Without having your business formally valued, there are a couple of key indicators of value creation to understand when looking at small to mid-sized businesses. These are:

- Future maintainable earnings (FME)

- Return on invested capital (ROIC).

As a business owner or manager looking for ways to improve your financial and operational performance, it’s important to know what sort of value an ‘arms-length person’ would place on your business.

This is the most sobering and/or informative piece of data that a business owner can have when running their business – it not only reflects a potential capital value if the business was sold, but it is also indicative of the earnings and value being generated by the business day to day.

Like any investment (shares, property, cash, superannuation etc), unless you have robust information on the value of the asset/investment, it’s hard to make meaningful judgements about the strength or otherwise of the investment, the risks and returns, and whether more or less money, time or resources should be invested.

Knowing the value indicators of your business at a point in time and tracking those on an annual basis is a litmus test as to whether the business is generating positive incremental value, diminishing in value or standing still – it’s a critical measurement to adjust and manage the performance of a business.

So how do you more closely understand the value your business is generating?

A formal valuation is obviously the most robust method, but you can also examine the key indicators mentioned above: Future maintainable earnings (FME) and Return on invested capital (ROIC).

The following information comes from Chapter 4 of our free ebook, Tips to improve financial and operational performance.

FME

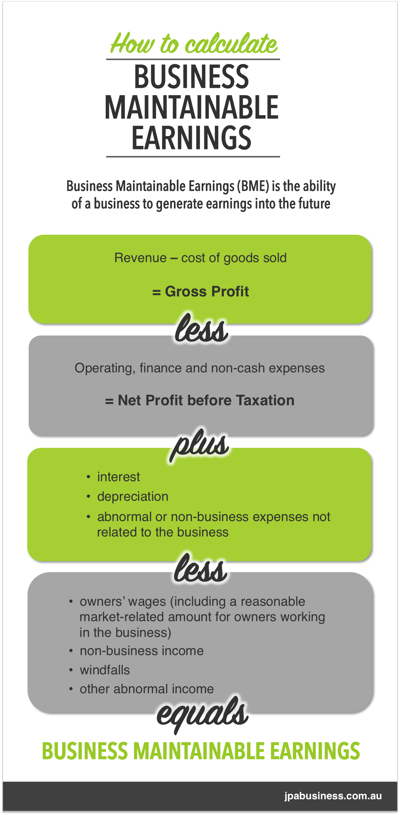

Future Maintainable Earnings (FME, also known as Business Maintainable Earnings or Sustainable Earnings) are often the way the market values small to mid-sized businesses.

Larger businesses traded on the stock exchange have a value attributed to them day by day, minute by minute, in the share price. The share price reflects the market’s view of the ability of the business to generate earnings into the future.

FME essentially measures the same thing: the ability of the business to generate earnings into the future.

How do you calculate FME?

The infographic sets out the calculation we use to determine FME/BME when conducting business valuations and market appraisals on behalf of clients.

It shows how to take account of abnormal fluctuations in a business’ performance (i.e. normalise) and calculate the business’s FME.

The calculation is often done on the previous three years’ performance and then looking forward – to at least the next 12 months.

The results are also often weighted based on seasonality and other market and business-related factors.

The calculation involves analysis over a number of years because BME represents future maintainable earnings, and therefore the analysis needs to consider business health factors, risks and other issues that impact the business.

What contributes to your FME?

So, what are these ‘health factors, risks and other issues’ we need to consider?

Here are 6 of the major ones:

- How much fuel is in the tank?

Does the business have contracts and work in the pipeline, and are they transferable?

- Business assets and management systems

How does the business manage its contracts and schedule its work to ensure there is no break in the chain where customers are not serviced appropriately? Does the business have sufficient plant and equipment and capability to deliver and what is the utilisation rate?

- Is the business reliant on one key person?

Even though there are contracts, does the owner do most of the work, or is the owner a coordinator and there is an experienced 2-I-C and/or team to assist?

- Does it have ‘quality’ FME?

You could have two businesses each with FME of $500,000 a year. One business has achieved $500,000 a year every year for the past five years, and is projecting the same for next year. The second business achieved $500,000 this year, had a negative $200,000 the year before, and a positive $150,000 the year before that, and the year before that broke even. Clearly the former business has a greater ability to repeat performance and consistently deliver FME.

