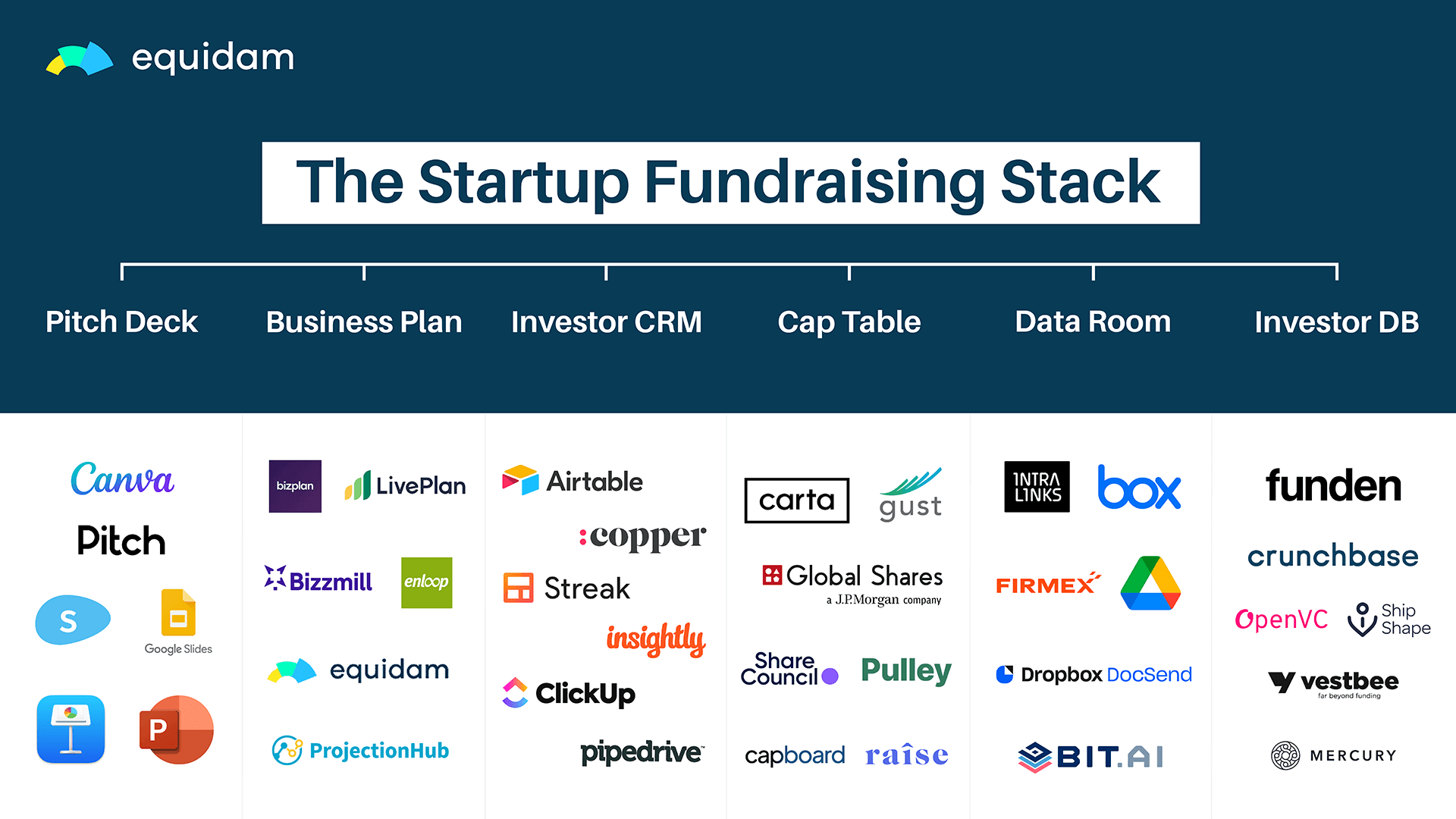

6 Tools to Help Close Your Round

As a startup founder, one of the biggest challenges you’ll face is securing funding to get your business off the ground. Whether you’re seeking investment from venture capitalists or angel investors, there are a variety of tools and strategies you can use to make your fundraising efforts more effective. In this article, we’ll take a look at some of the most important tools you can use to enable fundraising for your startup. From crafting a compelling pitch to building relationships with potential investors, we’ll explore the key factors that can make or break your fundraising efforts.

