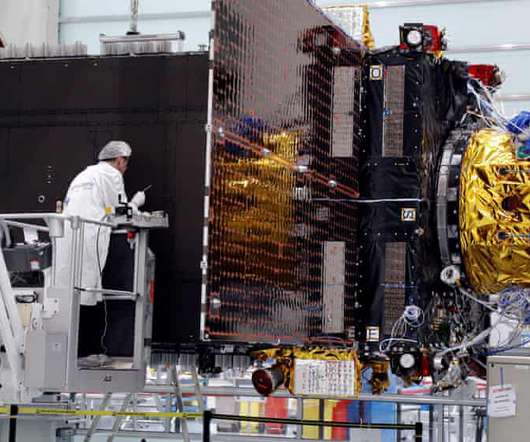

US satellite firm’s takeover of Inmarsat ‘not a step-in-and-steal deal’

The Guardian M&A

JANUARY 30, 2022

Viasat says it ‘isn’t about ripping out cost to make the numbers’, and it has longstanding relationship in UK The chief executive of the US satellite company that is buying Inmarsat for $7.3bn (£5.4bn) has said it is not “stealing” Britain’s crown jewel in the space communications race, and is confident the deal would be cleared by a potential investigation by the government to assess the threat of a foreign takeover to national security.

Let's personalize your content