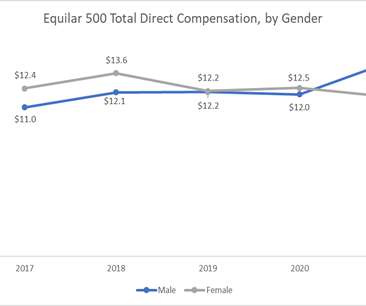

Proxy Season 2022: Early Trends in Executive Compensation

Harvard Corporate Governance

MARCH 29, 2022

Posted by Amit Batish, Equilar, Inc., on Tuesday, March 29, 2022 Editor's Note: Amit Batish is Director of Content at Equilar, Inc. This post is based on an Equilar memorandum by Mr. Batish and Courtney Yu. Related research from the Program on Corporate Governance includes The Perils and Questionable Promise of ESG-Based Compensation by Lucian A. Bebchuk and Roberto Tallarita (discussed on the Forum here ); and Paying for Long-Term Performance by Lucian Bebchuk and Jesse Fried (discussed on the

Let's personalize your content