employees to trade pursuant to 10b5-1 Plans, they should make them aware of the new requirements, such as cooling-off periods and the impact of modifications, as well as the restrictions on multiple overlapping plans and single-trade plans, as soon as possible.

Companies that do not currently have formal insider trading policies and procedures should consider adopting them before the compliance date for the new disclosures. If they do not, they will need to disclose in proxy statements and annual reports why they have not done so. Public disclosure regarding the absence of insider trading policies is likely to raise governance questions from investors, proxy advisors and corporate governance rating organizations.

Companies should inform their compensation committees that the amendments contain disclosure

requirements for director and executive compensation regarding equity compensation awards made close in time to the company’s disclosure of MNPI in order to give the committee time to assess whether it should adjust the timing of grants of equity awards, as well as an opportunity to consider generally its policy regarding grants in proximity to other milestones and material developments for the company that may be perceived as significant.

The amendments increase visibility of insider gifts of company securities and Chair Gensler made clear in his statement in support of the original proposal and the amendments that “charitable gifts of securities are subject to insider trading laws.” [8] In this environment, companies may want to review their insider trading policies to consider whether it would be appropriate to add or modify provisions addressing the extent to which their insider trading policies, including any pre-clearance requirement, apply to gifting. In addition, companies should notify their directors and officers subject to Section 16 reporting that gifting of securities will now need to be reported on Form 4 within two business days, which is much earlier than the current Form 5 deadline.

Before quarterly disclosure requirements regarding adoption or termination of 10b5-1 Plans become effective, companies will need to devise appropriate disclosure controls to gather this information on a timely basis. Since the certification as to the absence of MNPI will appear in the plan documents, it may be useful to gather those documents as a part of disclosure controls.

Those filing Forms 4 or 5 after April 1, 2023, should make sure they are using updated forms with the appropriate checkbox for 10b5-1 Plans.

While it is good news for public companies the amendments did not apply cooling-off periods or restrictions on multiple overlapping trading plans and single-trade plans to issuers, the adopting release stated that the SEC is “continuing to consider whether regulatory action is needed to mitigate any risk of investor harm from the misuse of 10b5-1 Plans by the issuer, such as in the share repurchase context.” Therefore, public companies engaging in or considering share buybacks will need to continue to monitor SEC developments in this area.

Organizations, such as brokerage firms, that use standard forms for 10b5-1 Plans with their clients should update their forms before the effective date of the amendments. For example, they will need to add a cooling off period requirement in their contracts for 10b5-1 Plans other than with issuers and required certifications for directors and officers and other representations and warranties. This may mean creating three different forms—a form for directors and officers, a form for persons other than directors, officers and issuers, and one for issuers.

See the SEC’s fact sheet and adopting release.

Endnotes

1Gary Gensler, Prepared Remarks CFO Network Summit (June 7, 2021); Recommendations of the Investor Advisory Committee Regarding 10b5-1 Plans

(Sept. 9, 2021).(go back)

2Gary Gensler, Statement on Final Amendments to Rule 10b5-1 and Other Insider Trading Requirements (Dec. 14, 2022).(go back)

3As defined in Rule 16a-1(f) “officer” generally means an issuer’s president, principal financial officer, principal accounting officer (or, if there is no such accounting officer, the controller), any vice-president of the issuer in charge of a principal business unit, division or function (such as sales, administration or finance), any other officer who performs a policy-making function, or any other person who performs similar policy-making functions for the issuer and may include officers of the issuer’s parent(s) or subsidiaries if they perform policy-making functions for the issuer.(go back)

4Hester M. Pierce, Statement on Final Rule: “Insider Trading Arrangements and Related Disclosures” (Dec. 14, 2022).(go back)

5See Rule 10b5-1(c)(iv) (“Any modification or change to the amount, price, or timing of the purchase or sale of the securities underlying a contract, instruction, or written plan as described in paragraph (c)(1)(i)(A) of this section is a termination of such contract, instruction, or written plan, and the adoption of a new contract, instruction, or written plan”).(go back)

6These disclosure requirements do not apply to Canadian issuers filing annual reports on Form 40-F under the SEC’s multi-jurisdictional disclosure system.(go back)

7As with other executive compensation requirements, the amendment provides that disclosure of this information in an annual report on Form 10-K may be incorporated by reference from a proxy or information statement involving the election of directors, if filed within 120 days of the end of the fiscal year.(go back)

8Supra note 2.(go back)

Print

Print