Cooley Stands Apart in Women and M&A Deal Leadership

Cooley M&A

AUGUST 25, 2021

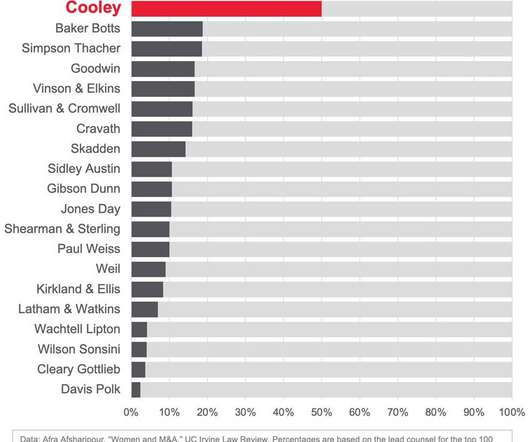

A recently published article by UC Davis School Law Professor Afra Afsharipour, “ Women and M&A ,” shows that of the 20 firms handling the most significant public M&A transactions from 2014 to 2020, Cooley is the only firm with equal gender representation in leading roles across such deals. “The outlier position is a testament to how our M&A team has led the practice – and the industry – with grit and talent over many years,” said Joe Conroy, Cooley’s chairman and chief executive off

Let's personalize your content