- What is the state of the market?

A business could have very positive FME that has grown steadily from $200,000 to $500,000 over the past few years, but it’s in a market that is suddenly becoming ultra-competitive. There is massive consolidation and big players are entering the market, which will affect the business’s ability to extract earnings into the future.

- How much cash does it generate?

Cash earnings help fund business operating requirements and contribute to profits. If a business generates positive cash earnings that’s a good sign there is sustainable value in the business.

Return on invested capital (ROIC)

There are a whole range of benchmarks that advisors and business owners use to consider the returns and performance of their business. One benchmark we look at is Return on invested capital (ROIC). This measure looks at the amount of money invested in a business compared to the amount of retained earnings the owner receives, as a percentage.

It is determined by calculating the net return (the business’s net income less the dividends paid) and dividing this number by the sum of the business’s debt and equity (i.e. invested capital) to determine a percentage return. Here’s the simple formula:

(We’ve included detailed examples in the ebook to assist you with using this formula.)

Using ROIC helps determine whether funds are being used effectively to generate an ‘acceptable’ rate of return, and therefore whether a business is investing in profitable activities in order for the business to grow and develop.

Along with business earnings performance, the following items are also important elements that will influence the level of return when measuring ROIC:

Dividends paid

Whether dividends are paid or kept in the business to fund growth can impact the ROIC. The latter will naturally increase ROIC, whereas if significant dividends are paid to owners, the ROIC will be reduced in proportion to the value benefit to its owners.

Debt levels

In a similar manner, increasing business debt levels and leverage may assist in funding business growth, however reducing debt levels will result in increasing the ROIC. The correct strategy for a business will depend on balance sheet strength, access to capital and growth opportunities at the time, and these can vary markedly over a business journey.

The ebook examples demonstrate that ROIC can be impacted by a range of things, including the business’s size and life cycle stage, capital invested, assets employed, cost of capital and external factors.

When setting an ROIC goal (i.e. your acceptable level of return), the most important aspects to consider are:

- ROIC percentage:

- How much, as a percentage of your invested money, do you expect to receive from your business as retained earnings?

This could be 5%, 10%, 20%, or whatever percentage you choose as your goal. Setting this ‘target number’ is about considering the risks taken versus an appropriate return, and also versus the return from other investment (property, shares, superannuation etc). It’s worth seeking views from an independent advisor or your accountant in determining a realistic target.

- Time frame:

- What is a reasonable time frame in which the desired ROIC percentage can be achieved?

This depends on the business lifecycle, economic and sector trends and issues, and also internal business growth or restructuring plans related to your business model.

Start by considering:

- what the business’s ROIC has been over the past 3–5 years;

- the forward outlook;

- ongoing capital investments required to sustain and deliver the business plans;

- near-term business budgets or forecasts.

Then ask yourself:

- What level of return would you expect your business to generate?

- How much more return would you expect to receive from your business than other forms of investment?

Don’t forget to consider the rate of inflation when considering your desired return as well.

Take-home message

As business owners looking to drive value in a business, the stronger and more consistently you can build FME and ROIC, and show that the earnings and measures are sustainable, the better your chances of achieving greater business value when looking to exit, all other things being equal.

Of course, engaging an independent valuer to conduct a fair market valuation on your business will provide you with robust information on the actual market value of your business at a point in time.

However, regardless of whether you seek a formal valuation, tracking and monitoring changes in FME and ROIC are good indicators of underlying value creation within a business that an owner can easily track and focus on with their regular advisors and internal teams.

Use our Financial and Operational Actions Timetable

Every business is different and every business owner has different goals, objectives, priorities and schedules.

In working with clients over many years, we have learned that, despite these differences, it is critical for financial and operational performance to have discipline and a deliberate focus around the key elements you monitor, review and address as an owner or manager.

Our free timetable covers the critical items to focus on in running and managing a business, including the Business Value elements.

If you would like to improve your business’s financial and operational performance, we’re keen to help you. Feel free to get in touch by calling 02 6360 0360 or 02 9893 1803 for a confidential, obligation-free discussion.