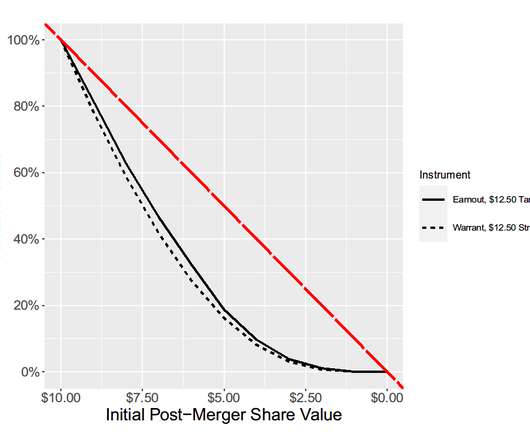

The Limits of SPAC Sponsor Earnouts

Harvard Corporate Governance

APRIL 7, 2022

Posted by Michael Klausner (Stanford University) and Michael Ohlrogge (NYU), on Thursday, April 7, 2022 Editor's Note: Michael Klausner is the Nancy and Charles Munger Professor of Business and Professor of Law at Stanford Law School; Michael Ohlrogge is Assistant Professor at NYU School of Law. This post is based on their recent paper. Related research from the Program on Corporate Governance includes SPAC Law and Myths by John C.

Let's personalize your content