Whether you’re a first-time founder or a seasoned entrepreneur, these tools can help smooth the path to raising the capital you need to turn your vision into a successful business.

If you know of a solution which should be added to this list, please submit it via this form!

Pitch Deck

A well-crafted pitch deck is crucial to securing investment. It should include a clear overview of your team, the scale of the problem you are tackling, your solution, your traction and the market opportunity. Check out our comprehensive pitch deck template, and consider the following tools for assembling your own:

- PowerPoint: A classic and widely-used tool for creating presentations, including pitch decks.

- Canva: A user-friendly design tool that offers a variety of customizable templates and graphics.

- Pitch: A platform specifically designed for creating pitch decks, offering collaboration features and templates.

- Keynote: A presentation software exclusive to Mac users, offering a range of multimedia features and customizable templates.

- Slidebean: An AI-powered presentation tool that automatically generates slides based on user inputs.

- Google Slides: A cloud-based presentation tool that allows for real-time collaboration and easy sharing.

Other notable tools that could be considered include Prezi, Haiku Deck, and Beautiful.ai. Ultimately, the best tool for creating a pitch deck will depend on individual preferences and needs, as well as the specific requirements of the pitch.

Business Plan

A comprehensive business plan can help you articulate your vision, strategy, and financial projections to potential investors. It should also include a detailed analysis of your competition, target market, and marketing plan. Below are a few examples of tools which can help you get this right:

- Equidam: A tool that helps startups to calculate the valuation of their startup, and present it in a clear and transparent report along with key financials.

- LivePlan: A platform that offers a step-by-step guide for creating a business plan, including financial forecasting tools and customizable templates.

- Bizplan: A tool that helps startups create investor-ready business plans, with features like team collaboration, financial forecasting, and progress tracking.

- Bizzmill: A cloud-based platform that allows users to create a business plan and financial projections, with features like collaboration, templates, and market analysis.

- Enloop: A business plan software that uses AI to automatically generate financial forecasts and offer personalized recommendations for improvement.

- ProjectionHub: A platform that offers financial forecasting tools and customizable templates for creating a business plan, as well as the ability to collaborate with team members and advisors.

Other notable tools that could be considered include PlanGuru, StratPad, and PlanBuildr. Ultimately, the best tool for creating a business plan will depend on individual preferences and needs, as well as the specific requirements of the business plan.

Investor CRM

A customer relationship management (CRM) system, which you are probably already making use of, can help you keep track of your investor interactions and progress in the fundraising process. Below are a few of the best options for a startup:

- Airtable: A customizable database tool that can be used to track investor contacts, manage fundraising pipelines, and analyze data.

- Pipedrive: A sales-focused CRM tool that can be adapted for investor management, with features like deal tracking, activity reminders, and contact management.

- Streak: A CRM tool built specifically for Gmail, with features like email tracking, contact management, and sales pipelines that can be adapted for investor management.

- Copper: A cloud-based CRM tool that offers features like lead management, deal tracking, and automation that can be useful for managing investor relationships.

- Insightly: A CRM platform that offers contact management, task tracking, and lead management, with customizable pipelines that can be adapted for fundraising.

- ClickUp: A project management tool that can be customized to track fundraising pipelines, with features like task management, time tracking, and reporting.

Other notable tools that could be considered include HubSpot CRM, Zoho CRM, and Salesforce. Ultimately, the best solution for building an investor CRM will depend on individual preferences and needs, as well as the specific requirements of the startup.

Cap Table

Cap table management tools can help you keep track of your equity and ownership percentages as you take on investment and bring on new team members. We’re partnered with all of the companies listed below, so check out our partners page for more information.

- Carta: A comprehensive platform for cap table management, offering equity management, compliance, valuation, and liquidity services.

- Share Council: A platform for managing and digitizing employee participation plans as, STAK, ESOP, SAR, Options, financials and legal documents.

- Global Shares: A platform that offers cap table management and equity plan administration services, with features like compliance tracking and stakeholder communications.

