Valuation of a Personal Service Franchise in Today’s Market

Last year we wrote an article on how to value a “personal service” franchise. In the original article we discussed some of the concerns. One being a continued decline in revenue trends for this industry, due to competition and overall saturation in the market. Another, and more importantly, the reliance on “cash flow”.

Steve Mize, ASA & Partner

Fast forward 12 months…

COVID has put an absolute halt on business acquisitions in this segment of the industry. GCF Valued 7 Massage Envy / Hand & Stone / European Wax franchises in 2019 and zero in 2020 or 2021 (for acquisitions). The only valuation that was performed for one of these franchises was for a divorce. Most of these businesses were significantly impacted by COVID with many not returning to “normalization” as of the first quarter of 2021.

Tale of Two Years

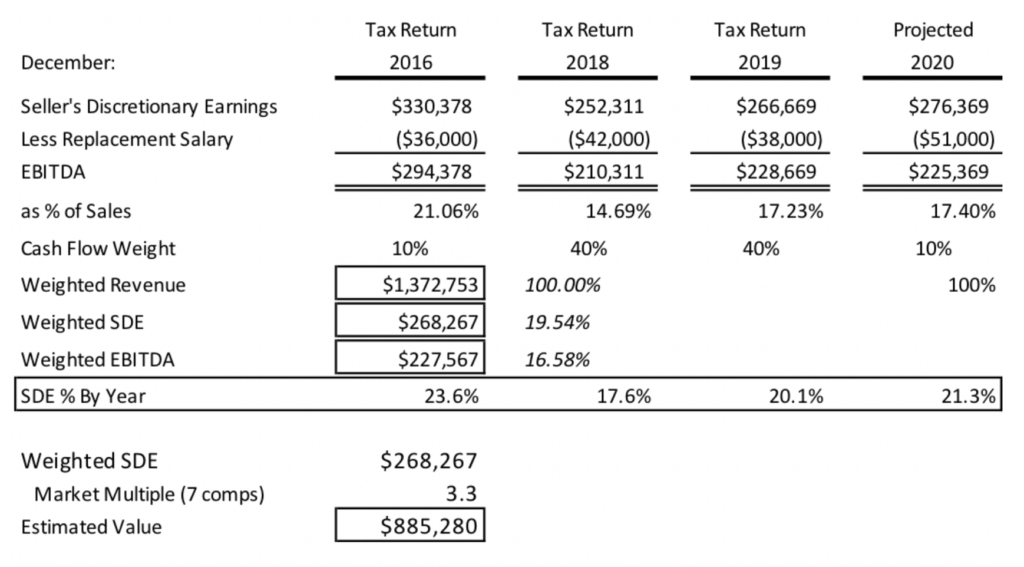

For a valuation we did on a recent “massage franchise”, we originally did the valuation for acquisition in 2019. I’ve outlined below the “market” approach that was used:

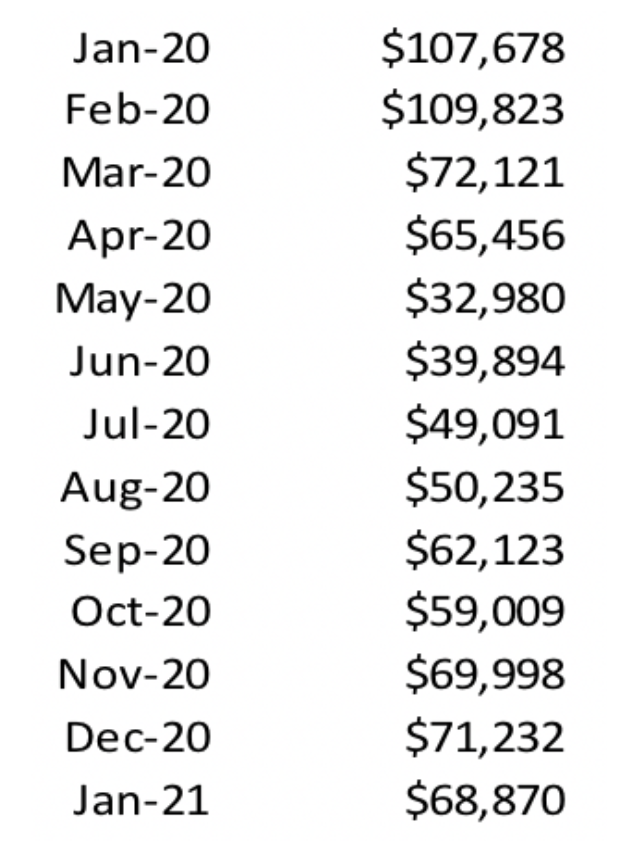

We were asked to “re-value” the business as of February 10, 2021. Due to COVID, 2020 revenue was down to $860,000 (down from $1.3mm in 2019) and unprofitable. Month to month sales is shown below:

As shown above, sales declined significantly in March through July and never really recovered as this region has strict COVID rules and were “on / off” again throughout most of 2020.

So what’s the best approach?

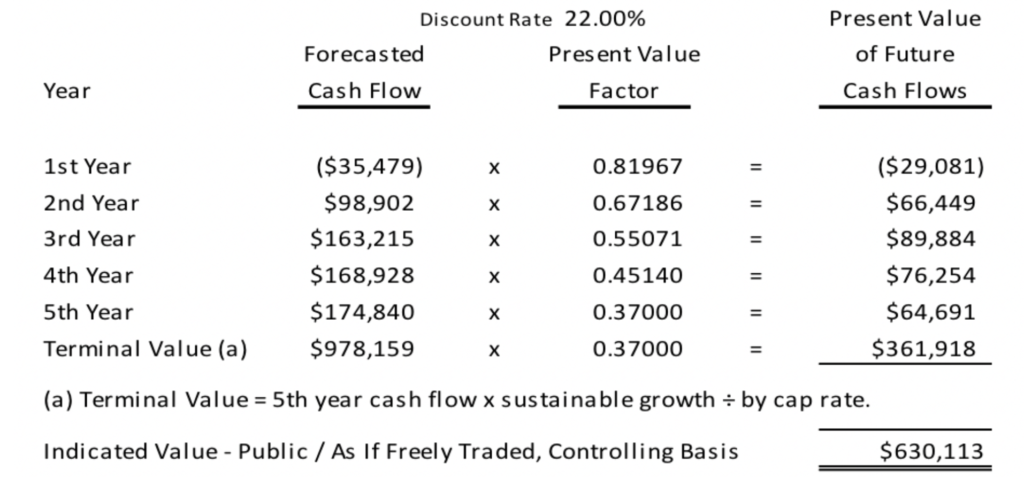

The ONLY approach is to project out sales and cash flow until normalization and discount back to the present value. A summarized calculation is shown below:

In the above example, given restrictions in the area, the first 12 months is projected to be negative “free” cash flow (after officer salary, taxes, etc). We estimated the subject business does not return to “normalcy” until year 3 (2023) with steady growth there after. With an after-tax discount rate of 22% and a cap rate of 18.5%, the value calculates to $630,000 – a COVID impairment of $255,000.

In Summary:

The above example would work in the opposite scenario…if a company had a “spike” in revenue/cash flow due to COVID. Historical years may not be the best representation of future performance IF the business has not shown a trend back to normal cash flows.