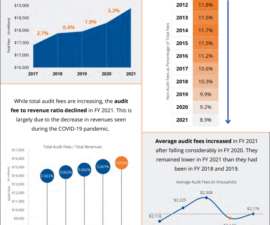

Twenty-Year Review of Audit and Non-Audit Fee Trends

Harvard Corporate Governance

NOVEMBER 2, 2022

Posted by Nicole Hallas, Kayla Coello, and Sarah Keohane, Audit Analytics, Inc., on Wednesday, November 2, 2022 Editor's Note: Nicole Hallas is Manager of Research Analytics, Kayla Coello is a Research Analyst and Sarah Keohane is a Data Analyst at Audit Analytics. This post is based on an Audit Analytics memorandum by Ms. Hallas, Ms. Coello, Ms. Keohane, and Ms.

Let's personalize your content