- Pulley: A cap table management tool that simplifies equity management for startups, with features like share issuances, secondary transfers, and reporting.

- Gust: A platform that offers cap table management, legal, and accounting services for startups, with features like compliance management, fundraising tools, and stakeholder reporting.

- Raise: A platform that helps startups manage their cap table, with features like equity management, compliance tracking, and fundraising tools.

- Capboard.io: A cap table management tool that simplifies the process of tracking equity ownership, with features like scenario planning, reporting, and stakeholder management.

Other notable tools that could be considered include Eqvista, Ledgy, and Capdesk. Ultimately, the best tool for managing a cap table will depend on individual preferences and needs, as well as the specific requirements of the startup.

Data Room

A data room is a secure online repository for documents related to your fundraising process. It can be used to store financial statements, legal documents, and other sensitive information that investors may want to review. There are a number of services that can help you securely share your investor documents:

- Box: A cloud-based platform that offers secure file storage, sharing, and collaboration, with features like granular permissions and audit trails.

- Google Workspace: A suite of cloud-based productivity tools that includes Google Drive for secure file storage and collaboration, with features like granular permissions and version control.

- DocSend: A secure document sharing platform that offers features like granular permissions, access tracking, and analytics for fundraising and due diligence.

- Intralinks: A secure collaboration platform for sensitive business documents, with features like permission controls, reporting, and compliance tracking.

- Firmex: A virtual data room platform that offers features like granular permissions, document tracking, and user analytics for fundraising and due diligence.

- Bit.AI: A cloud-based platform that offers secure and collaborative document creation and management, with features like granular permissions, analytics, and integrations.

Other notable tools that could be considered include Dropbox Business, Egnyte, and ShareFile. Ultimately, the best tool for managing a data room while fundraising will depend on individual preferences and needs, as well as the specific requirements of the startup.

Investor Databases

By using an investor database, founders can research and identify potential investors who are a good match for their startup’s industry, stage, and funding needs. Additionally, investor databases can provide valuable information on investors’ investment criteria, track record, and contact information, which can be helpful in crafting a targeted and personalized outreach strategy.

- Crunchbase: A comprehensive platform that offers data on startups, investors, and industries, with features like search filters, news and insights, and custom alerts.

- Funden: A database of European startups and investors, with features like search filters, data on funding rounds, and investor contact information.

- OpenVC: A database of venture capital firms and angel investors, with features like search filters, investor profiles, and funding data.

- ShipShape: A database of early-stage venture capital investors, with features like search filters, investor profiles, and contact information.

- Vestbee: A platform that connects startups with investors in Europe, with features like a startup database, investor matching, and pitch opportunities.

- Mercury: A platform that offers tools for fundraising and managing cap tables, with features like a database of investors, pitch deck creation, and compliance tracking.

Other notable databases that could be considered include PitchBook, CB Insights, AngelList, and SeedInvest. Ultimately, the best database for a startup will depend on individual preferences and needs, as well as the specific requirements of the fundraising campaign.

A well-planned fundraising process can help startups avoid common pitfalls and increase their chances of securing funding. By identifying the right investors, crafting a compelling pitch, and effectively communicating their story, startups can stand out in a crowded market and build strong relationships with potential investors.

That being said, it’s important to remember that fundraising ultimately comes down to the strength of the pitch and the story behind it. While having access to the right tools and resources can certainly facilitate the process, it’s the passion and vision of the founder that will ultimately win over investors.

In summary, the right tools and resources can certainly help with startup fundraising, but an efficient and thorough process coupled with a compelling pitch and story is what will ultimately close the deal. With the right approach, startups can successfully navigate the fundraising landscape and secure the resources they need to bring their vision to life.

An important additional category addresses Pitch Video production, hosting and (most important) distribution. Pitchflix.tv a video-centric investor network, supporting investor-founder engagement with LIVE and on-demand pitch showcase and discovery.

I would also recommend our product PitchSpace – the automated pitch builder for the pitch deck category. Our product helped more than 1750 startups to raise and is recommended by names like Virgin Startups, Crowdcube, Swoop Funding, Digital Catapult and many angel investors.