Weekly Roundup: December 9-15, 2022

Harvard Corporate Governance

DECEMBER 16, 2022

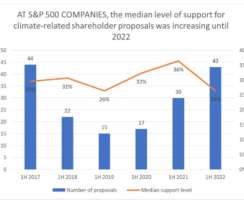

Posted by the Harvard Law School Forum on Corporate Governance, on Friday, December 16, 2022 Editor's Note: This roundup contains a collection of the posts published on the Forum during the week of December 9-15 2022. Remarks by Commissioner Peirce at the American Enterprise Institute. Posted by Hester M. Peirce, U.S. Securities and Exchange Commission, on Friday, December 9, 2022.

Let's personalize your content